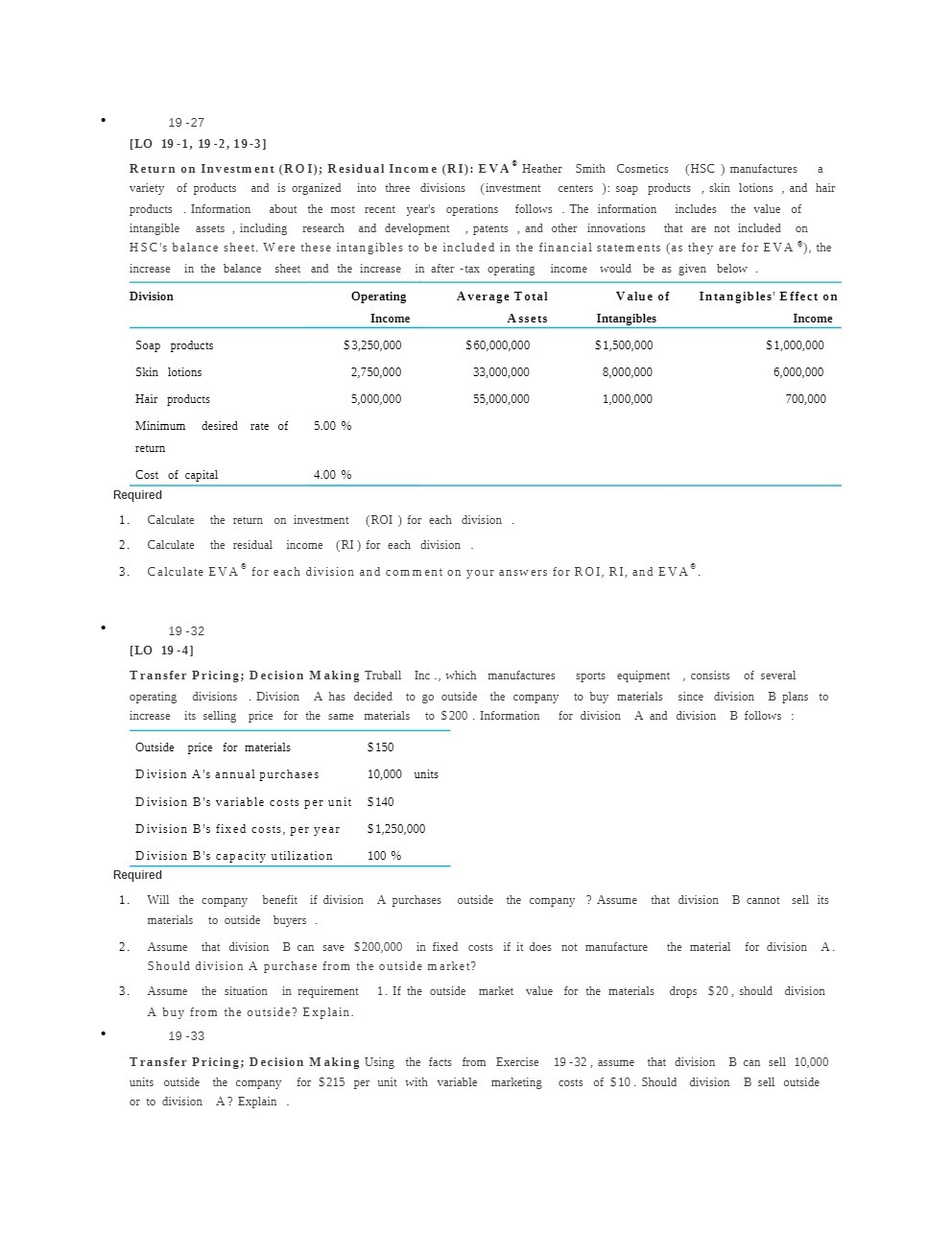

19 -27 [LO 19-1, 19-2, 19-3] Return on Investment (ROI); Residual Income (RI): EVA * Heather Smith Cosmetics (HSC ) manufactures a variety of products and is organized into three divisions s (investment centers ): soap products , skin lotions , and hair products . Information about the most recent year's operations follows . The information includes the value of intangible assets , including research and development , patents , and other innovations that are not included HSC's balance sheet. Were these intangibles to be included in the financial statements (as they are for EVA *), the increase in the balance sheet and the increase in after -tax operating income would be as given below Division Operating Average Total Value of Intangibles' Effect on Income Assets Intangibles Income Soap products $ 3,250,000 $ 60,000,000 $ 1,500,000 $ 1,000,000 Skin lotions 2,750,000 33,000,000 8,000,000 6,000,000 Hair products 5,000,000 55,000,000 1,000,000 700,000 Minimum desired rate of 5.00 % return Cost of capital 4.00 % Required 1. Calculate the return on investment (ROI ) for each division 2. Calculate the residual income (RI ) for each division 3. Calculate EVA for each division and comment on your answers for ROI, RI, and EVA 19-32 [LO 19-4] Transfer Pricing; Decision Making Truball Inc ., which manufactures sports equipment , consists of several operating divisions s . Division A has decided to go outside the company to buy materials since division B plans to increase its selling price for the same materials to $200 . Information for division A and division B follows : Outside price for materials $ 150 Division A's annual purchases 10,000 units Division B's variable costs per unit $140 Division B's fixed costs, per year $1,250,000 Division B's capacity utilization 100 9% Required 1. Will the company benefit if division A purchases outside the company ? Assume that division B cannot sell its materials to outside buyers 2. Assume that division B can save $200,000 in fixed costs if it does not manufacture the material for division A Should division A purchase from the outside market? 3. Assume the situation n in requirement 1. If the outside market value for the materials drops $20, should division A buy from the outside? Explain. 19-33 Transfer Pricing; Decision Making Using the facts from Exercise 19-32, assume that division B can sell 10,000 units outside the company for $215 per unit with variable marketing costs of $10. Should division B sell outside or to division A? Explain