Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1-9 are true and false! Finance is the study of how individuals, institutions, and businesses acquire, spend and manage money and other financial resources. 2.

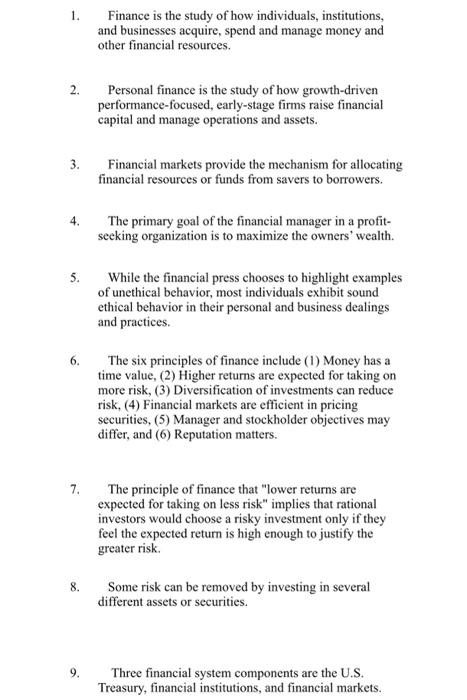

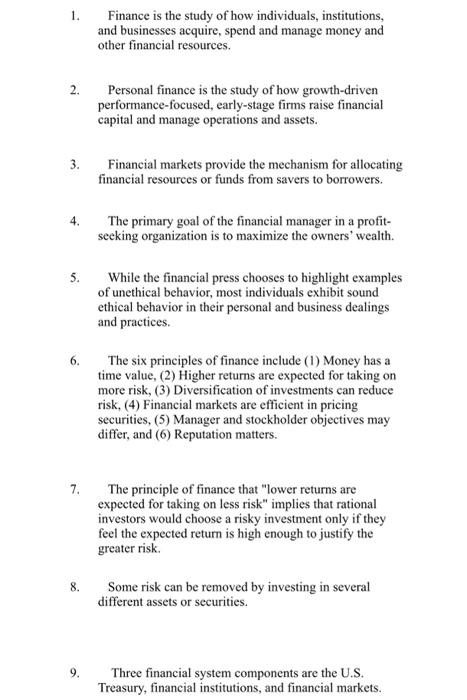

1-9 are true and false!

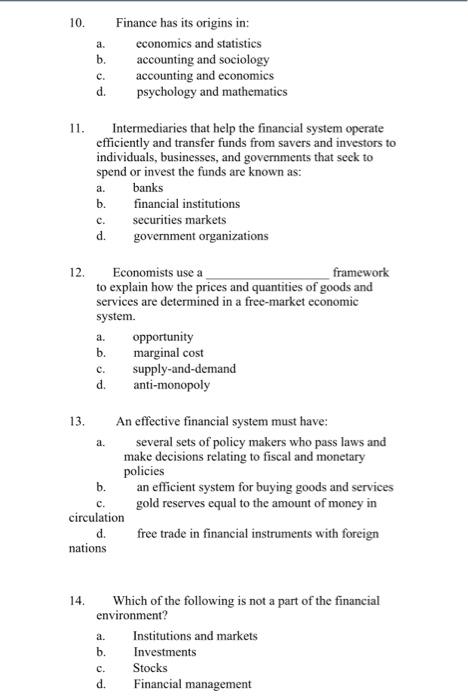

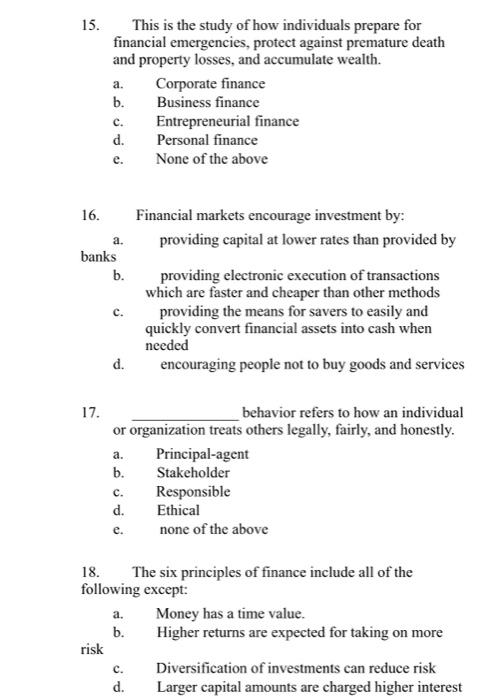

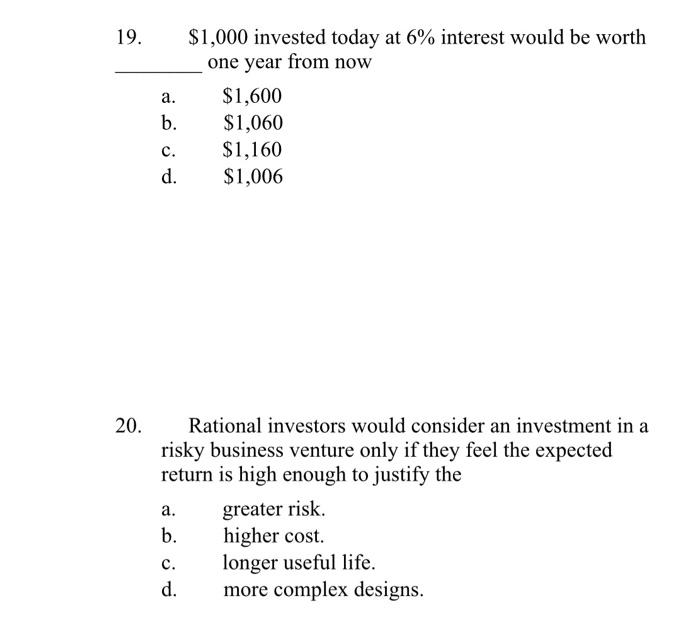

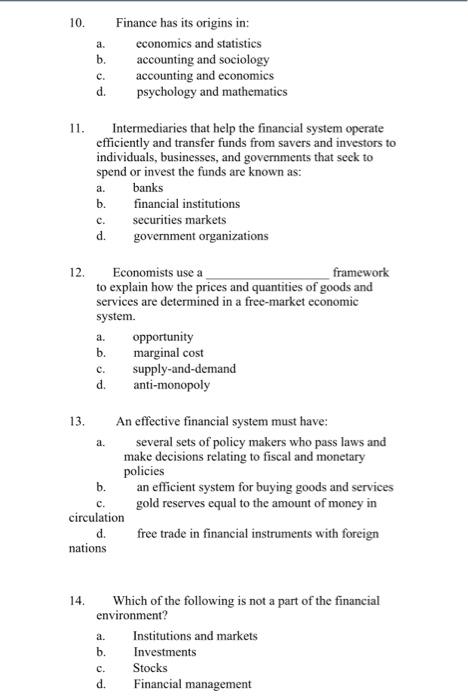

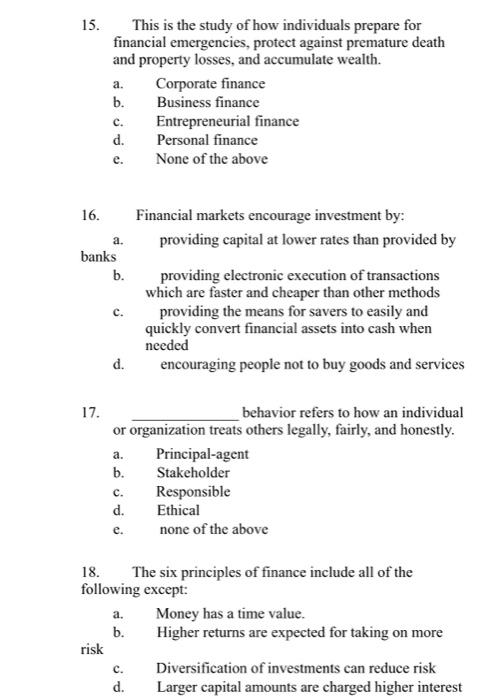

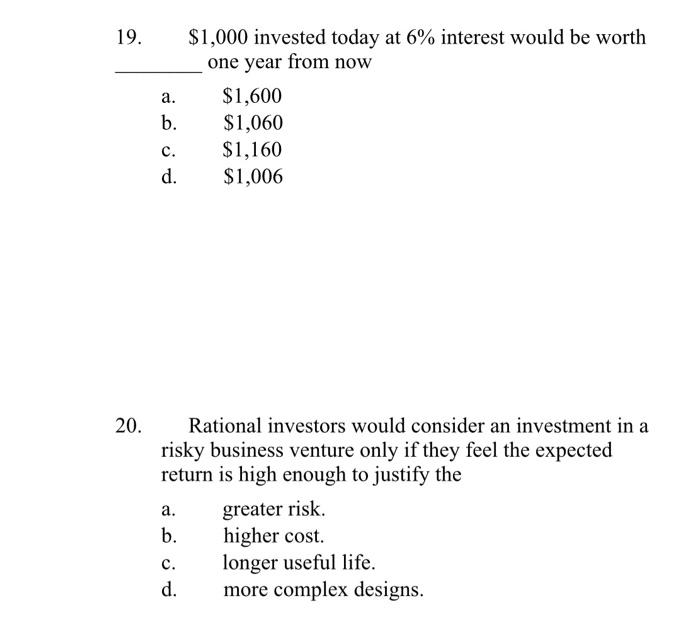

Finance is the study of how individuals, institutions, and businesses acquire, spend and manage money and other financial resources. 2. Personal finance is the study of how growth-driven performance-focused, early-stage firms raise financial capital and manage operations and assets. 3. Financial markets provide the mechanism for allocating financial resources or funds from savers to borrowers. 4. The primary goal of the financial manager in a profit- seeking organization is to maximize the owners' wealth. 5. While the financial press chooses to highlight examples of unethical behavior, most individuals exhibit sound ethical behavior in their personal and business dealings and practices. 6. The six principles of finance include (1) Money has a time value, (2) Higher returns are expected for taking on more risk, (3) Diversification of investments can reduce risk, (4) Financial markets are efficient in pricing securities, (5) Manager and stockholder objectives may differ, and (6) Reputation matters. 7. The principle of finance that "lower returns are expected for taking on less risk" implies that rational investors would choose a risky investment only if they feel the expected return is high enough to justify the greater risk 8. Some risk can be removed by investing in several different assets or securities. 9. Three financial system components are the U.S. Treasury, financial institutions, and financial markets. 10. a. b. c. d. Finance has its origins in: economics and statistics accounting and sociology accounting and economics psychology and mathematics 11. Intermediaries that help the financial system operate efficiently and transfer funds from savers and investors to individuals, businesses, and governments that seek to spend or invest the funds are known as: banks b. financial institutions securities markets d. government organizations a. c. 12. Economists use a framework to explain how the prices and quantities of goods and services are determined in a free-market economic system. a. opportunity b. marginal cost c. supply-and-demand d. anti-monopoly a. . An effective financial system must have: several sets of policy makers who pass laws and make decisions relating to fiscal and monetary policies b. an efficient system for buying goods and services gold reserves equal to the amount of money in circulation d. free trade in financial instruments with foreign nations c. 14. a. b. c. Which of the following is not a part of the financial environment? Institutions and markets Investments Stocks d. Financial management 15. This is the study of how individuals prepare for financial emergencies, protect against premature death and property losses, and accumulate wealth. a. Corporate finance b. Business finance Entrepreneurial finance d. Personal finance e. None of the above c. 16. a. banks b. Financial markets encourage investment by: providing capital at lower rates than provided by providing electronic execution of transactions which are faster and cheaper than other methods providing the means for savers to easily and quickly convert financial assets into cash when needed encouraging people not to buy goods and services c. d. 17. a. behavior refers to how an individual or organization treats others legally, fairly, and honestly. Principal-agent b. Stakeholder Responsible d. Ethical none of the above c. e. 18. The six principles of finance include all of the following except: a. Money has a time value. b. Higher returns are expected for taking on more risk Diversification of investments can reduce risk d. Larger capital amounts are charged higher interest C. 19. a. b. $1,000 invested today at 6% interest would be worth one year from now $1,600 $1,060 $1,160 $1,006 c. d. 20. Rational investors would consider an investment in a risky business venture only if they feel the expected return is high enough to justify the a. greater risk. b. higher cost. c. longer useful life. d. more complex designs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started