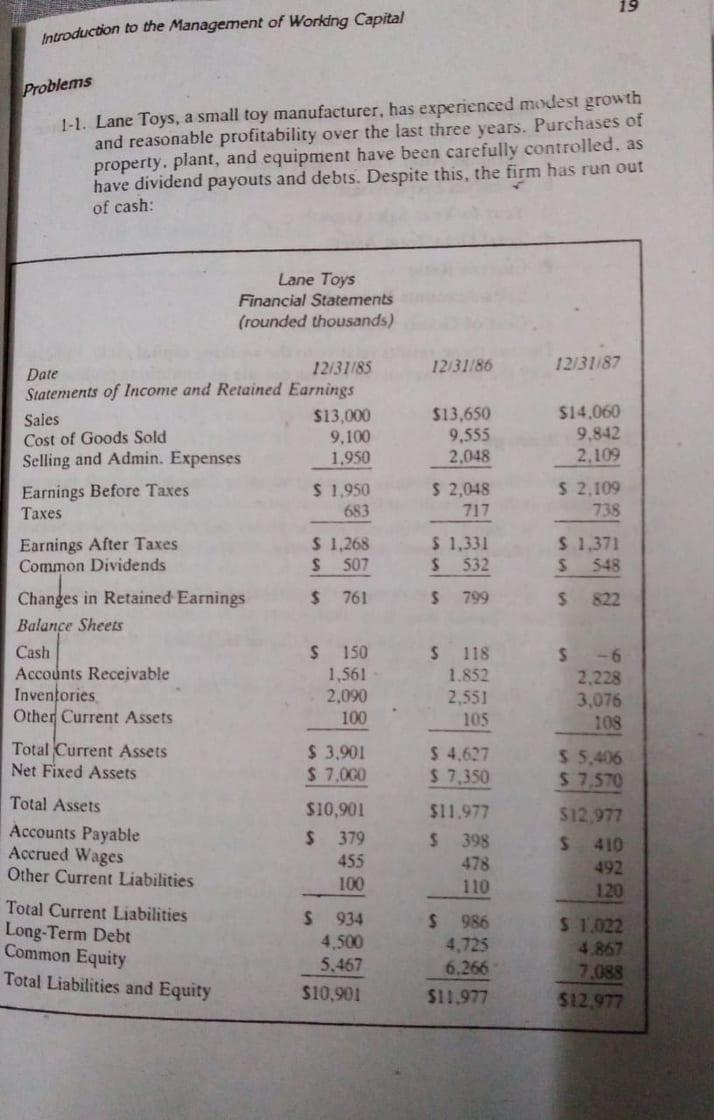

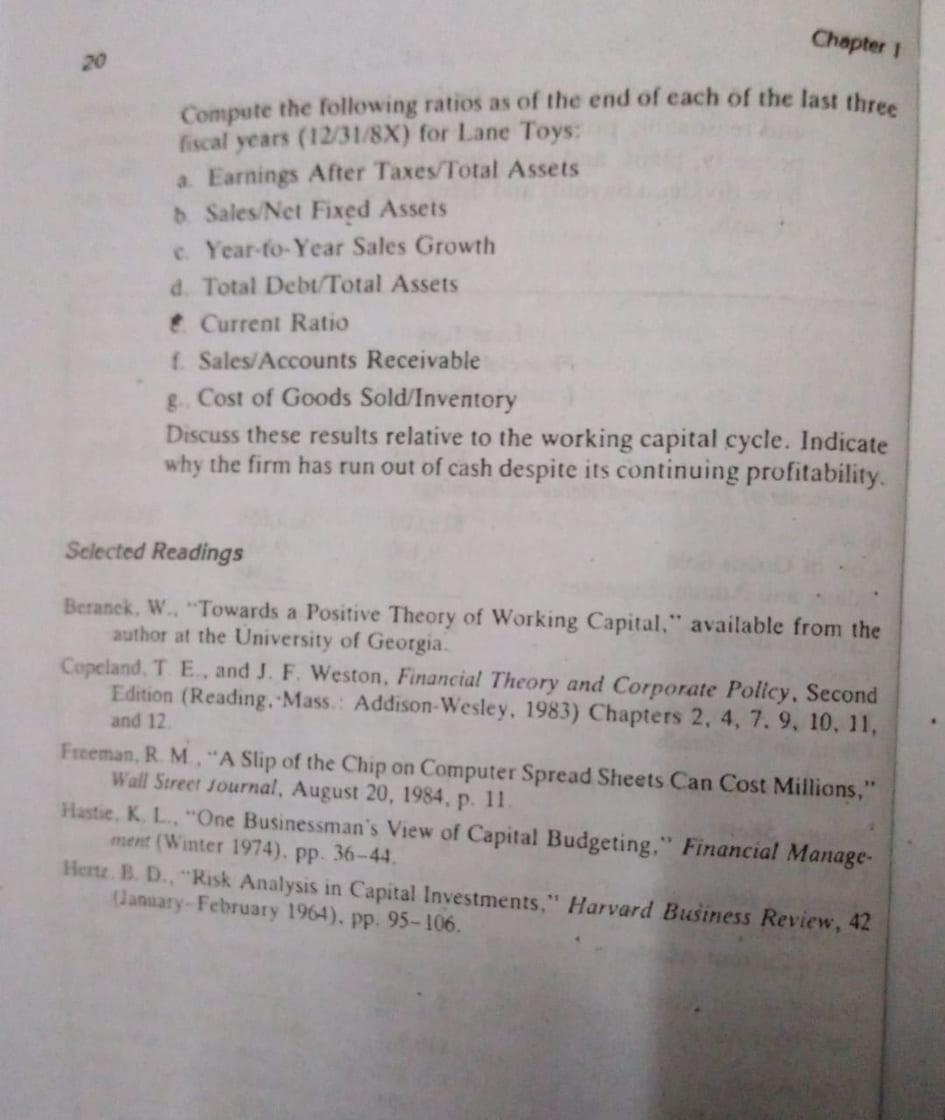

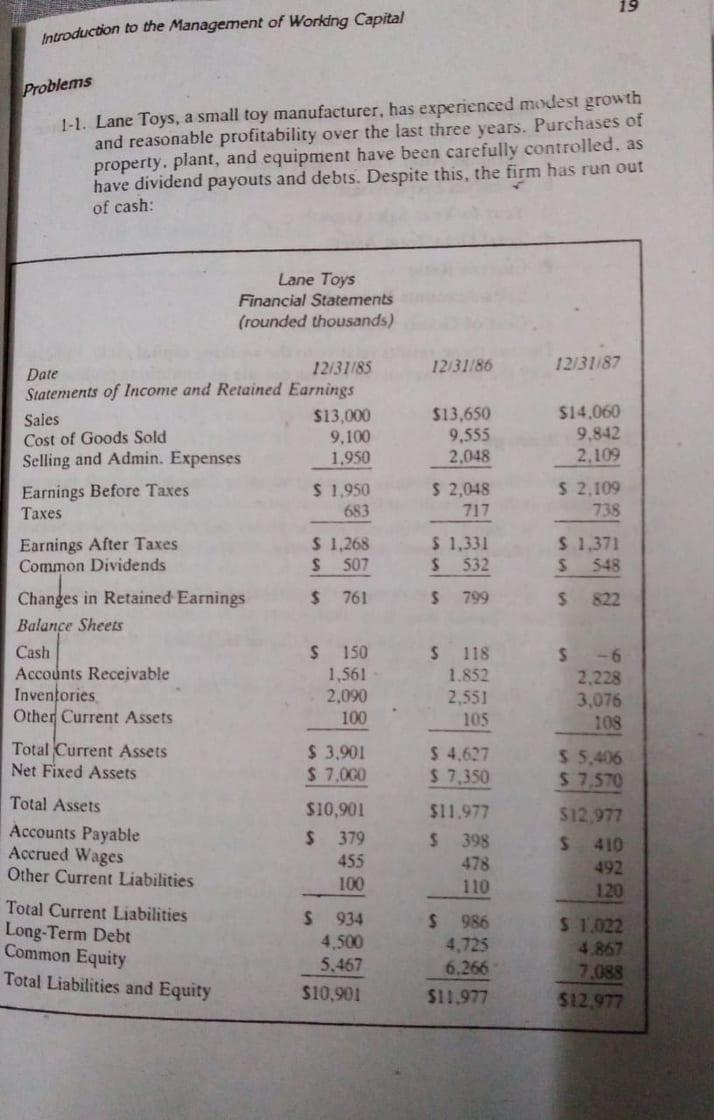

19 Introduction to the Management of Working Capital Problems 1-1. Lane Toys, a small toy manufacturer, has experienced modest growth and reasonable profitability over the last three years. Purchases of property, plant, and equipment have been carefully controlled, as have dividend payouts and debts. Despite this, the firm has run out of cash: Lane Toys Financial Statements (rounded thousands) 12/31/86 12/31/87 $13,650 9,555 2.048 $ 2,048 717 $14.060 9.842 2.109 $ 2.109 738 $ 1.331 532 S 1.371 S 548 S 799 $ 822 Date 12/31/85 Statements of Income and Retained Earnings Sales $13,000 Cost of Goods Sold 9.100 Selling and Admin. Expenses 1,950 Earnings Before Taxes $ 1.950 Taxes 683 Earnings After Taxes $ 1.268 Common Dividends S 507 Changes in Retained Earnings $ 761 Balance Sheets Cash $ 150 Accounts Receivable 1,561 Inventories 2,090 Other Current Assets 100 Total Current Assets $ 3.901 Net Fixed Assets $ 7.000 Total Assets $10,901 Accounts Payable $ 379 455 Other Current Liabilities 100 Total Current Liabilities S 934 Long-Term Debt 4.500 5.467 $10.901 $ 118 1.852 2,551 105 $ -6 2,228 3,076 108 $ 4,627 $ 7,350 $ 5,406 $ 7,570 Accrued Wages $11.977 $ 398 478 110 $12.977 $ 410 492 120 Common Equity Total Liabilities and Equity $ 986 4,725 6.266 $11.977 S 1.022 4.867 7.088 $12.977 Chapter 1 20 Compute the following ratios as of the end of each of the last three fiscal years (12/31/8X) for Lane Toys: a. Earnings After Taxes/Total Assets 0. Sales/Net Fixed Assets c. Year-to-Year Sales Growth d. Total Debt Total Assets Current Ratio 1. Sales/Accounts Receivable g.. Cost of Goods Sold/Inventory Discuss these results relative to the working capital cycle. Indicate why the firm has run out of cash despite its continuing profitability. Selected Readings Beranek, W. "Towards a Positive Theory of Working Capital," available from the author at the University of Georgia Copeland. T E, and J. F. Weston, Financial Theory and Corporate Policy. Second Edition (Reading, Mass.: Addison-Wesley, 1983) Chapters 2, 4, 7.9, 10, 11, and 12 Freeman, R. M. "A Slip of the Chip on Computer Spread Sheets Can Cost Millions," Wall Street Journal, August 20, 1984, p. 11 Hastie, K. L. "One Businessman's View of Capital Budgeting." Financial Manage- ment (Winter 1974). pp. 36-44. Heru B. D., "Risk Analysis in Capital Investments," Harvard Business Review, 42 January February 1964), pp. 95-106