Answered step by step

Verified Expert Solution

Question

1 Approved Answer

19. Mitch and Sydney file a joint income tax return for 2022. They have two dependent children, students, ages 19 and 20. Mitch earns

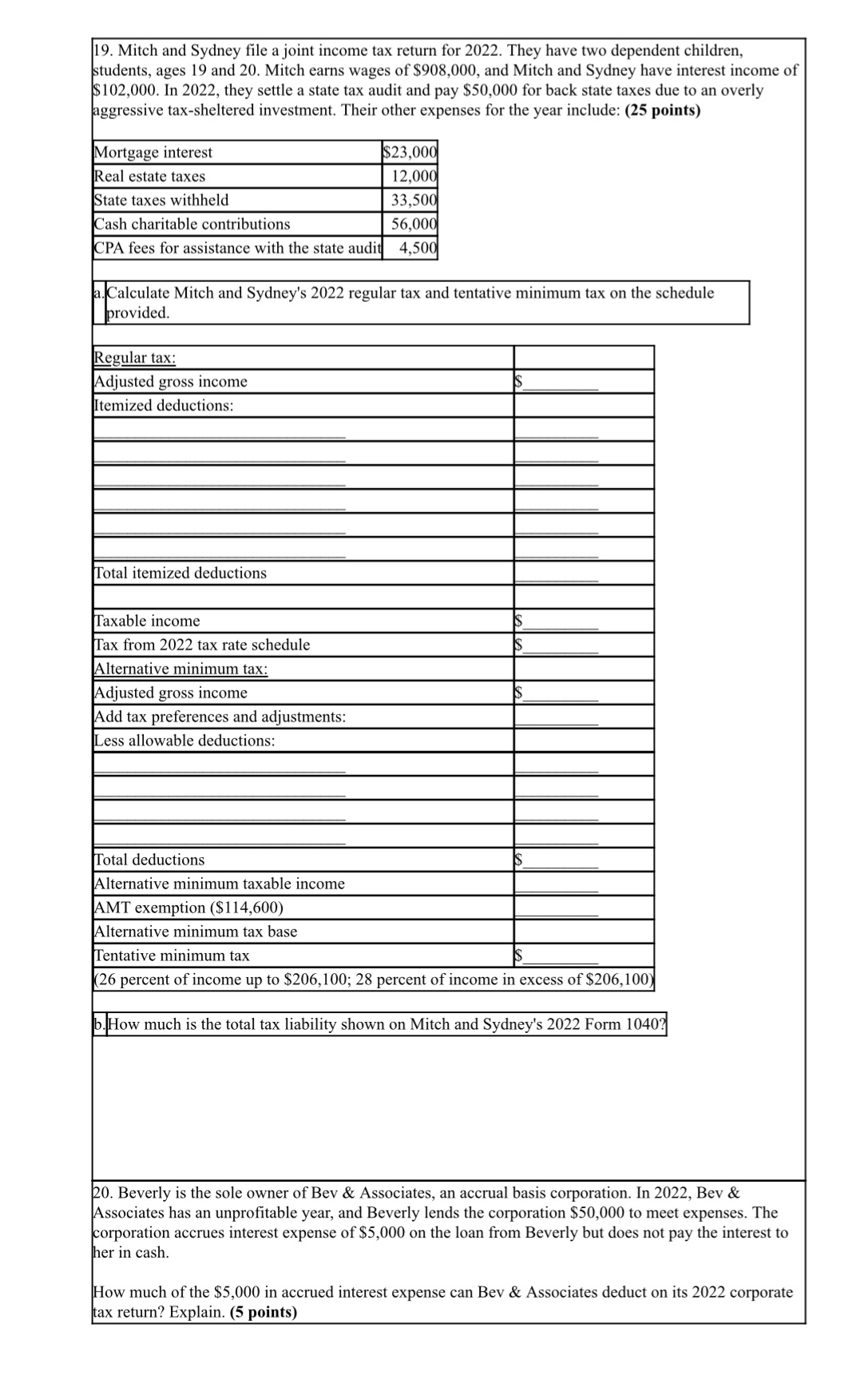

19. Mitch and Sydney file a joint income tax return for 2022. They have two dependent children, students, ages 19 and 20. Mitch earns wages of $908,000, and Mitch and Sydney have interest income of $102,000. In 2022, they settle a state tax audit and pay $50,000 for back state taxes due to an overly aggressive tax-sheltered investment. Their other expenses for the year include: (25 points) Mortgage interest Real estate taxes State taxes withheld Cash charitable contributions $23,000 12,000 33,500 56,000 CPA fees for assistance with the state audit 4,500 a. Calculate Mitch and Sydney's 2022 regular tax and tentative minimum tax on the schedule provided. Regular tax: Adjusted gross income Itemized deductions: Total itemized deductions Taxable income Tax from 2022 tax rate schedule Alternative minimum tax: Adjusted gross income Add tax preferences and adjustments: Less allowable deductions: Total deductions Alternative minimum taxable income AMT exemption ($114,600) Alternative minimum tax base Tentative minimum tax (26 percent of income up to $206,100; 28 percent of income in excess of $206,100) b.How much is the total tax liability shown on Mitch and Sydney's 2022 Form 1040? 20. Beverly is the sole owner of Bev & Associates, an accrual basis corporation. In 2022, Bev & Associates has an unprofitable year, and Beverly lends the corporation $50,000 to meet expenses. The corporation accrues interest expense of $5,000 on the loan from Beverly but does not pay the interest to her in cash. How much of the $5,000 in accrued interest expense can Bev & Associates deduct on its 2022 corporate tax return? Explain. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate Mitch and Sydneys 2022 regular tax and tentative minimum tax we need to consider thei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663da095b83d7_964271.pdf

180 KBs PDF File

663da095b83d7_964271.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started