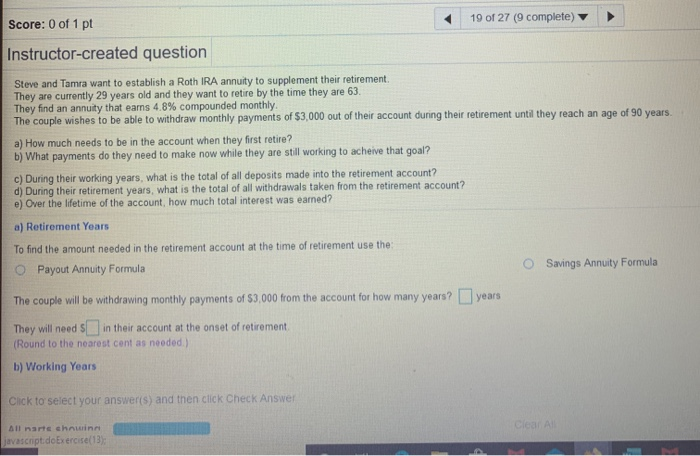

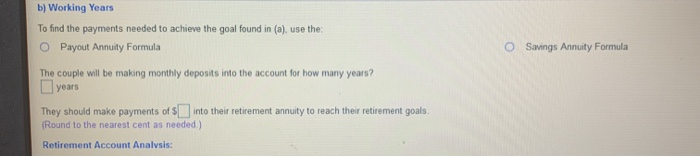

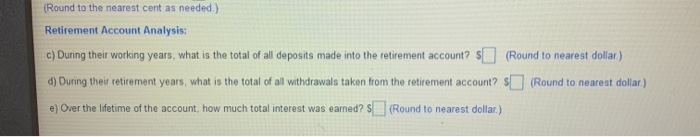

19 of 27 (9 complete) Score: 0 of 1 pt Instructor-created question Steve and Tamra want to establish a Roth IRA annuity to supplement their retirement They are currently 29 years old and they want to retire by the time they are 63. They find an annuity that earns 4.8% compounded monthly The couple wishes to be able to withdraw monthly payments of $3,000 out of their account during their retirement until they reach an age of 90 years. a) How much needs to be in the account when they first retire? b) What payments do they need to make now while they are still working to acheive that goal? c) During their working years, what is the total of all deposits made into the retirement account? d) During their retirement years, what is the total of all withdrawals taken from the retirement account? e) Over the lifetime of the account, how much total interest was earned? a) Retirement Years To find the amount needed in the retirement account at the time of retirement use the Payout Annuity Formula Savings Annuity Formula The couple will be withdrawing monthly payments of $3,000 from the account for how many years? years They will need in their account at the onset of retirement, (Round to the nearest cent as needed.) b) Working Years Click to select your answer(s) and then click Check Answer Clear A All arte chauinn javascript.doExercise (13) b) Working Years To find the payments needed to achieve the goal found in (a), use the O Payout Annuity Formula O Savings Annuity Formula The couple will be making monthly deposits into the account for how many years? years They should make payments of into their retirement annuity to reach their retirement goals. (Round to the nearest cent as needed) Retirement Account Analysis: (Round to the nearest cent as needed.) Retirement Account Analysis: c) During their working years, what is the total of all deposits made into the retirement account? $(Round to nearest dollar) d) During their retirement years, what is the total of all withdrawals taken from the retirement account? s (Round to nearest dollar) e) Over the lifetime of the account, how much total interest was earned? $(Round to nearest dollar.)