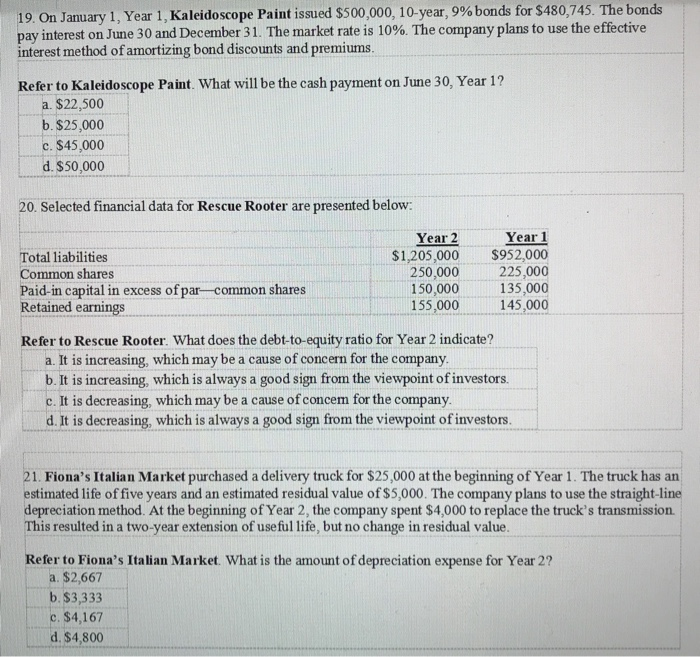

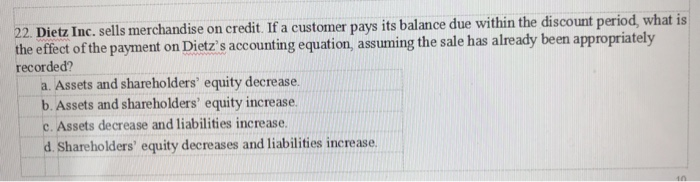

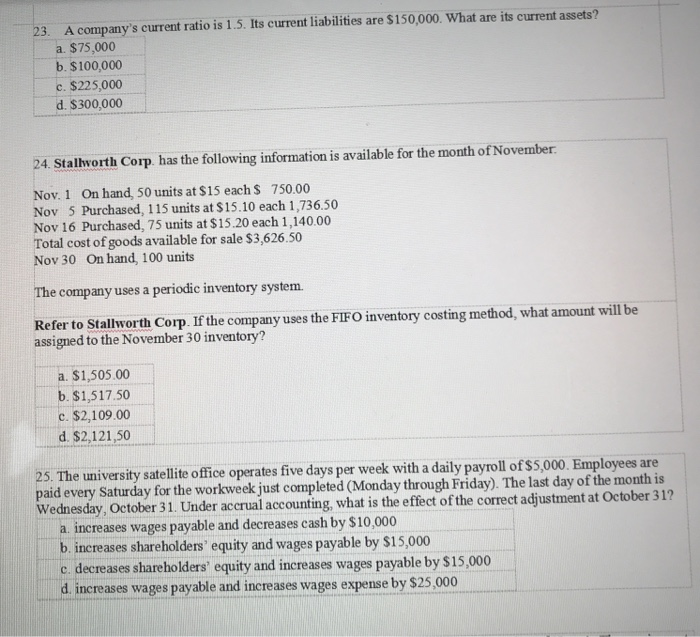

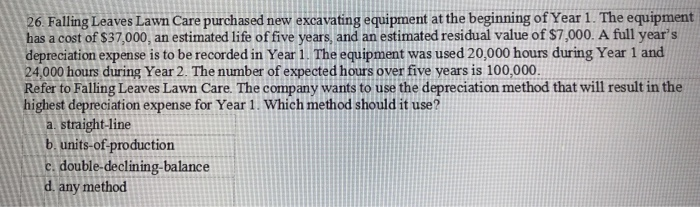

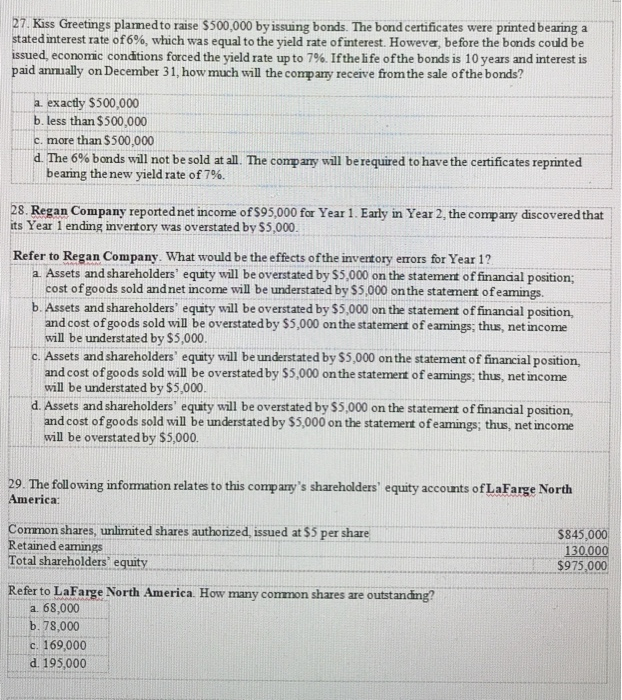

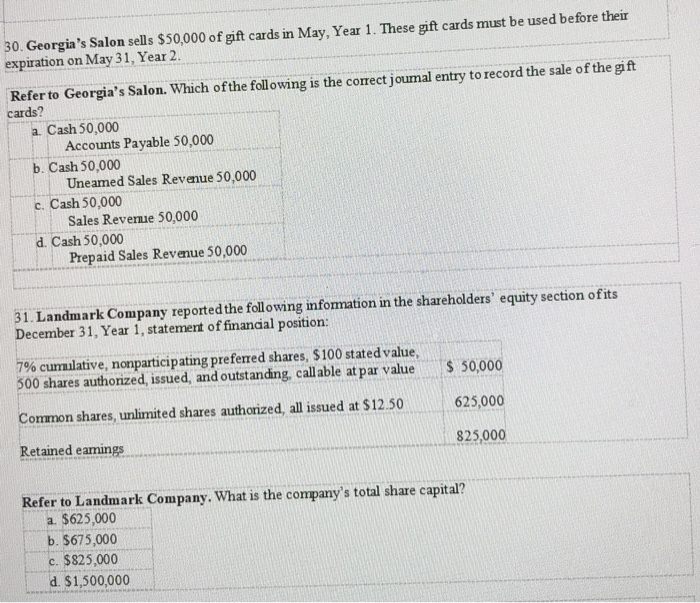

19. On January 1, Year 1, Kaleidoscope Paint issued $500,000, 10-year, 9% bonds for $480,745. The bonds pay interest on June 30 and December 31. The market rate is 10%. The company plans to use the effective interest method of amortizing bond discounts and premiums. Refer to Kaleidoscope Paint. What will be the cash payment on June 30, Year 1? a. $22,500 b. $25,000 c. $45,000 d. $50,000 20. Selected financial data for Rescue Rooter are presented below: Total liabilities Common shares Paid-in capital in excess of par-common shares Retained earnings Year 2 $1,205,000 250,000 150,000 155,000 Year 1 $952,000 225,000 135,000 145,000 Refer to Rescue Rooter. What does the debt-to-equity ratio for Year 2 indicate? a. It is increasing, which may be a cause of concern for the company. b. It is increasing, which is always a good sign from the viewpoint of investors. c. It is decreasing, which may be a cause of concem for the company. d. It is decreasing, which is always a good sign from the viewpoint of investors. 21. Fiona's Italian Market purchased a delivery truck for $25,000 at the beginning of Year 1. The truck has an estimated life of five years and an estimated residual value of $5,000. The company plans to use the straight-line depreciation method. At the beginning of Year 2, the company spent $4,000 to replace the truck's transmission. This resulted in a two-year extension of useful life, but no change in residual value Refer to Fiona's Italian Market. What is the amount of depreciation expense for Year 2? a $2,667 b. $3,333 c. $4,167 d. $4,800 22. Dietz Inc. sells merchandise on credit. If a customer pays its balance due within the discount period, what is the effect of the payment on Dietz's accounting equation, assuming the sale has already been appropriately recorded? a. Assets and shareholders' equity decrease. b. Assets and shareholders' equity increase. c. Assets decrease and liabilities increase. d. Shareholders' equity decreases and liabilities increase 23 A company's current ratio is 1.5. Its current liabilities are $150,000. What are its current assets? a. $75,000 b. $100,000 c. $225,000 d. $300,000 24. Stallworth Corp. has the following information is available for the month of November Nov. 1 On hand, 50 units at $15 each $ 750.00 Nov 5 Purchased, 115 units at $15.10 each 1,736.50 Nov 16 Purchased, 75 units at $15.20 each 1,140.00 Total cost of goods available for sale $3,626.50 Nov 30 On hand, 100 units The company uses a periodic inventory system. Refer to Stallworth Corp. If the company uses the FIFO inventory costing method, what amount will be assigned to the November 30 inventory? a. $1,505.00 b. $1,517.50 c. $2,109.00 d. $2,121,50 25. The university satellite office operates five days per week with a daily payroll of $5,000. Employees are paid every Saturday for the workweek just completed (Monday through Friday). The last day of the month is Wednesday, October 31. Under accrual accounting, what is the effect of the correct adjustment at October 312 a increases wages payable and decreases cash by $10,000 b. increases shareholders' equity and wages payable by $15,000 c. decreases shareholders' equity and increases wages payable by $15,000 d. increases wages payable and increases wages expense by $25,000 26. Falling Leaves Lawn Care purchased new excavating equipment at the beginning of Year 1. The equipment has a cost of $37,000, an estimated life of five years, and an estimated residual value of $7,000. A full year's depreciation expense is to be recorded in Year 1. The equipment was used 20,000 hours during Year 1 and 24,000 hours during Year 2. The number of expected hours over five years is 100,000. Refer to Falling Leaves Lawn Care. The company wants to use the depreciation method that will result in the highest depreciation expense for Year 1. Which method should it use? a straight-line b. units-of-production c. double-declining balance d. any method 27. Kiss Greetings planned to raise $500,000 by issuing bonds. The bond certificates were printed bearing a stated interest rate of 6%, which was equal to the yield rate of interest. However, before the bonds could be issued, economic conditions forced the yield rate up to 7%. If the life of the bonds is 10 years and interest is paid annually on December 31, how much will the company receive from the sale of the bonds? a. exactly $500,000 b. less than $500,000 c. more than $500,000 d. The 6% bonds will not be sold at all. The company will be required to have the certificates reprinted bearing the new yield rate of 7%. 28. Regan Company reported net income of $95,000 for Year 1. Early in Year 2, the company discovered that its Year 1 ending invertory was overstated by $5,000. Refer to Regan Company. What would be the effects of the inventory errors for Year 12 a Assets and shareholders' equity will be overstated by $5,000 on the statement of financial position; cost of goods sold and net income will be understated by $5,000 on the statement of eamings. b. Assets and shareholders' equity will be overstated by $5,000 on the statement of financial position, and cost of goods sold will be overstated by $5,000 on the statement of eamings; thus, net income will be understated by $5,000. c. Assets and shareholders' equity will be understated by $5,000 on the statement of financial position, and cost of goods sold will be overstated by $5,000 on the statement of eamings; thus, net income will be understated by $5,000. d. Assets and shareholders' equity will be overstated by $5,000 on the statement of financial position, and cost of goods sold will be understated by $5,000 on the statement of eamings; thus, net income will be overstated by $5,000. 29. The following information relates to this company's shareholders' equity accounts of LaFarge North America: Common shares, unlimited shares authorized, issued at $5 per share Retained eamings Total shareholders' equity $845,000 130.000 $975,000 Refer to LaFarge North America. How many common shares are outstanding? a. 68,000 b. 78,000 c. 169,000 d. 195,000 30. Georgia's Salon sells $50,000 of gift cards in May, Year 1. These gift cards must be used before their expiration on May 31, Year 2. Refer to Georgia's Salon. Which of the following is the correct joumal entry to record the sale of the gift cards a. Cash 50,000 Accounts Payable 50,000 b. Cash 50,000 Uneamed Sales Revenue 50,000 c. Cash 50,000 Sales Revenue 50,000 d. Cash 50,000 Prepaid Sales Revenue 50,000 31. Landmark Company reported the following information in the shareholders' equity section of its December 31, Year 1, statement of financial position: 7% currulative, nonparticipating preferred shares, $100 stated value, 300 shares authorized, issued, and outstanding, call able at par value $ 50,000 Corrmon shares, unlimited shares authorized, all issued at $12.50 625,000 Retained eamings 825,000 Refer to Landmark Company. What is the company's total share capital? a $625,000 b. $675,000 c. $825,000 d. $1,500,000