Answered step by step

Verified Expert Solution

Question

1 Approved Answer

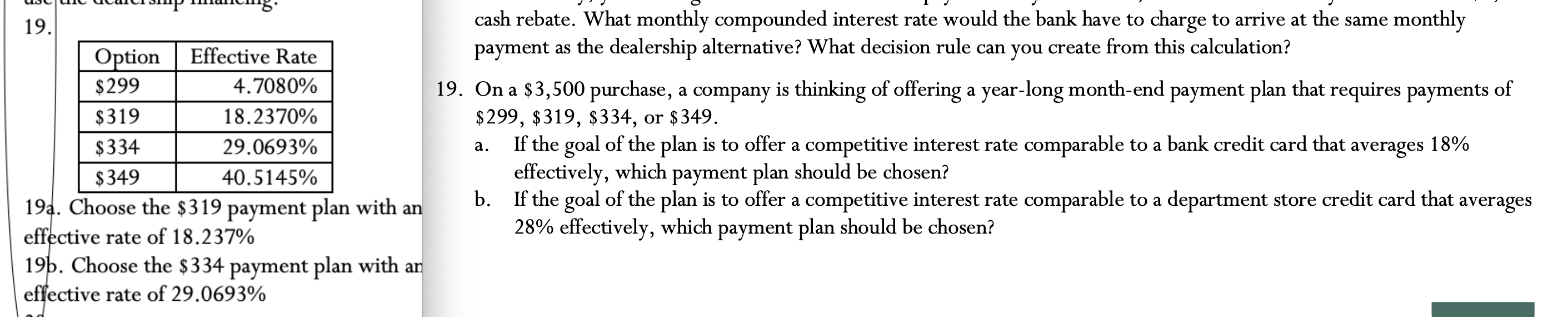

19. Option $299 $319 $334 $349 Effective Rate 4.7080% 18.2370% 29.0693% 40.5145% cash rebate. What monthly compounded interest rate would the bank have to

19. Option $299 $319 $334 $349 Effective Rate 4.7080% 18.2370% 29.0693% 40.5145% cash rebate. What monthly compounded interest rate would the bank have to charge to arrive at the same monthly payment as the dealership alternative? What decision rule can you create from this calculation? 19. On a $3,500 purchase, a company is thinking of offering a year-long month-end payment plan that requires payments of $299, $319, $334, or $349. a. If the goal of the plan is to offer a competitive interest rate comparable to a bank credit card that averages 18% effectively, which payment plan should be chosen? averages 19a. Choose the $319 payment plan with an effective rate of 18.237% 19b. Choose the $334 payment plan with an effective rate of 29.0693% b. If the goal of the plan is to offer a competitive interest rate comparable to a department store credit card that 28% effectively, which payment plan should be chosen?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started