Answered step by step

Verified Expert Solution

Question

1 Approved Answer

19. Post Haste, incorporated in 2014, suffers a net operating loss of $80,000 in 2016. Post Haste had a net operating loss of $30,000 in

19. Post Haste, incorporated in 2014, suffers a net operating loss of $80,000 in 2016. Post Haste had a net operating loss of $30,000 in 2014 and operating income of $65000 in 2015. Allison, the financial vice president of Post Haste, expects 2017 to be a banner year, with operating income of approximately $200,000. Write a memo to Allison advising her how to treat the $80,000 loss in 2016. Post Haste normally earns 9% on its investments.

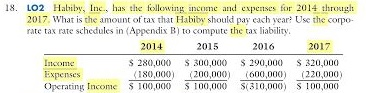

18. LO2 Habiby, Inc., has the following income and expenses for 2014 through 2017, What is the amou of tax that Habi should pay each year? Use the corpo- rate tax rate schedules in Appendix B) to compute the tax liability 2014 2015 2016 2017 280,000 300,000 290,000 S 320,000 Expenses 80, 00,0 600,00 220,00 Operating Income 100,000 100,000 S(3 0,000 0,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started