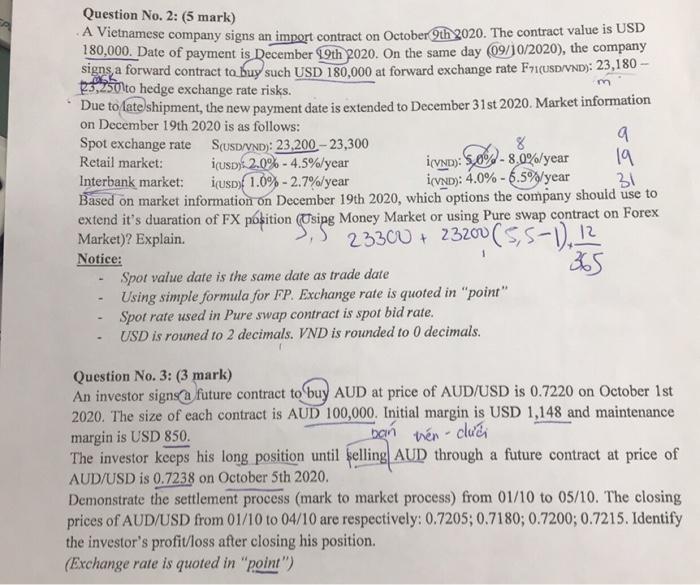

19 Question No. 2: (5 mark) A Vietnamese company signs an import contract on October 9th 2020. The contract value is USD 180,000. Date of payment is December 19th 2020. On the same day (09/10/2020), the company sign, a forward contract to buy such USD 180,000 at forward exchange rate F71(USD/VND): 23,180 - 23,2501to hedge exchange rate risks. Due to date shipment, the new payment date is extended to December 31st 2020. Market information on December 19th 2020 is as follows: Spot exchange rate S(USD/VND): 23,200 -23,300 8. a Retail market: i(USD) 2.0% - 4.5%/year (VND): 50% - 80%/year Interbank market: (USD) 1.0% - 2.7%/year (VND): 4.0% - 6.5%/year 31 Based on market information on December 19th 2020, which options the company should use to extend it's duaration of FX position (Usipg Money Market or using Pure swap contract on Forex Market)? Explain. 23300 + 23200(5,5-1,12 Notice: 35 Spor value date is the same date as trade date Using simple formula for FP. Exchange rate is quoted in "point" Spot rate used in Pure swap contract is spot bid rate. USD is rouned to 2 decimals. VND is rounded to 0 decimals. Question No. 3: (3 mark) An investor signs a future contract to buy AUD at price of AUD/USD is 0.7220 on October 1st 2020. The size of each contract is AUD 100,000. Initial margin is USD 1,148 and maintenance margin is USD 850. ban vn - dui The investor keeps his long position until selling AUD through a future contract at price of AUD/USD is 0.7238 on October 5th 2020. Demonstrate the settlement process (mark to market process) from 01/10 to 05/10. The closing prices of AUD/USD from 01/10 to 04/10 are respectively: 0.7205; 0.7180; 0.7200; 0.7215. Identify the investor's profit/loss after closing his position. (Exchange rate is quoted in "point") 19 Question No. 2: (5 mark) A Vietnamese company signs an import contract on October 9th 2020. The contract value is USD 180,000. Date of payment is December 19th 2020. On the same day (09/10/2020), the company sign, a forward contract to buy such USD 180,000 at forward exchange rate F71(USD/VND): 23,180 - 23,2501to hedge exchange rate risks. Due to date shipment, the new payment date is extended to December 31st 2020. Market information on December 19th 2020 is as follows: Spot exchange rate S(USD/VND): 23,200 -23,300 8. a Retail market: i(USD) 2.0% - 4.5%/year (VND): 50% - 80%/year Interbank market: (USD) 1.0% - 2.7%/year (VND): 4.0% - 6.5%/year 31 Based on market information on December 19th 2020, which options the company should use to extend it's duaration of FX position (Usipg Money Market or using Pure swap contract on Forex Market)? Explain. 23300 + 23200(5,5-1,12 Notice: 35 Spor value date is the same date as trade date Using simple formula for FP. Exchange rate is quoted in "point" Spot rate used in Pure swap contract is spot bid rate. USD is rouned to 2 decimals. VND is rounded to 0 decimals. Question No. 3: (3 mark) An investor signs a future contract to buy AUD at price of AUD/USD is 0.7220 on October 1st 2020. The size of each contract is AUD 100,000. Initial margin is USD 1,148 and maintenance margin is USD 850. ban vn - dui The investor keeps his long position until selling AUD through a future contract at price of AUD/USD is 0.7238 on October 5th 2020. Demonstrate the settlement process (mark to market process) from 01/10 to 05/10. The closing prices of AUD/USD from 01/10 to 04/10 are respectively: 0.7205; 0.7180; 0.7200; 0.7215. Identify the investor's profit/loss after closing his position. (Exchange rate is quoted in "point")