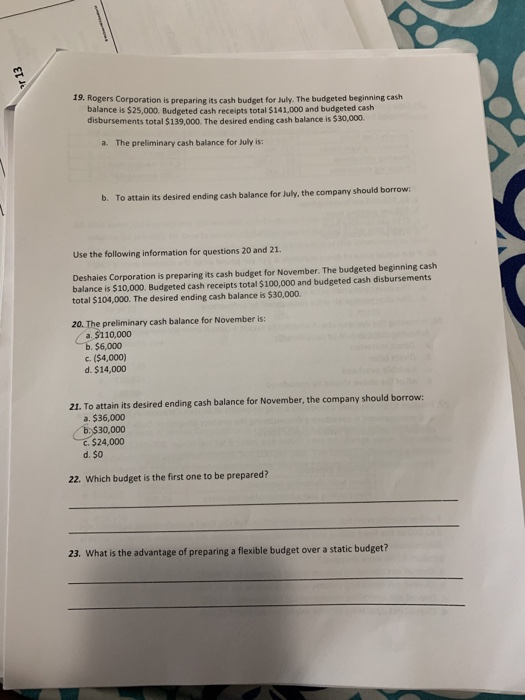

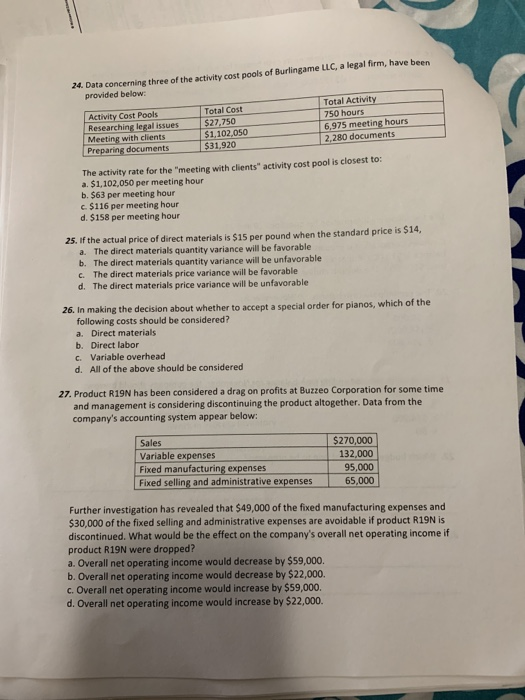

19. Rogers Corporation is preparing its cash budget for July. The budgeted beginning cash balance is $25,000. Budgeted cash receipts total $141,000 and budgeted cash disbursements total $139,000. The dsired ending cash balance is $30,000. The preliminary cash balance for July is: a. b. To attain its desired ending cash balance for luly, the company should borrow: Use the following information for questions 20 and 21. Deshales Corporation is preparing its cash budget for November. The budgeted beginning cash balance is $10,000. Budgeted cash receipts total $100,000 and budgeted cash disbursements total $104,000. The desired ending cash balance is $30,000. 20. The preliminary cash balance for November is: a. $110,000 b. $6,000 c. ($4,000) d. $14,000 21. To attain its desired ending cash balance for November, the company should borrow a. $36,000 b$30,000 c. $24,000 d. $0 22. Which budget is the first one to be prepared? 23. What is the advantage of preparing a flexible budget over a static budget? 34 Dats concerning three of the actvity cost pools of Burlingame LlC, a legal frm, have been provided below Total Activity Total Cost $27.750 Activity Cost Pools Researching legal issues 750 hours 6,975 meeting hours 2,280 documents 1,102,050 $31,920 Meeting with clients Preparing documents The activity rate for the "meeting with clients" activity cost pool is closest to: a. $1,102,050 per meeting hour b. $63 per meeting hour c $116 per meeting hour d. $158 per meeting hour 25. If the actual price of direct materials is $15 per pound when the standard price is $14 The direct materials quantity variance will be favorable a. b. The direct materials quantity variance will be unfavorable The direct materials price variance will be favorable d. c. The direct materials price variance will be unfavorable 26. In making the decision about whether to accept a special order for pianos, which of the following costs should be considered? a. Direct materials b. Direct labor c. Variable overhead d. All of the above should be considered 27. Product R19N has been considered a drag on profits at Buzzeo Corporation for some time and management is considering discontinuing the product altogether. Data from the company's accounting system appear below: Sales Variable expenses Fixed manufacturing expenses Fixed selling and administrative expenses 5270,000 132,000 95,000 65,000 Further investigation has revealed that $49,000 of the fixed manufacturing expenses and 30,000 of the fixed selling and administrative expenses are avoidable if product R19N is discontinued. What would be the effect on the company's overall net operating income if product R19N were dropped? a. Overall net operating income would decrease by $59,000. b. Overall net operating income would decrease by $22,000. c. Overall net operating income would increase by $59,000. d. Overall net operating income would increase by $22,000