Answered step by step

Verified Expert Solution

Question

1 Approved Answer

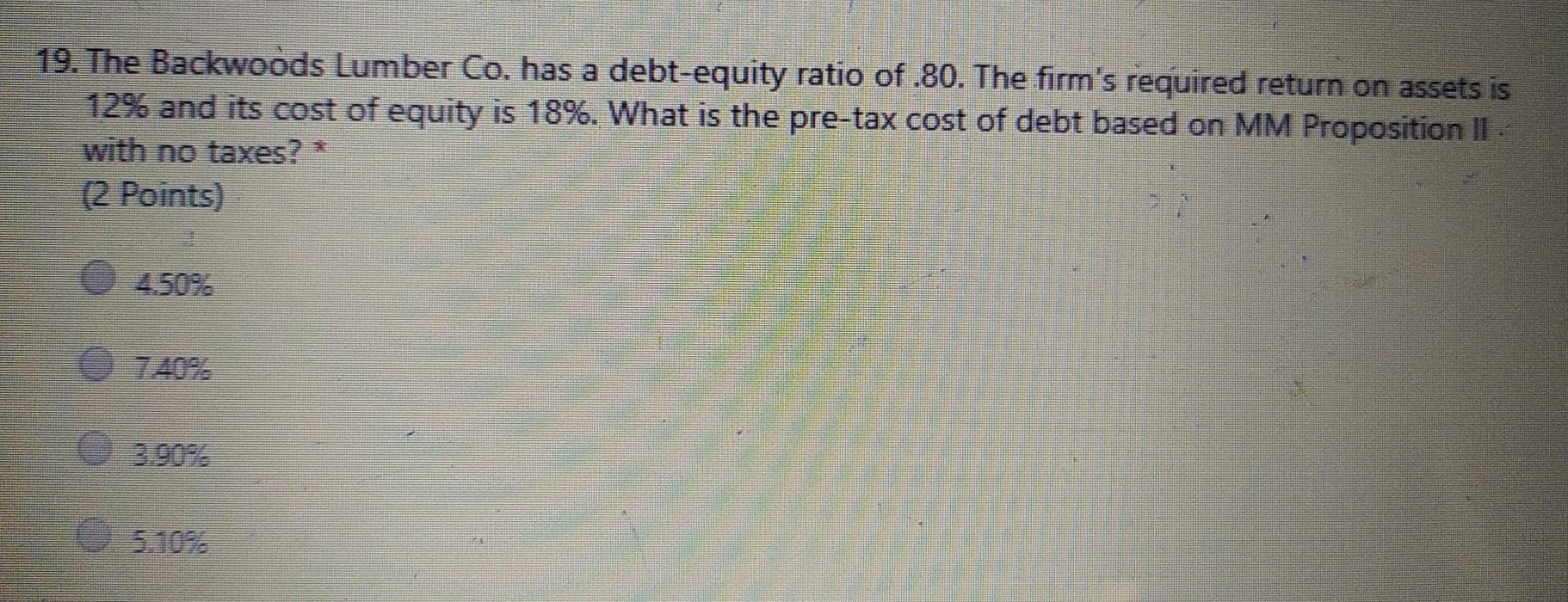

19. The Backwoods Lumber Co. has a debt-equity ratio of 80. The firm's required return on assets is 12% and its cost of equity is

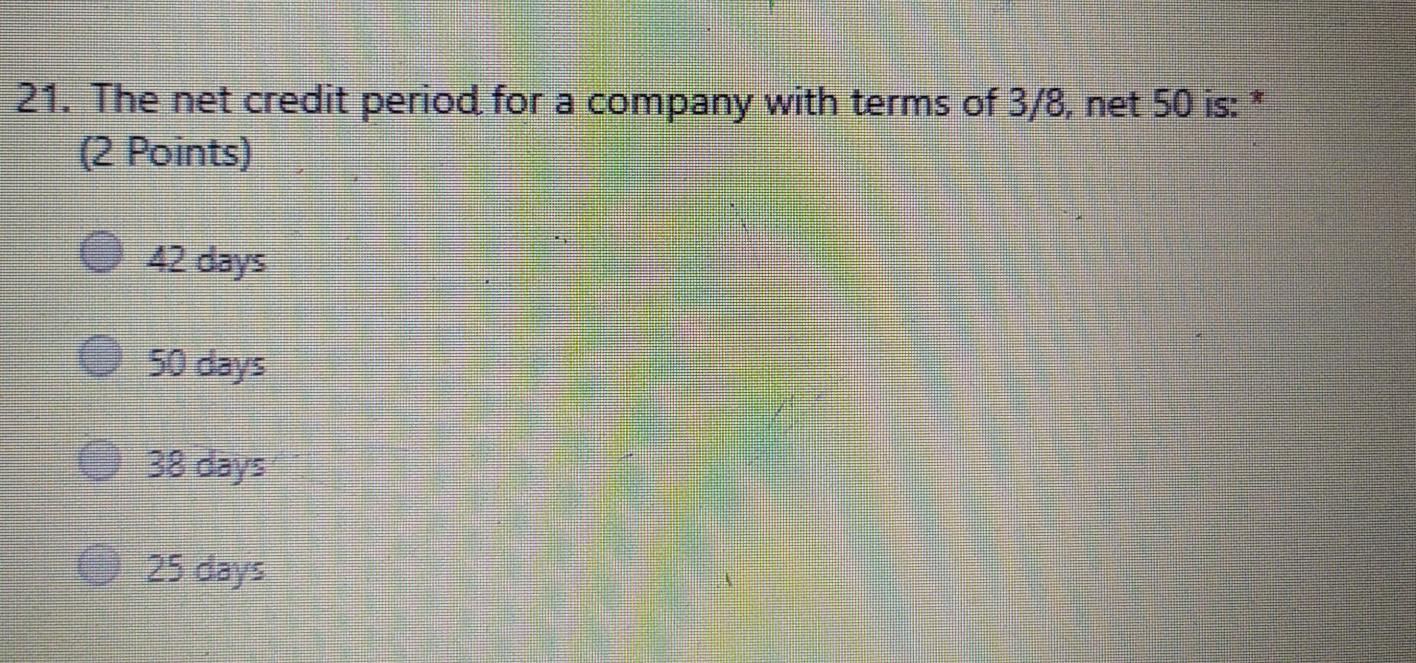

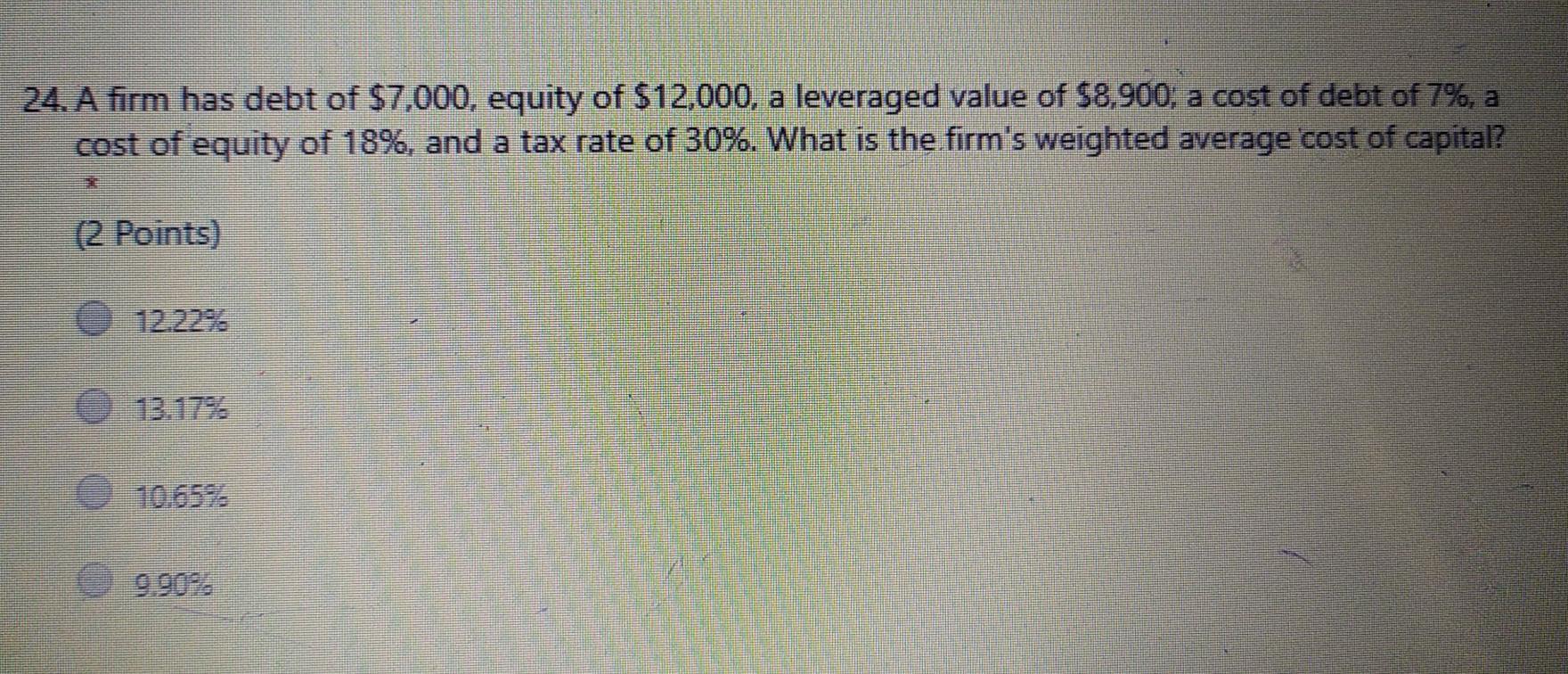

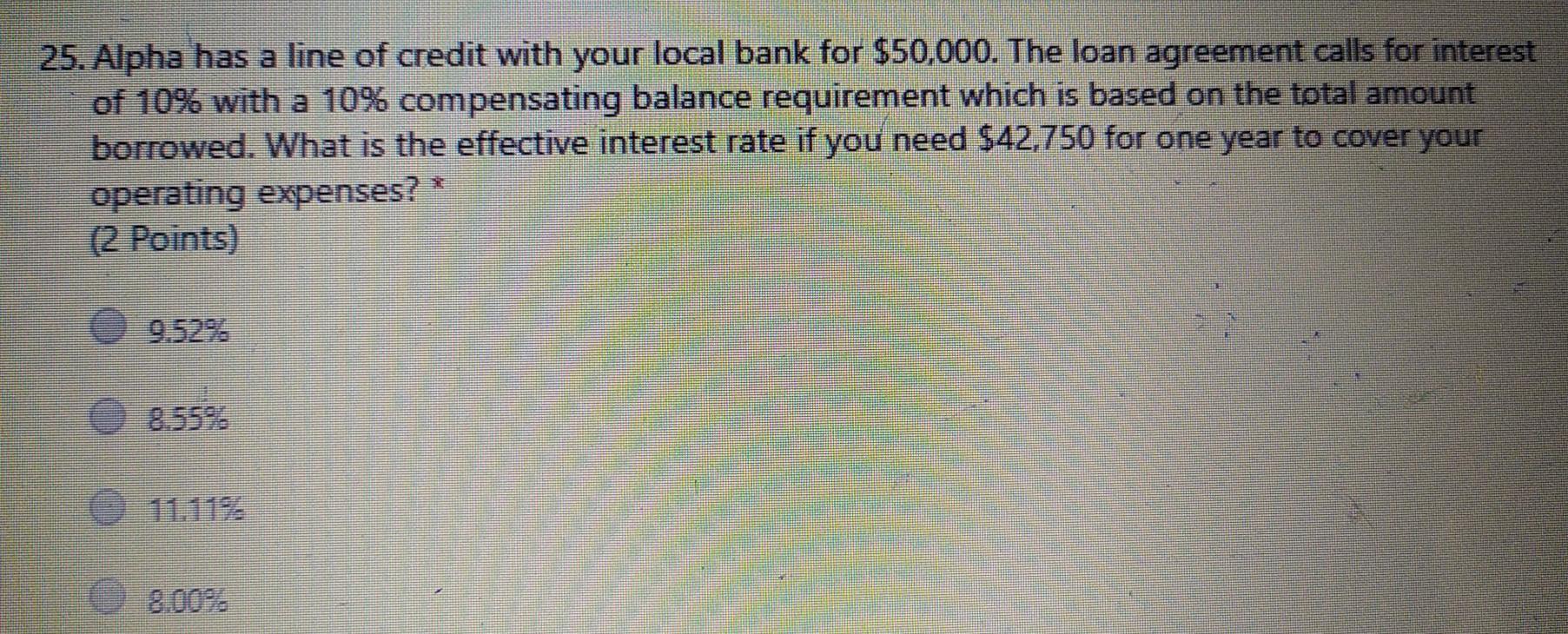

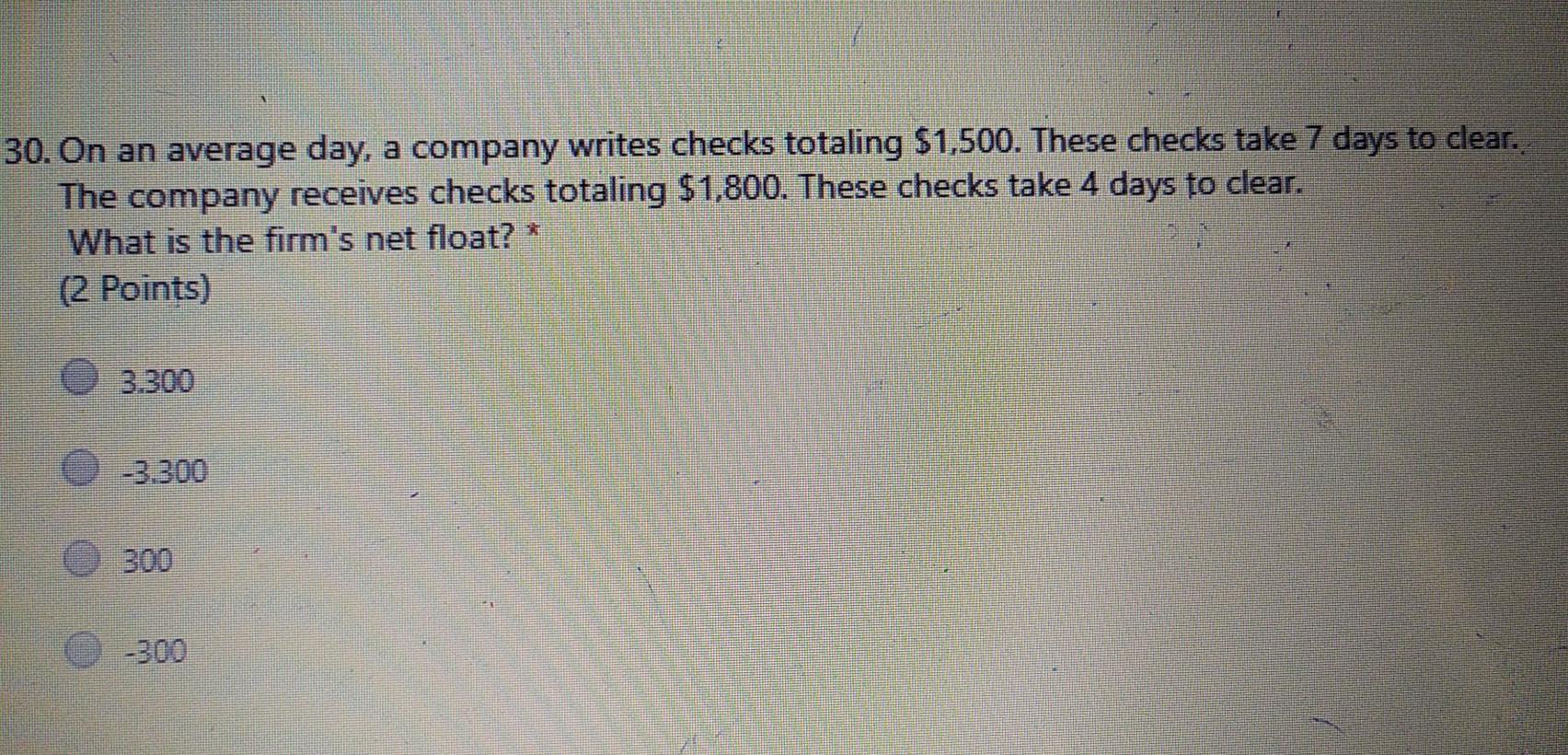

19. The Backwoods Lumber Co. has a debt-equity ratio of 80. The firm's required return on assets is 12% and its cost of equity is 18%. What is the pre-tax cost of debt based on MM Proposition II with no taxes? * (2 Points) 21. The net credit period for a company with terms of 3/8, net 50 is: * (2 Points) 42 days 24. A firm has debt of $7.000, equity of $12,000, a leveraged value of 58,900: a cost of debt of 7%, a cost of equity of 18%, and a tax rate of 30%. What is the firm's weighted average cost of capital? (2 Points) 25. Alpha has a line of credit with your local bank for $50,000. The loan agreement calls for interest of 10% with a 10% compensating balance requirement which is based on the total amount borrowed. What is the effective interest rate if you need $42,750 for one year to cover your operating expenses? 12 Points) 8.0092 30. On an average day, a company writes checks totaling $1,500. These checks take 7 days to clear. The company receives checks totaling $1,800. These checks take 4 days to clear. What is the firm's net float? * (2 Points) 3.300 -3.300 300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started