Answered step by step

Verified Expert Solution

Question

1 Approved Answer

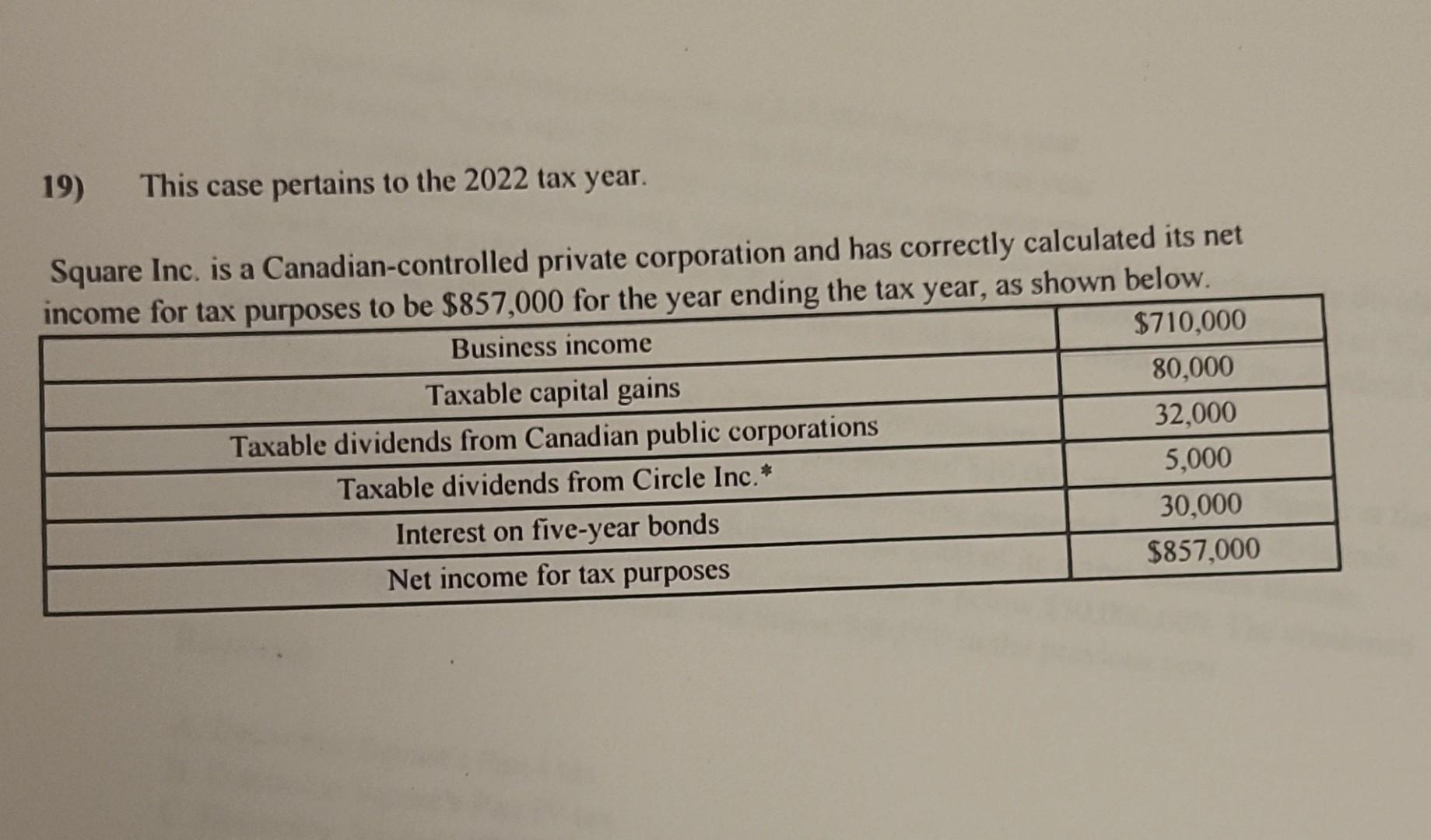

19) This case pertains to the 2022 tax year. Square Inc. is a Canadian-controlled private corporation and has correctly calculated its net *Square owns 100%

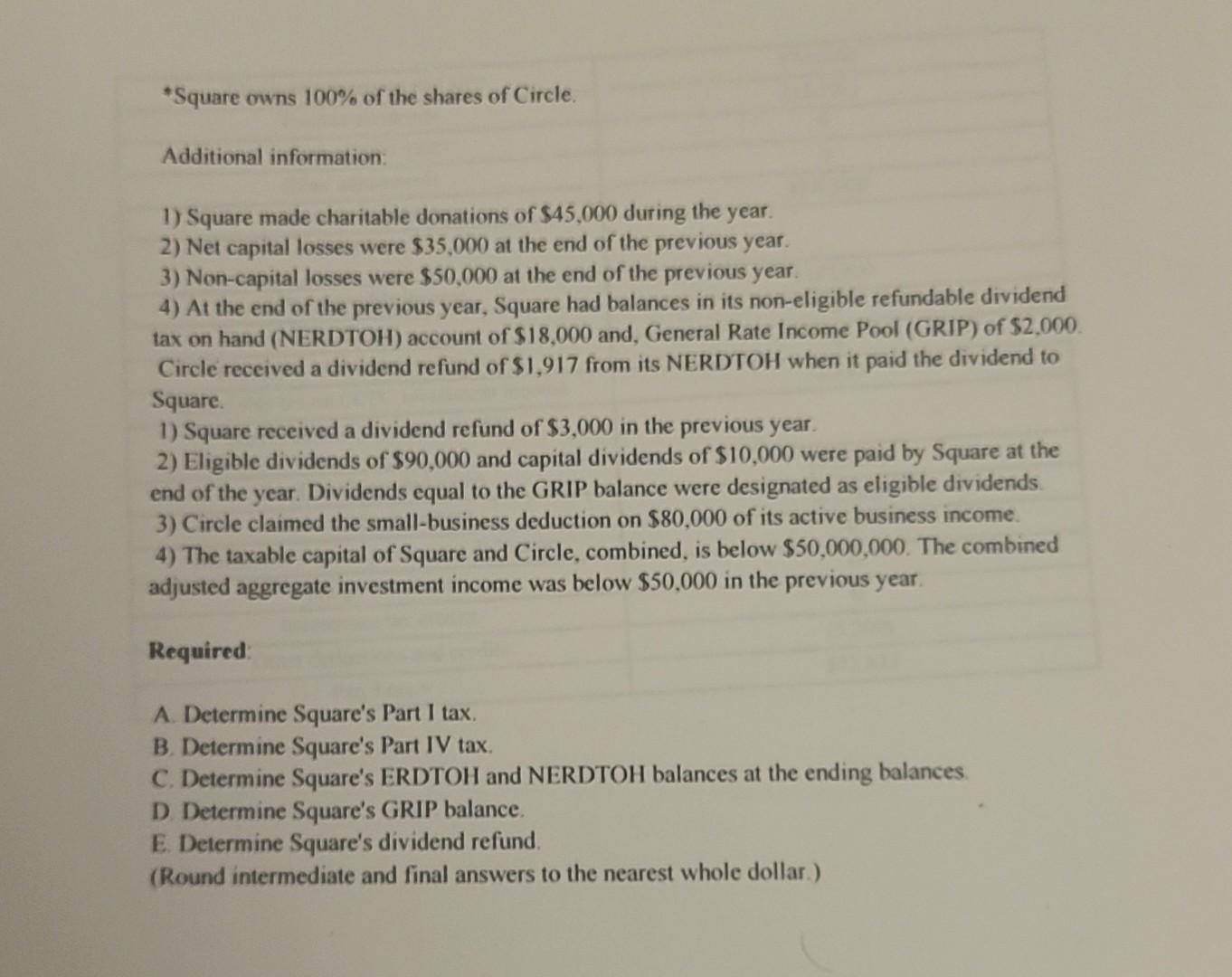

19) This case pertains to the 2022 tax year. Square Inc. is a Canadian-controlled private corporation and has correctly calculated its net *Square owns 100% of the shares of Circle. Additional information: 1) Square made charitable donations of $45,000 during the year. 2) Net capital losses were $35,000 at the end of the previous year. 3) Non-capital losses were $50,000 at the end of the previous year. 4) At the end of the previous year, Square had balances in its non-eligible refundable dividend tax on hand (NERDTOH) account of $18,000 and, General Rate Income Pool (GRIP) of $2,000 Circle received a dividend refund of $1,917 from its NERDTOH when it paid the dividend to Square. 1) Square received a dividend refund of $3,000 in the previous year. 2) Eligible dividends of $90,000 and capital dividends of $10,000 were paid by Square at the end of the year. Dividends equal to the GRIP balance were designated as eligible dividends. 3) Circle claimed the small-business deduction on $80,000 of its active business income. 4) The taxable capital of Square and Circle, combined, is below $50,000,000. The combined adjusted aggregate investment income was below $50,000 in the previous year. Requred: A. Determine Square's Part I tax. B. Determine Square's Part IV tax. C. Determine Square's ERDTOH and NERDTOH balances at the ending balances. D Determine Square's GRIP balance. E. Determine Square's dividend refund. (Round intermediate and final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started