Answered step by step

Verified Expert Solution

Question

1 Approved Answer

19. This companys operating profit margin (as a percent rounded to 1 decimal place) in 2016 was ________. 20. The total asset turnover ratio for

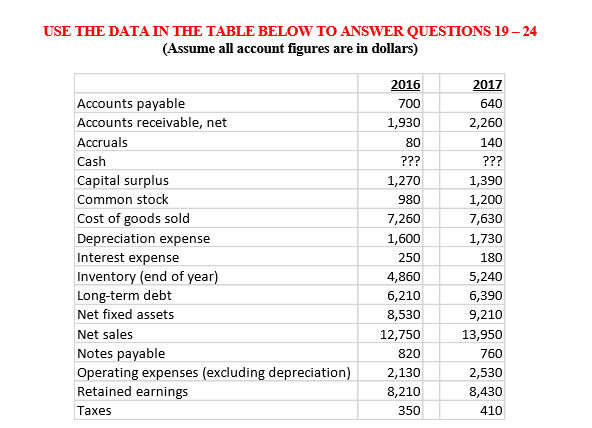

19. This companys operating profit margin (as a percent rounded to 1 decimal place) in 2016 was ________. 20. The total asset turnover ratio for this company in 2017 = _______. 21. ROE for 2017 is _____%. 22. Cash flow from operating activities in 2017 is $ _______. 23. Cash flow from investing activities in 2017 is $ _________. 24. Cash flow from financing activities in 2017 is $ _________.

USE THE DATAIN THE TABLE BELOW TO ANSWER QUESTIONS 19-24 Assume all account figures are in dollars) 2016 700 1,930 80 2017 640 2,260 140 Accounts payable Accounts receivable, net Accruals Cash Capital surplus Common stock Cost of goods sold Depreciation expense Interest expense Inventory (end of year) Long-term debt Net fixed assets Net sale:s Notes payable Operating expenses (excluding depreciation) Retained earnings Taxes 1,270 980 7,260 1,600 250 4,860 6,210 8,530 12,750 820 2,130 8,210 350 1,390 1,200 7,630 1,730 180 5,240 6,390 9,210 13,950 760 2,530 8,430 410Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started