Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(19) / Twitter Maps YouTube MLA Format & M... anslate ENGLISH SPANISH ARADIL UCI CUI LANGUAGE Fran, who is in the 35% tax category, recently

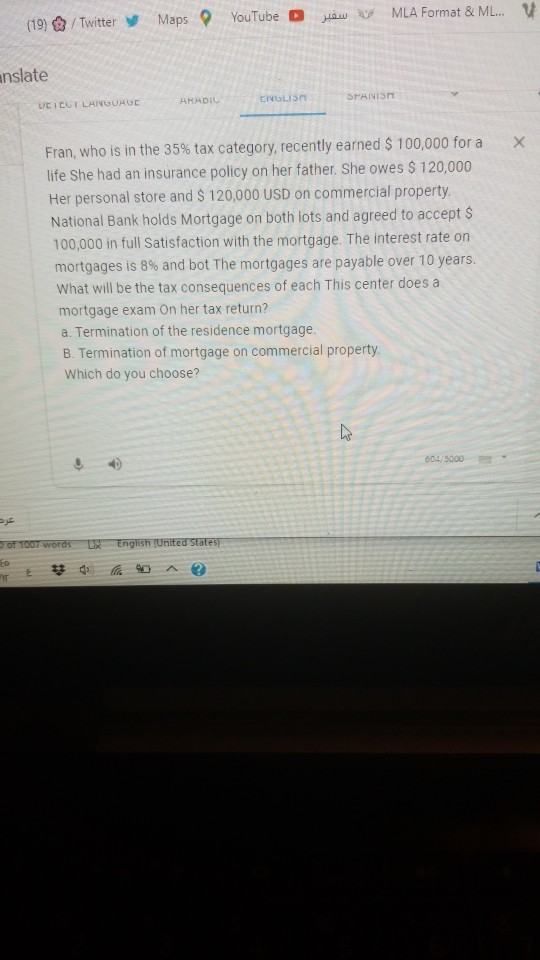

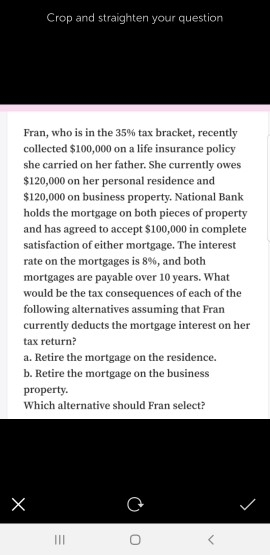

(19) / Twitter Maps YouTube MLA Format & M... anslate ENGLISH SPANISH ARADIL UCI CUI LANGUAGE Fran, who is in the 35% tax category, recently earned $ 100,000 for a life She had an insurance policy on her father. She owes $ 120,000 Her personal store and $ 120,000 USD on commercial property. National Bank holds Mortgage on both lots and agreed to accept $ 100,000 in full Satisfaction with the mortgage. The interest rate on mortgages is 8% and bot The mortgages are payable over 10 years. What will be the tax consequences of each This center does a mortgage exam on her tax return? a. Termination of the residence mortgage B. Termination of mortgage on commercial property Which do you choose? 6045000 Of T007 words English (United States Crop and straighten your question Fran, who is in the 35% tax bracket, recently collected $100,000 on a life insurance policy she carried on her father. She currently owes $120,000 on her personal residence and $120,000 on business property. National Bank holds the mortgage on both pieces of property and has agreed to accept $100,000 in complete satisfaction of either mortgage. The interest rate on the mortgages is 8%, and both mortgages are payable over 10 years. What would be the tax consequences of each of the following alternatives assuming that Fran currently deducts the mortgage interest on her tax return? a. Retire the mortgage on the residence. b. Retire the mortgage on the business property. Which alternative should Fran select? X 0 III (19) / Twitter Maps YouTube MLA Format & M... anslate ENGLISH SPANISH ARADIL UCI CUI LANGUAGE Fran, who is in the 35% tax category, recently earned $ 100,000 for a life She had an insurance policy on her father. She owes $ 120,000 Her personal store and $ 120,000 USD on commercial property. National Bank holds Mortgage on both lots and agreed to accept $ 100,000 in full Satisfaction with the mortgage. The interest rate on mortgages is 8% and bot The mortgages are payable over 10 years. What will be the tax consequences of each This center does a mortgage exam on her tax return? a. Termination of the residence mortgage B. Termination of mortgage on commercial property Which do you choose? 6045000 Of T007 words English (United States Crop and straighten your question Fran, who is in the 35% tax bracket, recently collected $100,000 on a life insurance policy she carried on her father. She currently owes $120,000 on her personal residence and $120,000 on business property. National Bank holds the mortgage on both pieces of property and has agreed to accept $100,000 in complete satisfaction of either mortgage. The interest rate on the mortgages is 8%, and both mortgages are payable over 10 years. What would be the tax consequences of each of the following alternatives assuming that Fran currently deducts the mortgage interest on her tax return? a. Retire the mortgage on the residence. b. Retire the mortgage on the business property. Which alternative should Fran select? X 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started