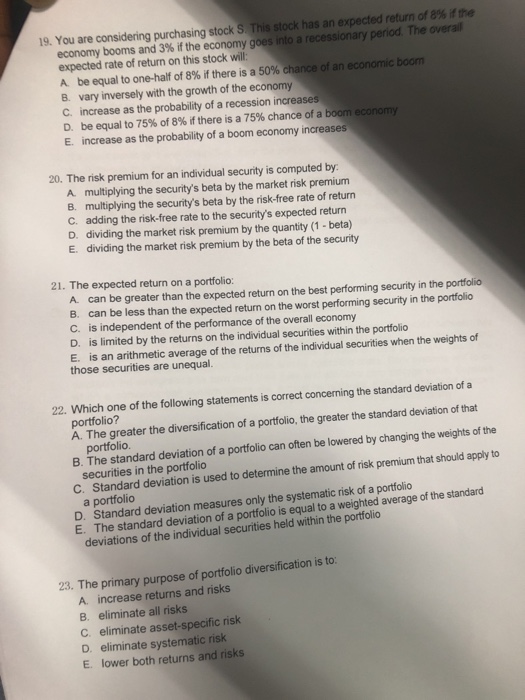

19. You are considering purchasing stocks. This stock has an expected return of 8% if the if the economy goes into a recessionary period. The overail expected rate of return on this stock will: A be equal to one-half of 8% if there is a 50% chance of an economic boom B. vary inversely with the growth of the economy C. increase as the probability of a recession increases D. be equal to 75% of 8% if there is a 75% chance of a boom economy E. increase as the probability of a boom economy increases 20. The risk premium for an individual security is computed by A multiplying the security's beta by the market risk premium B. multiplying the security's beta by the risk-free rate of return C. adding the risk-free rate to the security's expected return D. dividing the market risk premium by the quantity (1- beta) E. dividing the market risk premium by the beta of the security 21. The expected return on a portfolio: A can be greater than the expected return on the best performing security in the portfolio B. can be less than the expected return on the worst performing security in the portfolio C. is independent of the performance of the overall economy D. is limited by the returns on the individual securities within the portfolio E. is an arithmetic average of the returns of the individual securities when the weights of those securities are unequal. 22. Which one of the following statements is correct concerning the standard deviation of a portfolio? A. The greater the diversification of a portfolio, the greater the standard deviation of that portfolio B. The standard deviation of a portfolio can often be lowered by changing the weights of the securities in the portfolio C. Standard deviation is used to determine the amount of risk premium that should apply to a portfolio D. Standard deviation measures only the systematic risk of a portfolio E. The standard deviation of a portfolio is equal to a weighted average of the standard deviations of the individual securities held within the portfolio 23. The primary purpose of portfolio diversification is to A. increase returns and risks B. eliminate all risks C. eliminate asset-specific risk D. eliminate systematic risk E. lower both returns and risks