Answered step by step

Verified Expert Solution

Question

1 Approved Answer

190 Question 2 (15 marks) Gamma Ltd. acquired a tract of land with a building for $900,000. The closing statement indicated that the land's assessed

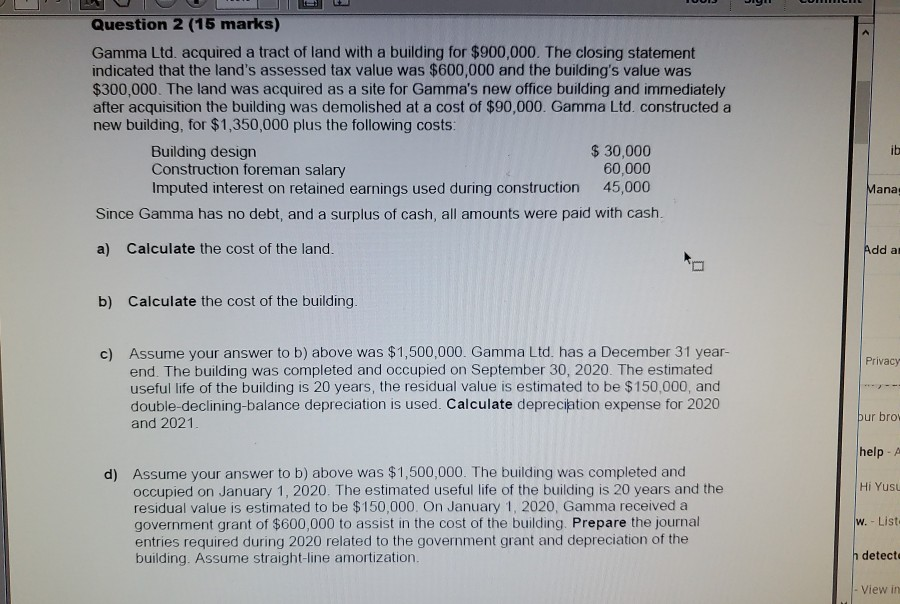

190 Question 2 (15 marks) Gamma Ltd. acquired a tract of land with a building for $900,000. The closing statement indicated that the land's assessed tax value was $600,000 and the building's value was $300,000. The land was acquired as a site for Gamma's new office building and immediately after acquisition the building was demolished at a cost of $90,000. Gamma Ltd, constructed a new building, for $1,350,000 plus the following costs Building design $ 30,000 Construction foreman salary 60,000 Imputed interest on retained earnings used during construction 45,000 Since Gamma has no debt, and a surplus of cash, all amounts were paid with cash. Mana: a) Calculate the cost of the land. Add a b) Calculate the cost of the building. Privacy c) Assume your answer to b) above was $1,500,000. Gamma Ltd. has a December 31 year- end. The building was completed and occupied on September 30, 2020. The estimated useful life of the building is 20 years, the residual value is estimated to be $150.000, and double-declining-balance depreciation is used. Calculate depreciation expense for 2020 and 2021. bur bro: help- Hi Yusu d) Assume your answer to b) above was $1,500,000. The building was completed and occupied on January 1, 2020. The estimated useful life of the building is 20 years and the residual value is estimated to be $150,000. On January 1, 2020, Gamma received a government grant of $600,000 to assist in the cost of the building. Prepare the journal entries required during 2020 related to the government grant and depreciation of the building. Assume straight-line amortization. w. - List: h detect - View in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started