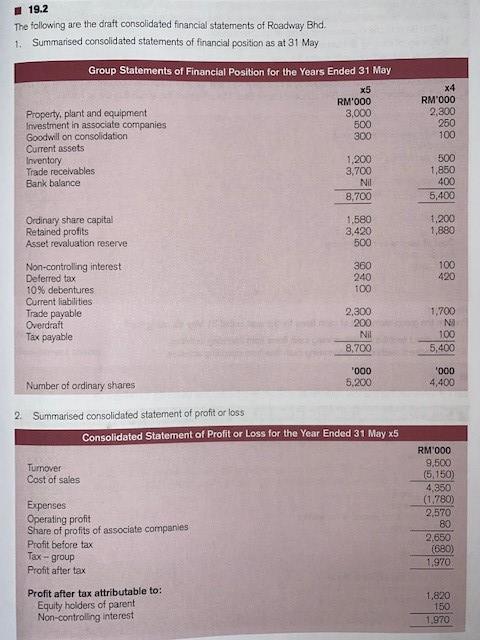

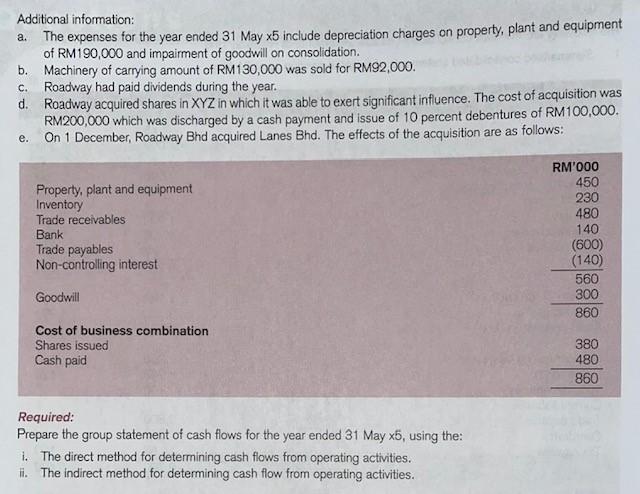

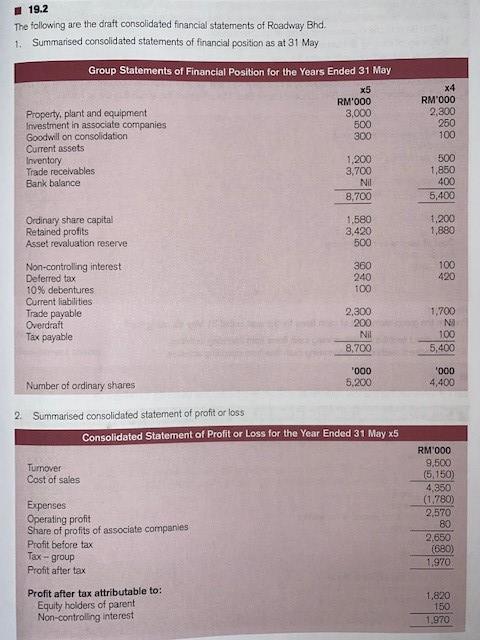

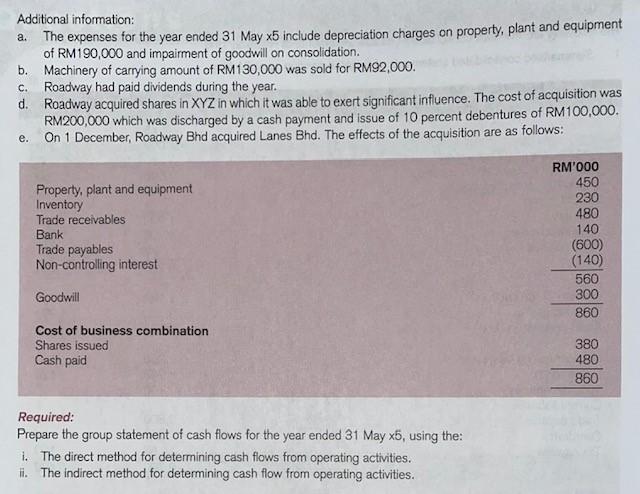

19.2 The following are the draft consolidated financial statements of Roadway Bhd. 1. Summarised consolidated statements of financial position as at 31 May Group Statements of Financial Position for the Years Ended 31 May x5 RM'000 3,000 500 300 X4 RM'000 2,300 250 100 Property, plant and equipment Investment in associate companies Goodwill on consolidation Current Assets Inventory Trade receivables Bank balance 1,200 3,700 Nil 8,700 500 1,850 400 5,400 Ordinary share capital Retained profits Asset revaluation reserve 1.580 3,420 500 1,200 1.880 360 240 100 100 420 Non-controlling interest Deferred tax 10% debentures Current liabilities Trade payable Overdraft Tax payable 2,300 200 Nil 1.700 NA 100 5,400 8.700 000 5.200 '000 4,400 Number of ordinary shares 2. Summarised consolidated statement of profit or loss Consolidated Statement of Profit or Loss for the Year Ended 31 May x5 RM000 Turnover Cost of sales Expenses Operating profit Share of profits of associate companies Profit before tax 9,500 (5 150) 4,850 (1.780) 2.570 80 2.650 (680) 1,970 Tax-group Profit after tax Profit after tax attributable to: Equity holders of parent Non-controlling interest 1,820 150 1.970 Additional information: a. The expenses for the year ended 31 May x5 include depreciation charges on property, plant and equipment of RM190,000 and impairment of goodwill on consolidation. b. Machinery of carrying amount of RM130,000 was sold for RM92,000. C. Roadway had paid dividends during the year. d. Roadway acquired shares in XYZ in which it was able to exert significant influence. The cost of acquisition was RM200,000 which was discharged by a cash payment and issue of 10 percent debentures of RM100,000. On 1 December, Roadway Bhd acquired Lanes Bhd. The effects of the acquisition are as follows: e. Property, plant and equipment Inventory Trade receivables Bank Trade payables Non-controlling interest RM'000 450 230 480 140 (600) (140) 560 300 860 Goodwill Cost of business combination Shares issued Cash paid 380 480 860 Required: Prepare the group statement of cash flows for the year ended 31 May x5, using the: 1. The direct method for determining cash flows from operating activities. li. The indirect method for determining cash flow from operating activities