Answered step by step

Verified Expert Solution

Question

1 Approved Answer

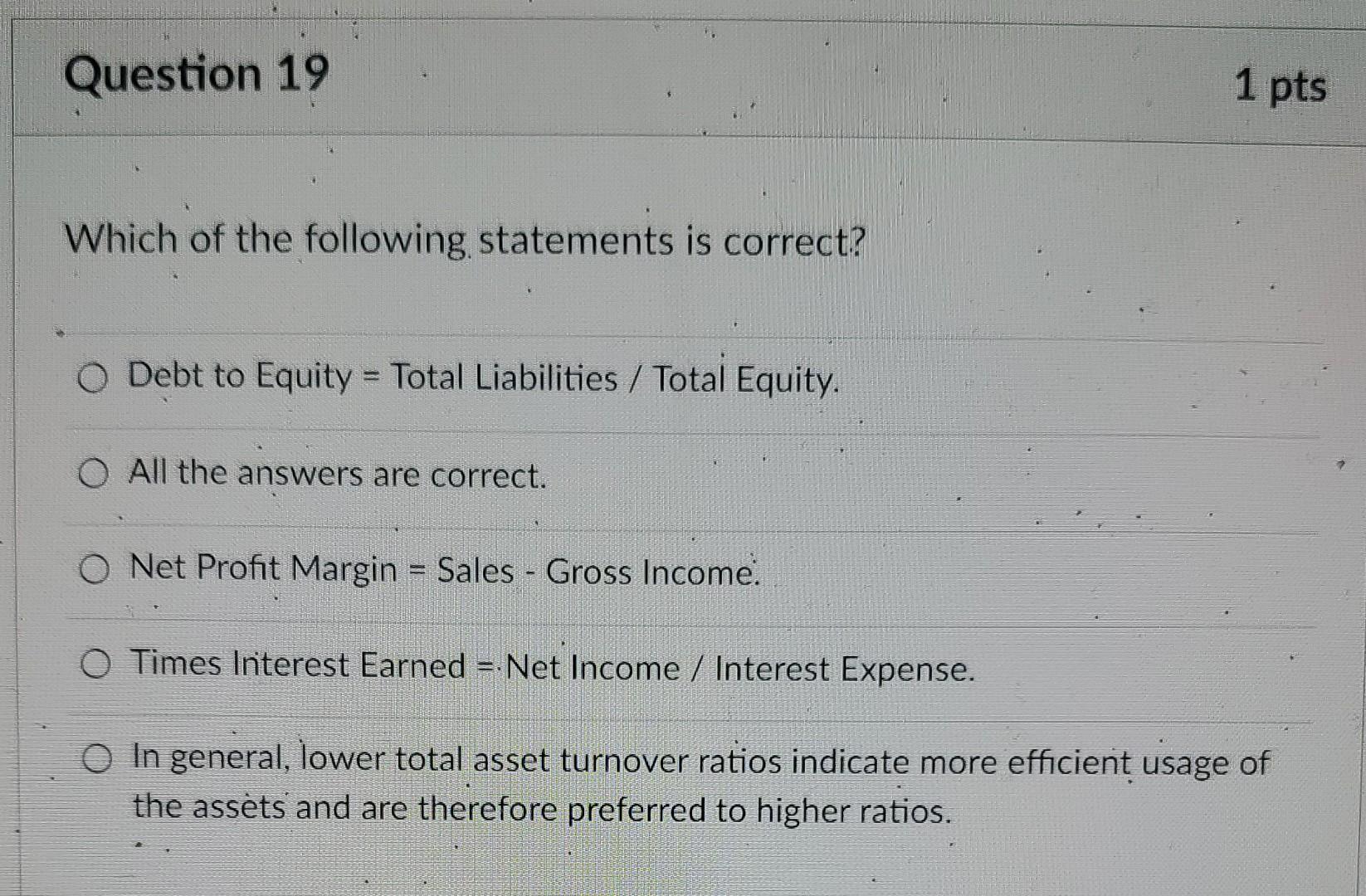

19&20 will upvote Which of the following statements is correct? Debt to Equity = Total Liabilities / Total Equity. All the answers are correct. Net

19&20 will upvote

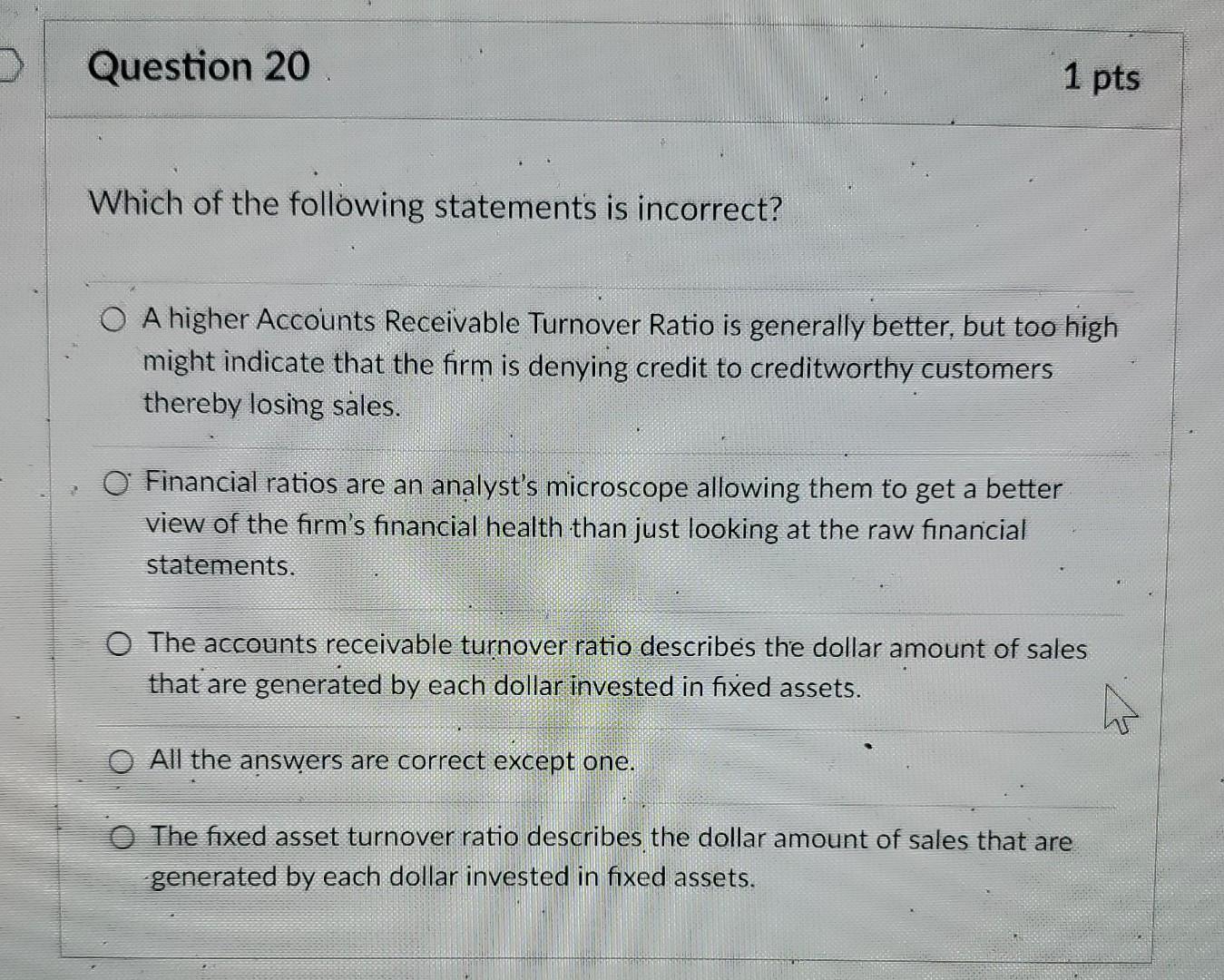

Which of the following statements is correct? Debt to Equity = Total Liabilities / Total Equity. All the answers are correct. Net Profit Margin = Sales - Gross Income Times Interest Earned =. Net Income / Interest Expense. In general, lower total asset turnover ratios indicate more efficient usage of Which of the following statements is incorrect? A higher Accounts Receivable Turnover Ratio is generally better, but too high might indicate that the firm is denying credit to creditworthy customers thereby losing sales. Financial ratios are an analyst's microscope allowing them to get a better view of the firm's financial health than just looking at the raw financial statements. The accounts receivable turnover ratio describes the dollar amount of sales that are generated by each dollar invested in fixed assets. All the answers are correct except one. The fixed asset turnover ratio describes the dollar amount of sales that are generated by each dollar invested in fixed assetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started