#19-22 the last 4 images

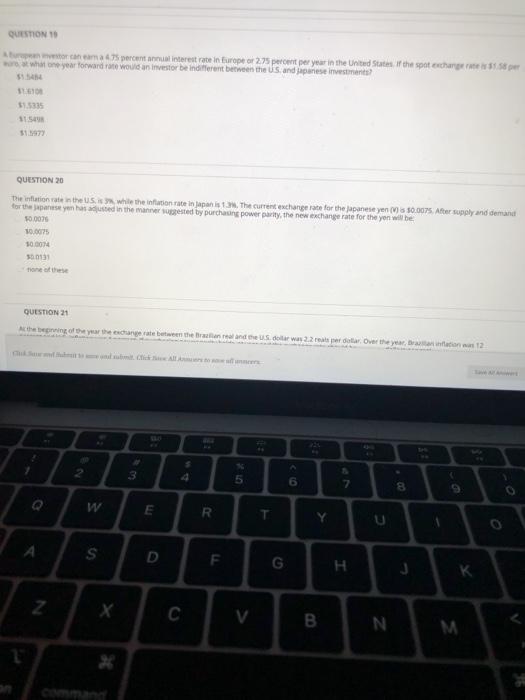

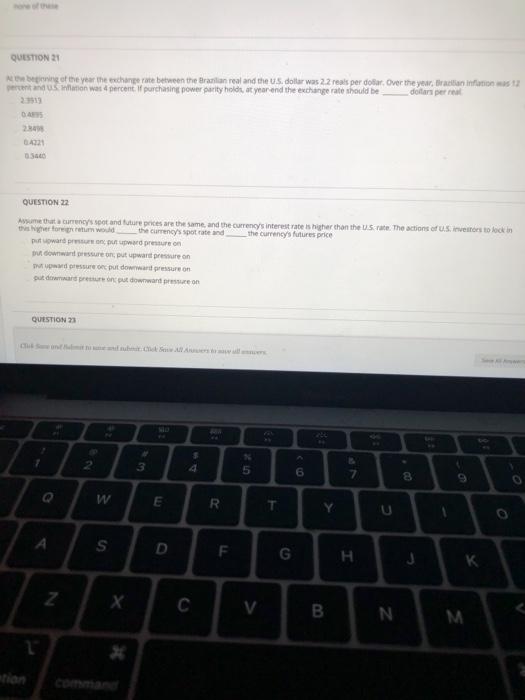

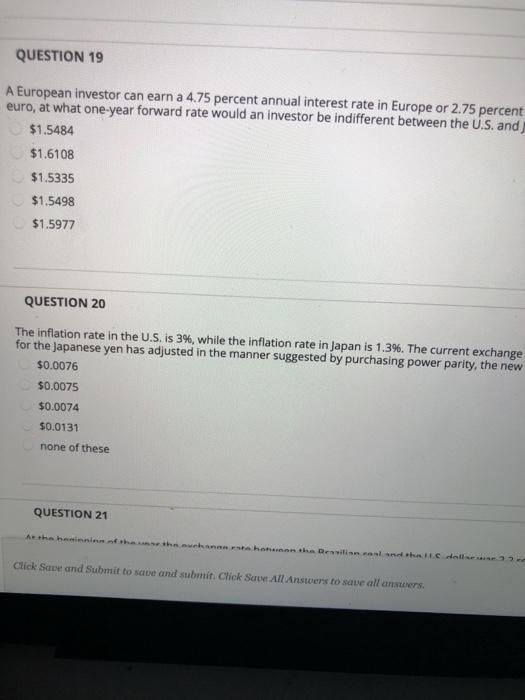

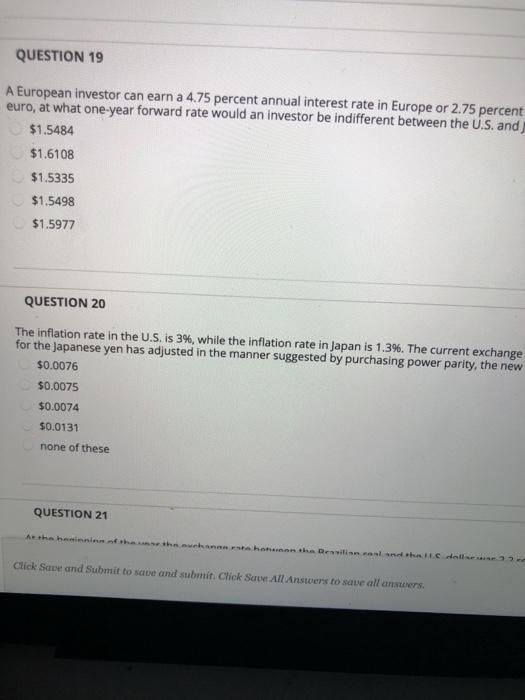

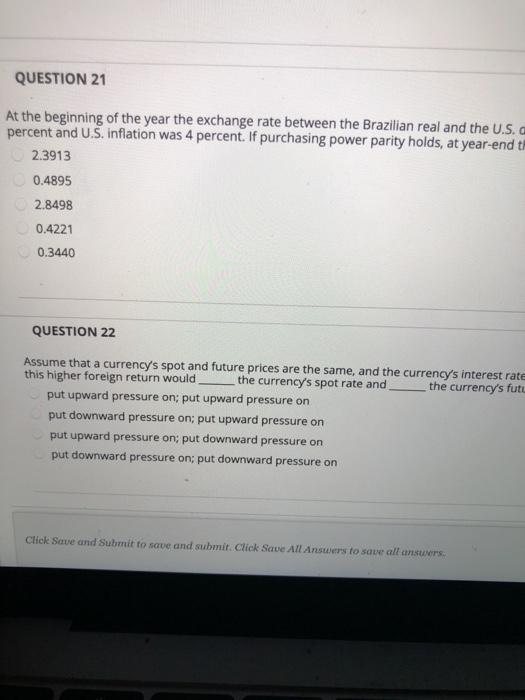

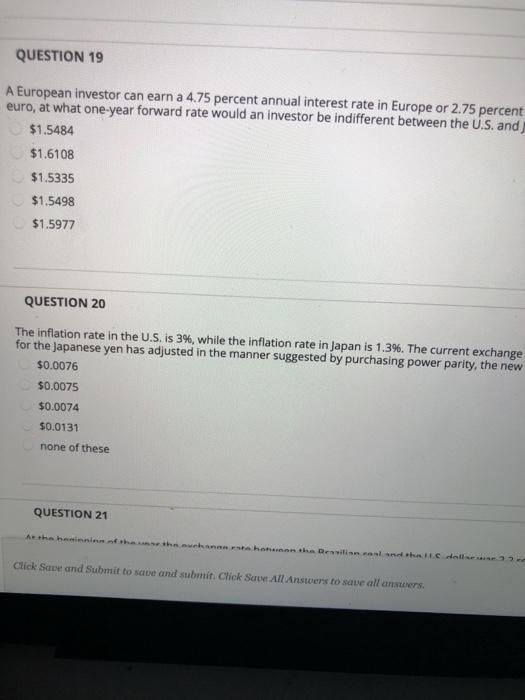

QUESTION nema 75 percent terest rate in Europe of 2.75 percent per year in the United States if the spot exchange what the year forward te would an investorbe indifferent between the US and Japanese investments 1161 $1.5335 3154 QUESTION 20 the nation rate in the US while the nationale in Japan. The current exchange rate for the japanese yen ( M50.0075. After supply and demand for the past years in the manner sted by purchasing power party, the new exchange rate for the yon will be 50.0076 0.0075 500014 500133 QUESTION 21 Acthe beginning of the year the change rate between the wind Swarower the year 12 3 5 6 7 8 o Q W E R Y U A S D F G . J Z C V B N M QUESTION 21 Nening of the year the exchange rate between the Brazilian real and the US dollar was 2.2 reals per dobar. Over the year, Brainfot pertanton was percent. If purchasing power party hold year end the exchange rate should be dollars per al DES G4221 QUESTION 22 Asume that currency's stand future prices are the same, and the currencys interest rate is higher than the US rate. The actions of U.S. investors to look in the currencys spot rate and the currency's futures price pur wrd r , Du want pressure or put upward pressure on pressure put down pressure on put down to put down on QUESTION 23 $ 2 Un at B. 7 6 W E R T Y S D F G H J Z C V B N M QUESTION 19 A European investor can earn a 4.75 percent annual interest rate in Europe or 2.75 percent euro, at what one-year forward rate would an investor be indifferent between the U.S. and $1.5484 $1.6108 $1.5335 $1.5498 $1.5977 QUESTION 20 The inflation rate in the U.S. is 3%, while the inflation rate in Japan is 1.3%. The current exchange for the Japanese yen has adjusted in the manner suggested by purchasing power parity, the new $0.0076 $0.0075 $0.0074 30.0131 none of these QUESTION 21 Ar the besinninn of the theme sonst hann the Dessin ruled the colle Click Save and Submit to save and submit. Click Save All Answers to save all answers. ual interest rate in Europe or 2.75 percent per year in the United States. If the spot exchange rate is $1.58 per restorbe indifferent between the US and Japanese investments? nflation rate in Japan is 1.3%. The current exchange rate for the Japanese yen (1) is 50,0075. After supply and demand ener suggested by purchasing power parity, the new exchange rate for the yen will be: hthin this artha Di lick Save All Astors to save all ans Save All An 8. 9 QUESTION 21 At the beginning of the year the exchange rate between the Brazilian real and the U.S. percent and U.S. Inflation was 4 percent. If purchasing power parity holds, at year-endt 2.3913 0.4895 2.8498 0.4221 0.3440 QUESTION 22 Assume that a currency's spot and future prices are the same, and the currency's interest rate this higher foreign return would the currency's spot rate and the currency's futu put upward pressure on; put upward pressure on put downward pressure on; put upward pressure on put upward pressure on; put downward pressure on put downward pressure on: put downward pressure on Click Save and Submit to save and submit. Click Save All Answers to save all answers between the Brazilian real and the U.S. dollar was 2.2 reals per dollar. Over the year, Brazilian inflation was 12 hasing power parity holds, at year-end the exchange rate should be dollars per real rices are the same, and the currencys interest rate is higher than the U.S. rate. The actions of U.S. Investors to lock in currency's spot rate and the currency's futures price ressure on -d pressure on Td pressure on wward pressure on Click Save all answer to move all answers