Answered step by step

Verified Expert Solution

Question

1 Approved Answer

19:25 19% Read Only - You can't save changes to this file. 1. The interest in a second mortgages on a first mortgage created the

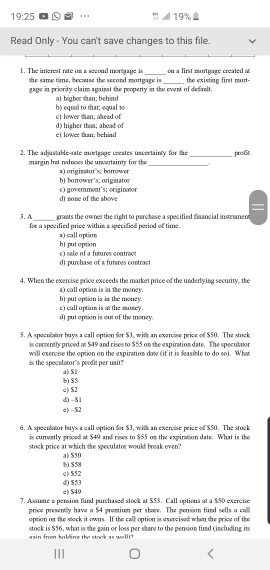

19:25 19% Read Only - You can't save changes to this file. 1. The interest in a second mortgages on a first mortgage created the same time, because the second mortgeis the existing first mort gage in prily claim samite property in the event of defelt a) higher than behind b) cqual to that; equal to ch lower than head of d) higher than half e lower than behind 2. The adjustablerte meg a certainly for the margin brat reduces the uncertainty for the a) originator borrower b) borrower's originator c) government's originario done of the above 3.A rats the owner the right to purchase a specified financial instrumen for a specified price within a specified period of time. a) call option bi putea c) sale of a future contract di purchase of a futures context 4. When the exercise price exceeds the market price of the underlying security, the a) call option is in the money bpul option is in the money c) call option is at the moscy. dipulation is out of the money , 5. A speculator bays a call option for S), with an exercise price of SS. The stock is currently priced at $19 and rises to $55 on the expiration date. The speculator will exercise the option on the expiration date if it is feasible to do so). What is the speculator's poodit per mit a) SI b) c) 52 6. A specular buys a call option for S3, with an exercise prices. The stock is currently priced at $40 and rises to $55 on the expiration date. What is the stock price at which the speculate would break even! asso c) 552 da c) 549 7. Asume a person fund purchased stecka 553. Call options at a 550 exercise price presently have a premium shee The person fund sells a call option on the stock it was the call option is need when the price of the stock is 856 utast is the gain or loss per share to the pension find (including its asin from hin the will

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started