Answered step by step

Verified Expert Solution

Question

1 Approved Answer

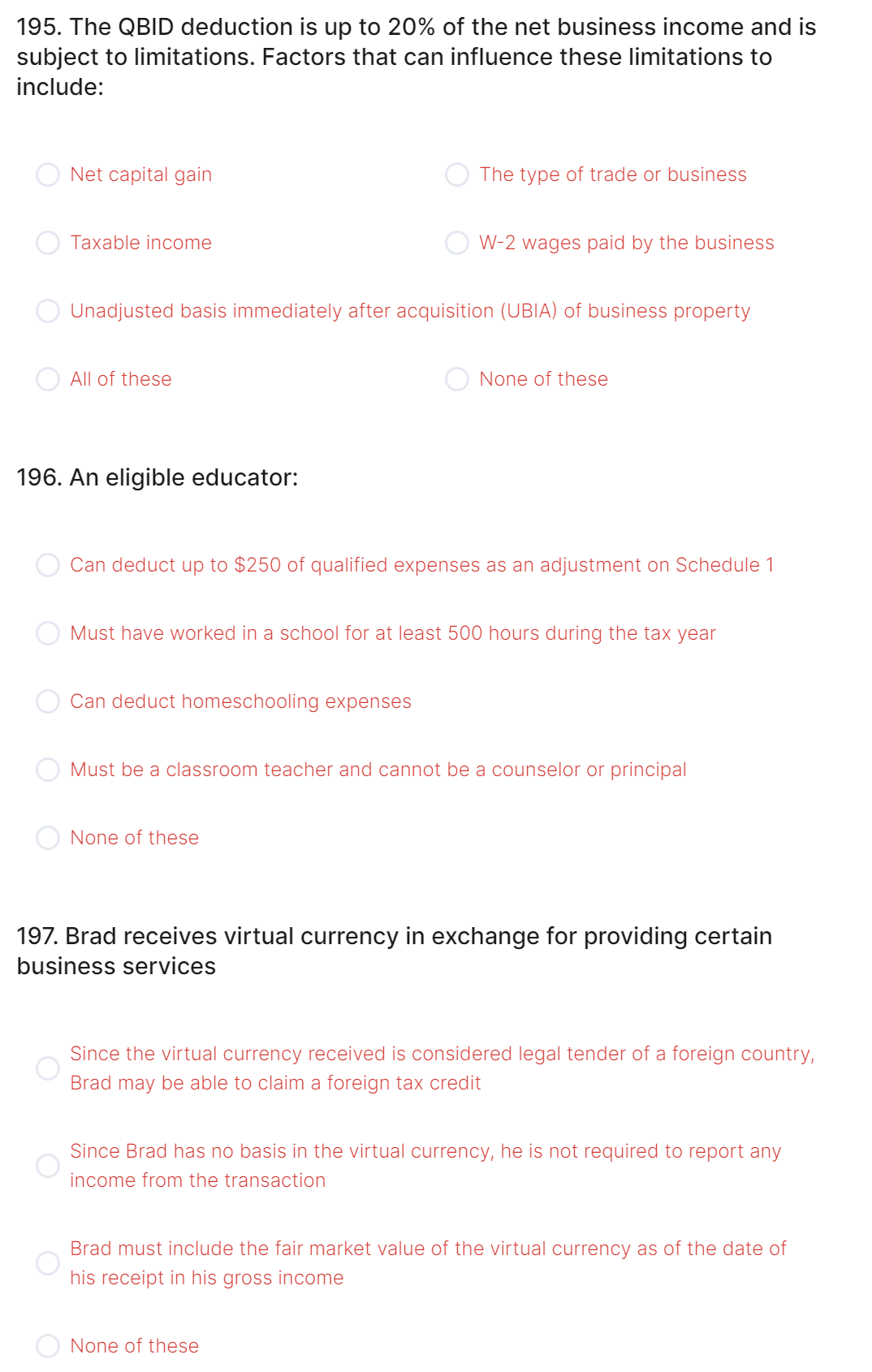

195. The QBID deduction is up to 20% of the net business income and is subject to limitations. Factors that can influence these limitations to

195. The QBID deduction is up to 20% of the net business income and is subject to limitations. Factors that can influence these limitations to include: Net capital gain The type of trade or business Taxable income W-2 wages paid by the business Unadjusted basis immediately after acquisition (UBIA) of business property All of these None of these 196. An eligible educator: Can deduct up to $250 of qualified expenses as an adjustment on Schedule 1 Must have worked in a school for at least 500 hours during the tax year Can deduct homeschooling expenses Must be a classroom teacher and cannot be a counselor or principal None of these 197. Brad receives virtual currency in exchange for providing certain business services Since the virtual currency received is considered legal tender of a foreign country, Brad may be able to claim a foreign tax credit Since Brad has no basis in the virtual currency, he is not required to report any income from the transaction Brad must include the fair market value of the virtual currency as of the date of his receipt in his gross income None of these

195. The QBID deduction is up to 20% of the net business income and is subject to limitations. Factors that can influence these limitations to include: Net capital gain The type of trade or business Taxable income W-2 wages paid by the business Unadjusted basis immediately after acquisition (UBIA) of business property All of these None of these 196. An eligible educator: Can deduct up to $250 of qualified expenses as an adjustment on Schedule 1 Must have worked in a school for at least 500 hours during the tax year Can deduct homeschooling expenses Must be a classroom teacher and cannot be a counselor or principal None of these 197. Brad receives virtual currency in exchange for providing certain business services Since the virtual currency received is considered legal tender of a foreign country, Brad may be able to claim a foreign tax credit Since Brad has no basis in the virtual currency, he is not required to report any income from the transaction Brad must include the fair market value of the virtual currency as of the date of his receipt in his gross income None of these Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started