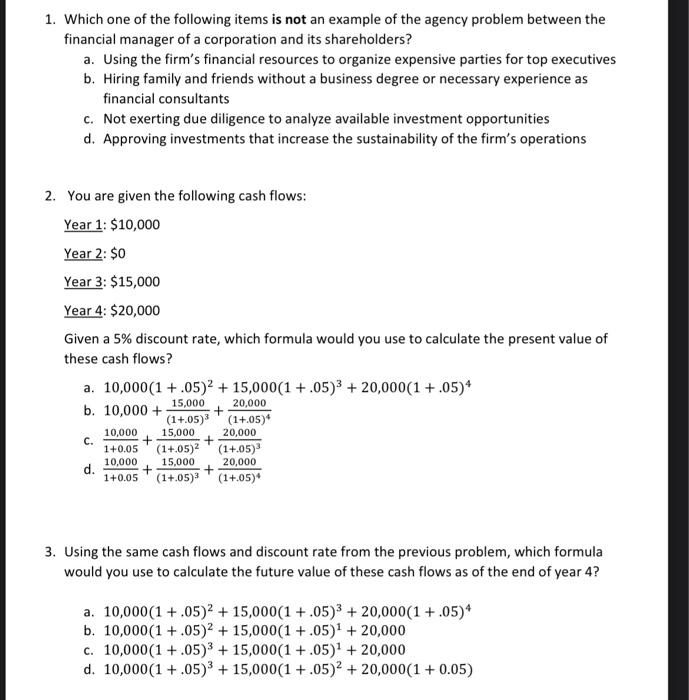

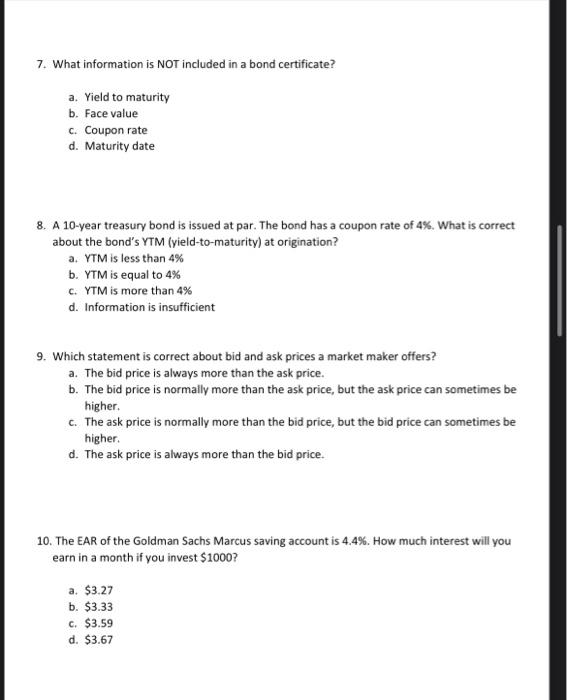

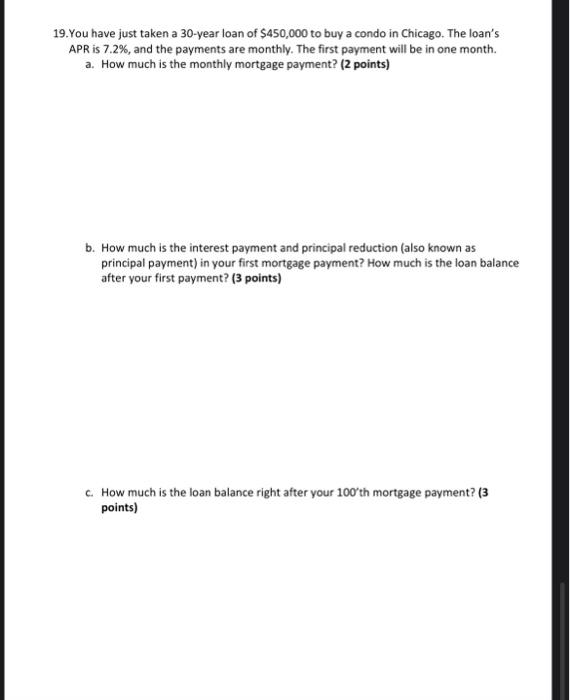

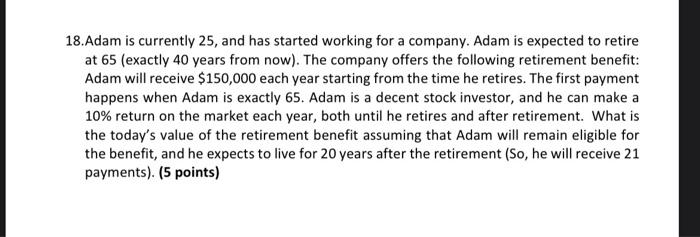

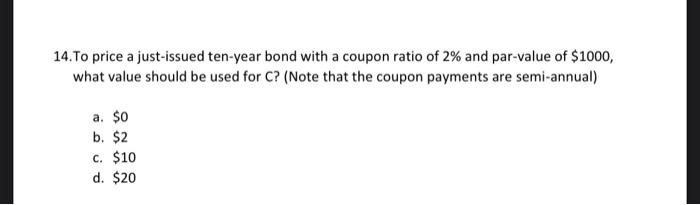

19.You have just taken a 30-year loan of $450,000 to buy a condo in Chicago. The loan's APR is 7.2%, and the payments are monthly. The first payment will be in one month. a. How much is the monthly mortgage payment? (2 points) b. How much is the interest payment and principal reduction (also known as principal payment) in your first mortgage payment? How much is the loan balance after your first payment? (3 points) c. How much is the loan balance right after your 100 th mortgage payment? (3 points) 18. Adam is currently 25 , and has started working for a company. Adam is expected to retire at 65 (exactly 40 years from now). The company offers the following retirement benefit: Adam will receive $150,000 each year starting from the time he retires. The first payment happens when Adam is exactly 65 . Adam is a decent stock investor, and he can make a 10% return on the market each year, both until he retires and after retirement. What is the today's value of the retirement benefit assuming that Adam will remain eligible for the benefit, and he expects to live for 20 years after the retirement (So, he will receive 21 payments). (5 points) 7. What information is NOT included in a bond certificate? a. Yield to maturity b. Face value c. Coupon rate d. Maturity date 8. A 10-year treasury bond is issued at par. The bond has a coupon rate of 4%. What is correct about the bond's YTM (yield-to-maturity) at origination? a. YTM is less than 4% b. YTM is equal to 4% c. YTM is more than 4% d. Information is insufficient 9. Which statement is correct about bid and ask prices a market maker offers? a. The bid price is always more than the ask price. b. The bid price is normally more than the ask price, but the ask price can sometimes be higher. c. The ask price is normally more than the bid price, but the bid price can sometimes be higher. d. The ask price is always more than the bid price. 10. The EAR of the Goldman Sachs Marcus saving account is 4.4%. How much interest will you earn in a month if you invest $1000 ? a. $3.27 b. $3.33 c. $3.59 d. $3.67 14.To price a just-issued ten-year bond with a coupon ratio of 2% and par-value of $1000, what value should be used for C ? (Note that the coupon payments are semi-annual) a. $0 b. $2 c. $10 d. $20 1. Which one of the following items is not an example of the agency problem between the financial manager of a corporation and its shareholders? a. Using the firm's financial resources to organize expensive parties for top executives b. Hiring family and friends without a business degree or necessary experience as financial consultants c. Not exerting due diligence to analyze available investment opportunities d. Approving investments that increase the sustainability of the firm's operations 2. You are given the following cash flows: Year 1: $10,000 Year 2: \$0 Year 3: $15,000 Year 4: $20,000 Given a 5% discount rate, which formula would you use to calculate the present value of these cash flows? a. 10,000(1+.05)2+15,000(1+.05)3+20,000(1+.05)4 b. 10,000+(1+.05)315,000+(1+.05)420,000 c. 1+0.0510,000+(1+.05)215,000+(1+.05)320,000 d. 1+0.0510,000+(1+.05)315,000+(1+.05)420,000 3. Using the same cash flows and discount rate from the previous problem, which formula would you use to calculate the future value of these cash flows as of the end of year 4 ? a. 10,000(1+.05)2+15,000(1+.05)3+20,000(1+.05)4 b. 10,000(1+.05)2+15,000(1+.05)1+20,000 c. 10,000(1+.05)3+15,000(1+.05)1+20,000 d. 10,000(1+.05)3+15,000(1+.05)2+20,000(1+0.05)