Question

1A. Assume that Lavonia's marginal tax rate is 22 percent. If a city of Tampa bond pays 7.2 percent interest, what interest rate would a

1A. Assume that Lavonia's marginal tax rate is 22 percent. If a city of Tampa bond pays 7.2 percent interest, what interest rate would a corporate bond have to offer for Lavonia to be indifferent between the two bonds?

Multiple Choice

a. 22.00 percent

b. 7.20 percent

c. 9.20 percent

d. 6.10 percent

e. 9.23 percent

1B. Assume that Keisha's marginal tax rate is 37 percent and her tax rate on dividends is 15 percent. If a city of Atlanta bond pays 10.03 percent interest, what dividend yield would a dividend-paying stock (with no growth potential) have to offer for Keisha to be indifferent between the two investments from a cash-flow perspective?

Top of Form

Multiple Choice

a. 15.00 percent

b. 12.80 percent

c. 11.80 percent

d. 10.03 percent

e. None of the choices are correct.

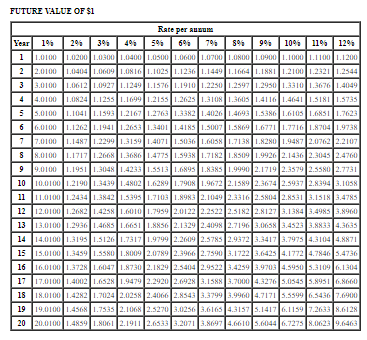

1C. Nicolai earns a 10 percent after-tax rate of return, $7,000 today would be worth how much to Nicolai in five years? Usethe future value of $1.

Note: Round discount factor(s) to four decimal places.

Multiple Choice

a. $7,000

b. $4,354

c. $6,365

d. $7,700

e. None of the choices are correct.

1D. Assume that John's marginal tax rate is 37 percent. If a city of Austin bond pays 5.7 percent interest, what interest rate would a corporate bond have to offer for John to be indifferent between the two bonds?

Multiple Choice

a. 35.15 percent

b. 9.05 percent

c. 5.70 percent

d. 3.59 percent

e. None of the choices are correct.

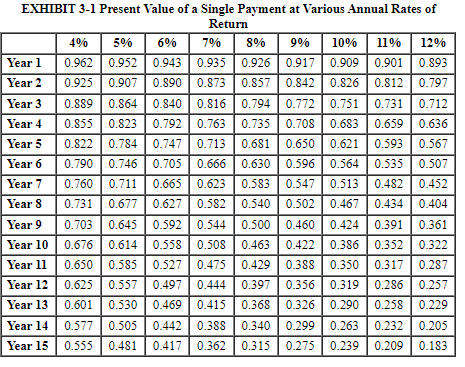

1E. If Thomas has a 37 percent tax rate and a 6 percent after-tax rate of return, $65,000 of income in five years will cost him how much tax in today's dollars? UseExhibit 3.1.

Note: Round discount factor(s) to three decimal places.

Multiple Choice

a. $65,000

b. $24,050

c. $49,230

d. $17,965

e. None of the choices are correct.

FUTURF VALUF OF $1 EXHIBIT 3-1 Present Value of a Single Payment at Various Annual Rates ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started