HELP ASAP

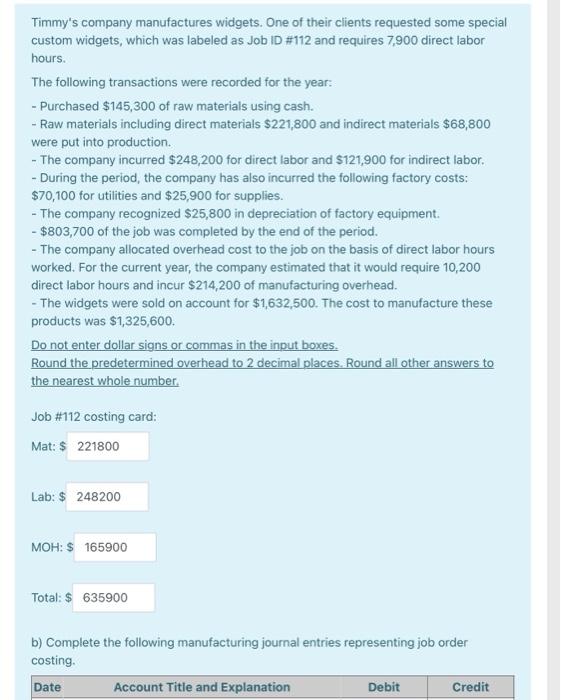

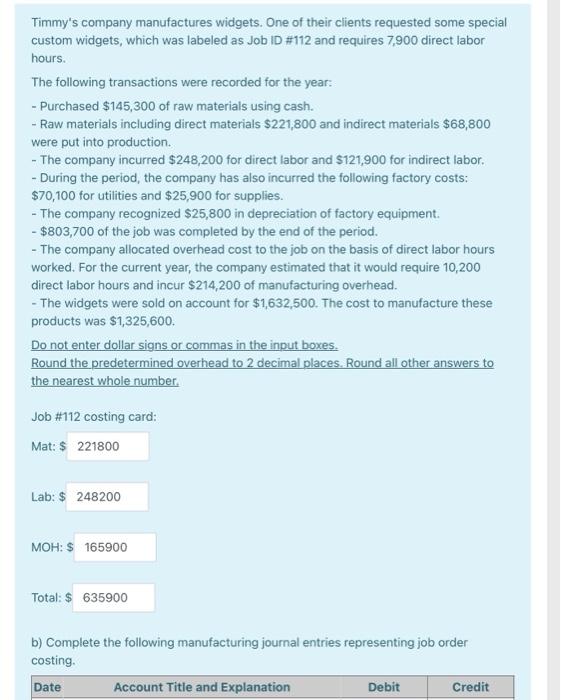

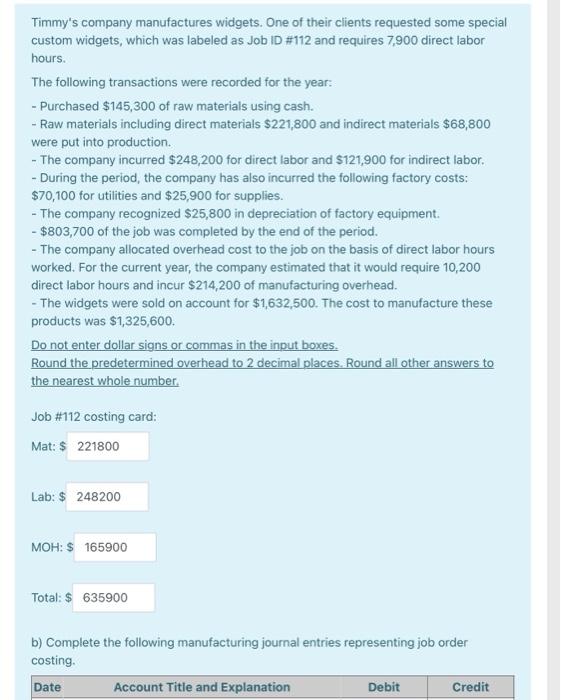

Timmy's company manufactures widgets. One of their clients requested some special custom widgets, which was labeled as Job ID#112 and requires 7,900 direct labor hours. The following transactions were recorded for the year: - Purchased $145,300 of raw materials using cash. - Raw materials including direct materials $221,800 and indirect materials $68,800 were put into production. - The company incurred $248,200 for direct labor and $121,900 for indirect labor. - During the period, the company has also incurred the following factory costs: $70,100 for utilities and $25,900 for supplies. - The company recognized $25,800 in depreciation of factory equipment. - $803,700 of the job was completed by the end of the period. - The company allocated overhead cost to the job on the basis of direct labor hours worked. For the current year, the company estimated that it would require 10,200 direct labor hours and incur $214,200 of manufacturing overhead. - The widgets were sold on account for $1,632,500. The cost to manufacture these products was $1,325,600. Do not enter dollar signs or commas in the input boxes. Round the predetermined overhead to 2 decimal places. Round all other answers to the nearest whole number. Job #112 costing card: Mat: $ 221800 Lab: $ 248200 MOH: $ 165900 Total: $ 635900 b) Complete the following manufacturing journal entries representing job order costing. Date Account Title and Explanation Debit Credit costing Date Account Title and Explanation 1 Raw Materials Debit Credit Cash To record purchase of raw materials with cash 2 WIP Manufacturing Overhead Raw Materials Enter direct and indirect materials into production 3 WIP Manufacturing Overhead Wages Payable To apply direct and indirect labor 4 Manufacturing Overhead Accounts Payable To record factory costs for utilities and supplies Manufacturing Overhead 5 Accumulated Depreciation To record depreciation on factory equipment 6 WIP 7 Manufacturing Overhead To record allocated manufacturing overtiead Finished Goods Inventory WIP To transfer WIP to finished goods inventory 8 Accounts Recebalo Sales Revenue To record sales revenue Cost of Goods Sold 9 Finished Goods Inventory To record cost of goods sold