Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.a b. c. d. e. R&B Enterprises will pay an annual dividend of $2.08 a share on its common stock one year from today. Yesterday,

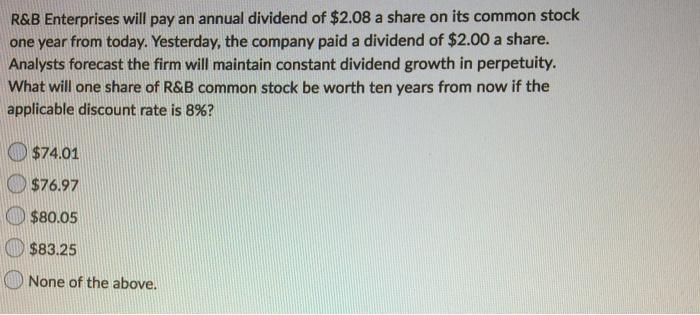

1.a

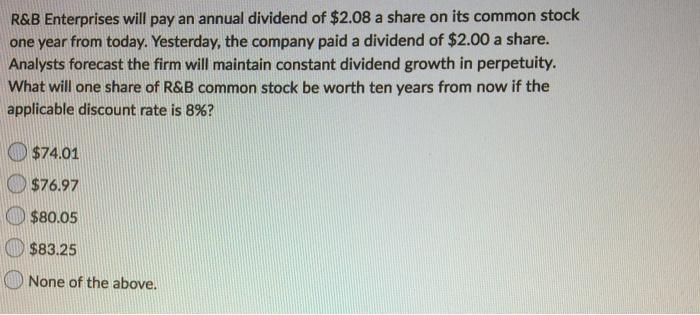

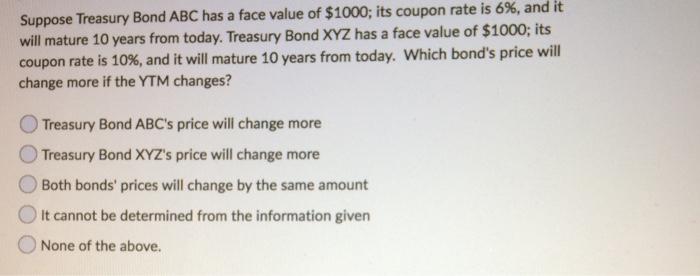

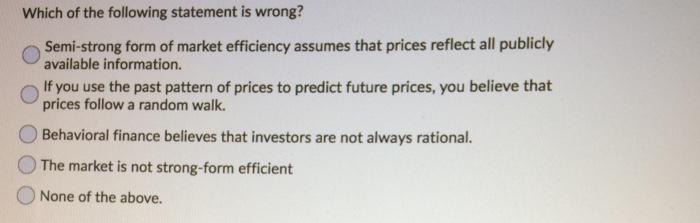

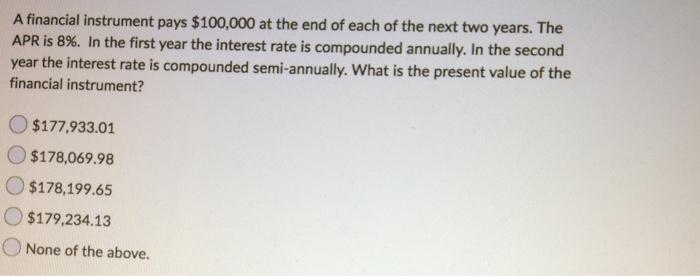

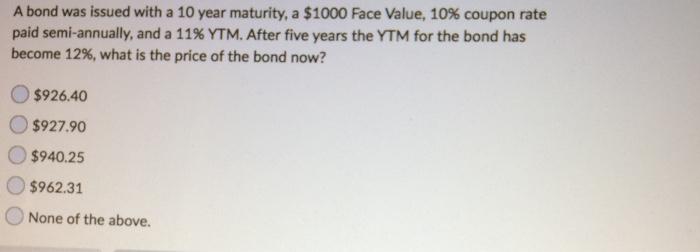

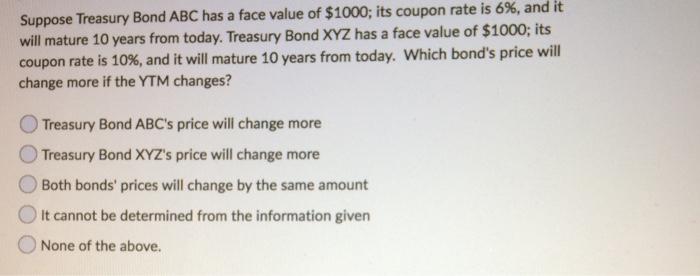

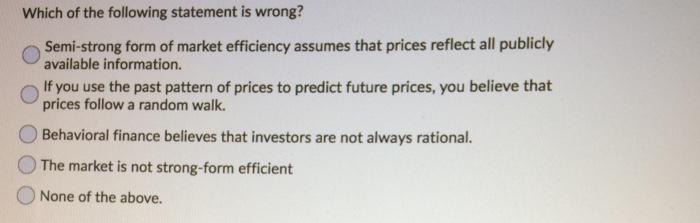

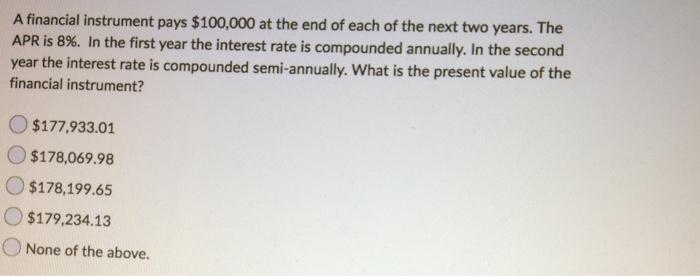

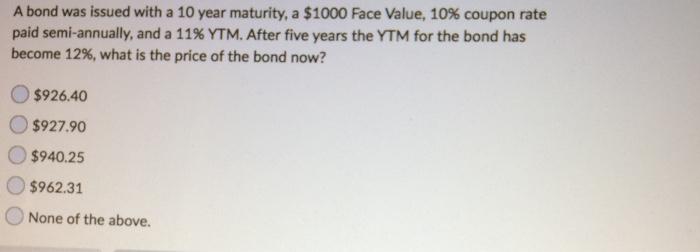

R&B Enterprises will pay an annual dividend of $2.08 a share on its common stock one year from today. Yesterday, the company paid a dividend of $2.00 a share. Analysts forecast the firm will maintain constant dividend growth in perpetuity. What will one share of R&B common stock be worth ten years from now if the applicable discount rate is 8%? $74.01 $76.97 $80.05 $83.25 None of the above. Suppose Treasury Bond ABC has a face value of $1000; its coupon rate is 6%, and it will mature 10 years from today. Treasury Bond XYZ has a face value of $1000; its coupon rate is 10%, and it will mature 10 years from today. Which bond's price will change more if the YTM changes? Treasury Bond ABC's price will change more Treasury Bond XYZ's price will change more Both bonds' prices will change by the same amount It cannot be determined from the information given None of the above. Which of the following statement is wrong? Semi-strong form of market efficiency assumes that prices reflect all publicly available information. If you use the past pattern of prices to predict future prices, you believe that prices follow a random walk. Behavioral finance believes that investors are not always rational. The market is not strong-form efficient None of the above. A financial instrument pays $100,000 at the end of each of the next two years. The APR is 8%. In the first year the interest rate is compounded annually. In the second year the interest rate is compounded semi-annually. What is the present value of the financial instrument? $177,933.01 $178,069.98 $178,199.65 $179,234.13 None of the above. A bond was issued with a 10 year maturity, a $1000 Face Value, 10% coupon rate paid semi-annually, and a 11% YTM. After five years the YTM for the bond has become 12%, what is the price of the bond now? $926.40 $927.90 $940.25 $962.31 None of the above

b.

c.

d.

e.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started