Answered step by step

Verified Expert Solution

Question

1 Approved Answer

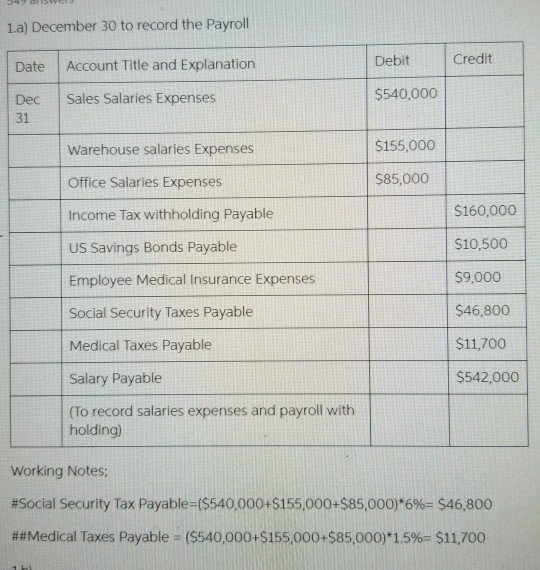

1.a) December 30 to record the Payroll Date Account Title and Explanation Debit Credit Dec Sales Salaries Expenses $540,000 Warehouse salaries Expenses $155,000 $85,000 Office

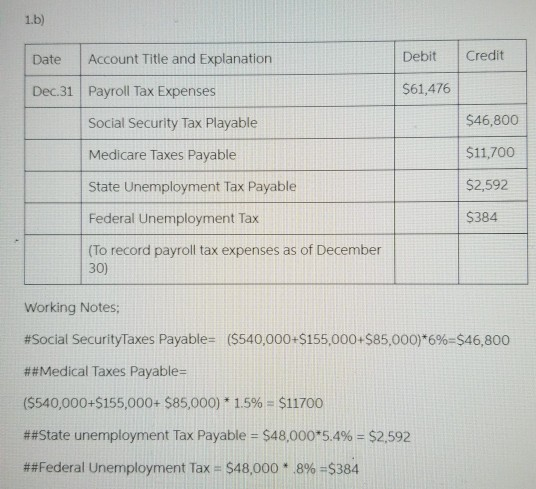

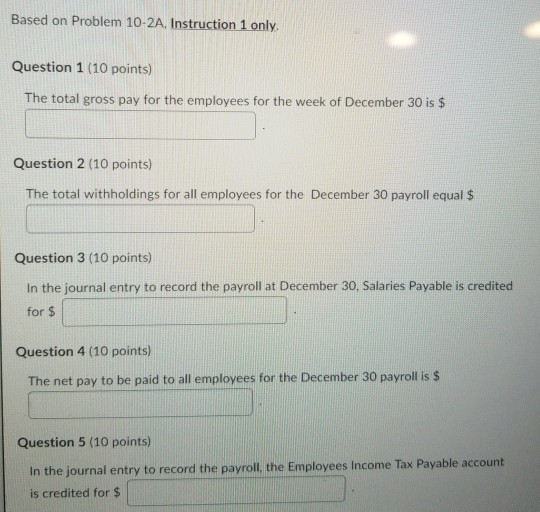

1.a) December 30 to record the Payroll Date Account Title and Explanation Debit Credit Dec Sales Salaries Expenses $540,000 Warehouse salaries Expenses $155,000 $85,000 Office Salaries Expenses Income Tax withholding Payable $160,000 US Savings Bonds Payable $10,500 $9,000 Employee Medical Insurance Expenses Social Security Taxes Payable Medical Taxes Payable $46,800 $11,700 $542,000 Salary Payable (To record salaries expenses and payroll with holding) Working Notes: #Social Security Tax Payable=($540,000+S155,000+$85,000)*6%-$46,800 ##Medical Taxes Payable = ($540,000+S155,000+$85,000)*1.5%= $11,700 1.b) Date Account Title and Explanation Debit Credit $61,476 $46,800 Dec.31 Payroll Tax Expenses Social Security Tax Playable Medicare Taxes Payable State Unemployment Tax Payable Federal Unemployment Tax $11,700 $2,592 $384 (To record payroll tax expenses as of December 30) Working Notes #Social SecurityTaxes Payable= ($540,000+$155,000+$85,000)*6%=$46,800 ##Medical Taxes Payable= (5540,000+S155,000+ $85,000) * 1.5% = $11700 ##State unemployment Tax Payable = $48.000*5.4% = $2,592 ##Federal Unemployment Tax = $48,000 * 8% =$384 Based on Problem 10-2A. Instruction 1 only. Question 1 (10 points) The total gross pay for the employees for the week of December 30 is $ Question 2 (10 points) The total withholdings for all employees for the December 30 payroll equal $ Question 3 (10 points) In the journal entry to record the payroll at December 30, Salaries Payable is credited for $ Question 4 (10 points) The net pay to be paid to all employees for the December 30 payroll is $ Question 5 (10 points) In the journal entry to record the payroll, the Employees Income Tax Payable account is credited for $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started