Answered step by step

Verified Expert Solution

Question

1 Approved Answer

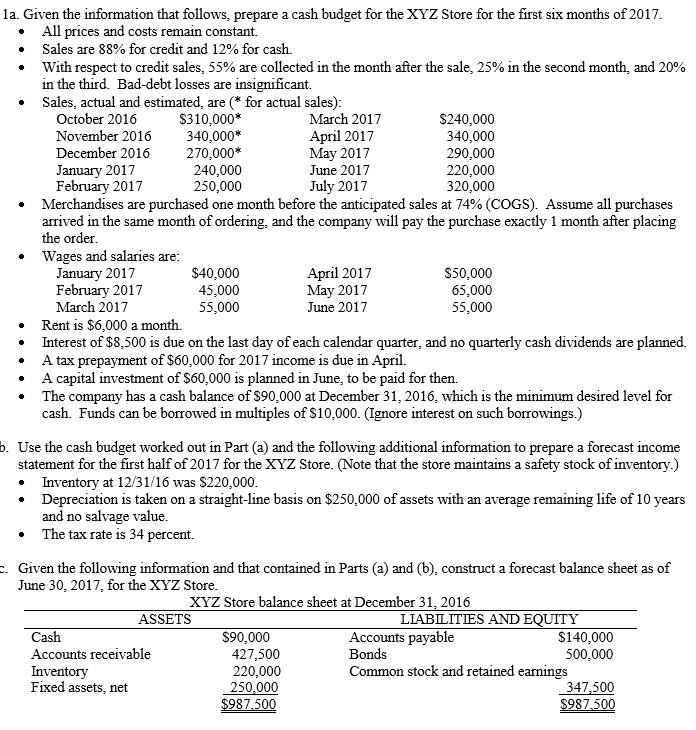

1a. Given the information that follows, prepare a cash budget for the XYZ Store for the first six months of 2017. All prices and

1a. Given the information that follows, prepare a cash budget for the XYZ Store for the first six months of 2017. All prices and costs remain constant. Sales are 88% for credit and 12% for cash. . . . . With respect to credit sales, 55% are collected in the month after the sale, 25% in the second month, and 20% in the third. Bad-debt losses are insignificant. Sales, actual and estimated, are (* for actual sales): October 2016 $310,000* November 2016 December 2016 Wages and salaries are: January 2017 February 2017 March 2017 340,000* April 2017 270,000* May 2017 June 2017 January 2017 240,000 220,000 February 2017 250,000 July 2017 320,000 Merchandises are purchased one month before the anticipated sales at 74% (COGS). Assume all purchases arrived in the same month of ordering, and the company will pay the purchase exactly 1 month after placing the order. $40,000 45,000 55,000 March 2017 $240,000 340,000 290,000 April 2017 May 2017 June 2017 Rent is $6,000 a month. Interest of $8,500 is due on the last day of each calendar quarter, and no quarterly cash dividends are planned. A tax prepayment of $60,000 for 2017 income is due in April. A capital investment of $60,000 is planned in June, to be paid for then. b. Use the cash budget worked out in Part (a) and the following additional information to prepare a forecast income statement for the first half of 2017 for the XYZ Store. (Note that the store maintains a safety stock of inventory.) . Inventory at 12/31/16 was $220,000. Cash Accounts receivable Inventory Fixed assets, net The company has a cash balance of $90,000 at December 31, 2016, which is the minimum desired level for cash. Funds can be borrowed in multiples of $10,000. (Ignore interest on such borrowings.) $50,000 65,000 55,000 $90,000 Depreciation is taken on a straight-line basis on $250,000 of assets with an average remaining life of 10 years and no salvage value. The tax rate is 34 percent. 427,500 220,000 250,000 $987.500 c. Given the following information and that contained in Parts (a) and (b), construct a forecast balance sheet as of June 30, 2017, for the XYZ Store. XYZ Store balance sheet at December 31, 2016 ASSETS LIABILITIES AND EQUITY $140,000 500,000 Accounts payable Bonds Common stock and retained earnings 347,500 $987.500

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

la Total Sales Cash Collection Cash sales 55 25 20 Total Collection less payments Purchases Salaries ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started