Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.A major element in budgetary control is a. the preparation of long-term plans. 2. 5. b. the comparison of actual results with planned objectives.

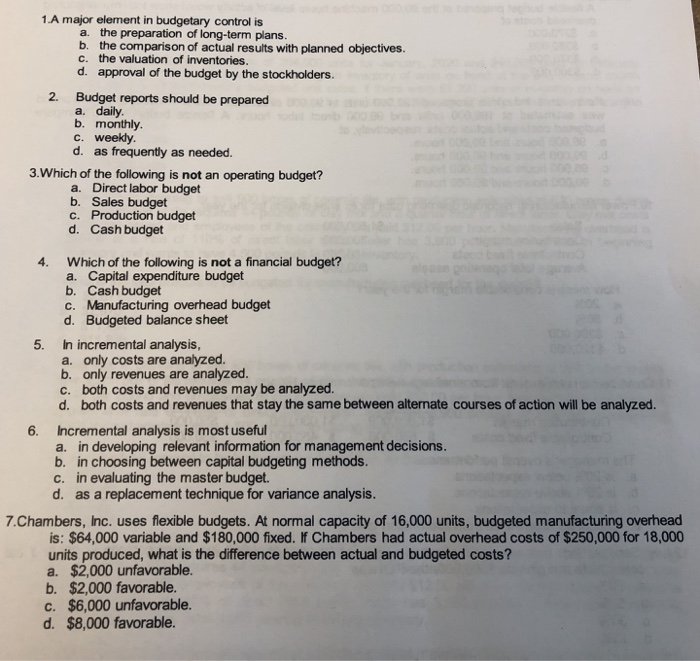

1.A major element in budgetary control is a. the preparation of long-term plans. 2. 5. b. the comparison of actual results with planned objectives. c. the valuation of inventories. d. approval of the budget by the stockholders. Budget reports should be prepared a. daily. b. monthly. c. weekly. d. as frequently as needed. 3. Which of the following is not an operating budget? a. Direct labor budget b. Sales budget c. Production budget d. Cash budget Which of the following is not a financial budget? a. Capital expenditure budget b. Cash budget c. Manufacturing overhead budget d. Budgeted balance sheet In incremental analysis, a. only costs are analyzed. b. only revenues are analyzed. c. both costs and revenues may be analyzed. d. both costs and revenues that stay the same between alternate courses of action will be analyzed. 6. Incremental analysis is most useful a. in developing relevant information for management decisions. b. in choosing between capital budgeting methods. c. in evaluating the master budget. d. as a replacement technique for variance analysis. 7.Chambers, Inc. uses flexible budgets. At normal capacity of 16,000 units, budgeted manufacturing overhead is: $64,000 variable and $180,000 fixed. If Chambers had actual overhead costs of $250,000 for 18,000 units produced, what is the difference between actual and budgeted costs? a. $2,000 unfavorable. b. $2,000 favorable. c. $6,000 unfavorable. d. $8,000 favorable.

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started