Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1a,b,c please Total Marks: 100 marks Question 1 (50 marks) Beauty Forever Company is engaged in providing medical beauty service including various treatment service and

1a,b,c please

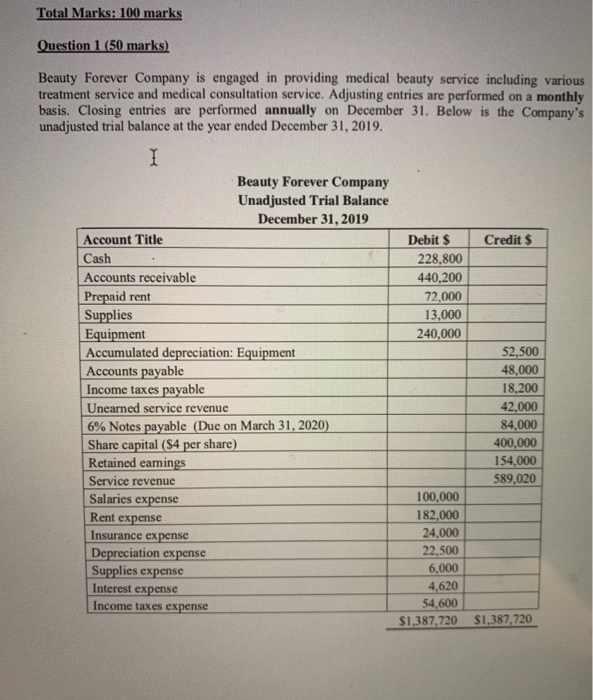

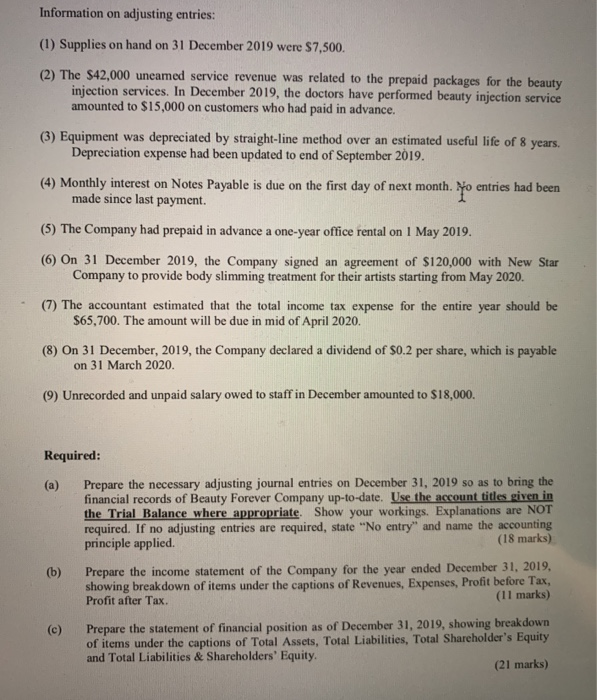

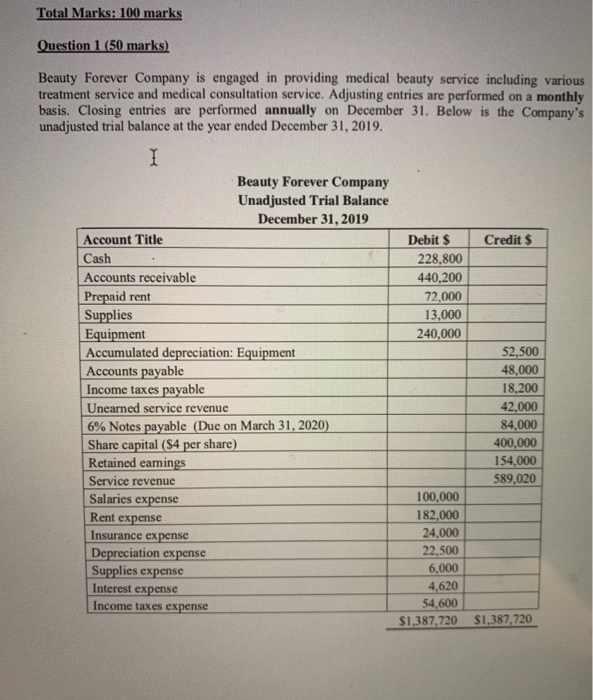

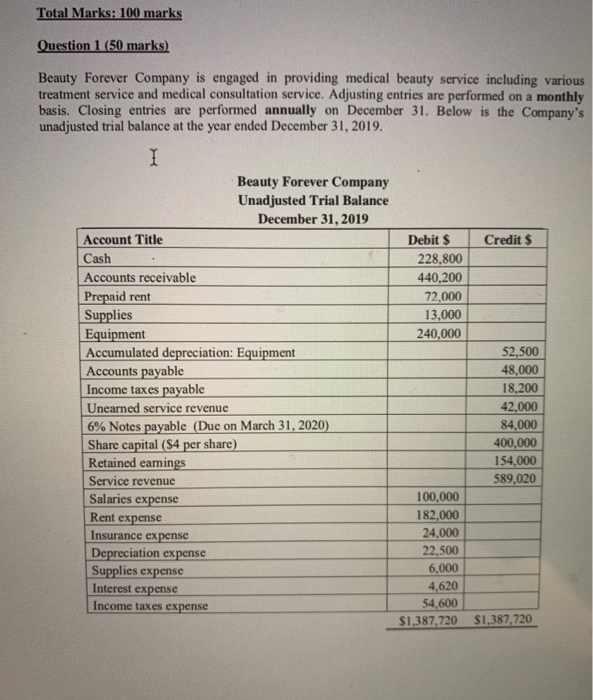

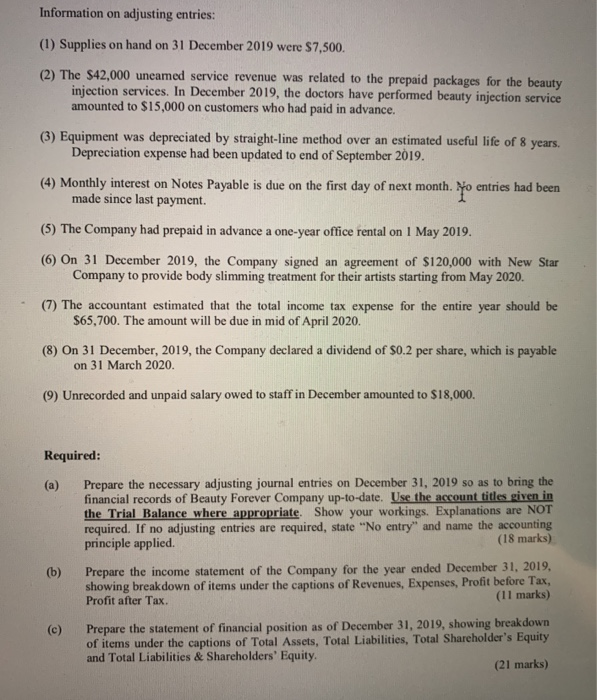

Total Marks: 100 marks Question 1 (50 marks) Beauty Forever Company is engaged in providing medical beauty service including various treatment service and medical consultation service. Adjusting entries are performed on a monthly basis. Closing entries are performed annually on December 31. Below is the Company's unadjusted trial balance at the year ended December 31, 2019. Credit $ Debit $ 228,800 440,200 72,000 13,000 240,000 Beauty Forever Company Unadjusted Trial Balance December 31, 2019 Account Title Cash . Accounts receivable Prepaid rent Supplies Equipment Accumulated depreciation: Equipment Accounts payable Income taxes payable Unearned service revenue 6% Notes payable (Due on March 31, 2020) Share capital (S4 per share) Retained eamings Service revenue Salaries expense Rent expense Insurance expense Depreciation expense Supplies expense Interest expense Income taxes expense 52,500 48,000 18,200 42,000 84,000 400,000 154,000 589,020 100,000 182,000 24,000 22,500 6,000 4,620 54,600 $1,387.720 S1,387,720 Information on adjusting entries: (1) Supplies on hand on 31 December 2019 were $7,500. (2) The $42,000 uneamed service revenue was related to the prepaid packages for the beauty injection services. In December 2019, the doctors have performed beauty injection service amounted to $15,000 on customers who had paid in advance. (3) Equipment was depreciated by straight-line method over an estimated useful life of 8 years. Depreciation expense had been updated to end of September 2019. (4) Monthly interest on Notes Payable is due on the first day of next month. Yo entries had been made since last payment. (5) The Company had prepaid in advance a one-year office rental on 1 May 2019. (6) On 31 December 2019, the Company signed an agreement of $120,000 with New Star Company to provide body slimming treatment for their artists starting from May 2020. (7) The accountant estimated that the total income tax expense for the entire year should be $65,700. The amount will be due in mid of April 2020. (8) On 31 December, 2019, the Company declared a dividend of $0.2 per share, which is payable on 31 March 2020. (9) Unrecorded and unpaid salary owed to staff in December amounted to $18,000. Required: (b) Prepare the necessary adjusting journal entries on December 31, 2019 so as to bring the financial records of Beauty Forever Company up-to-date. Use the account titles given in the Trial Balance where appropriate. Show your workings. Explanations are NOT required. If no adjusting entries are required, state "No entry" and name the accounting principle applied. (18 marks) Prepare the income statement of the Company for the year ended December 31, 2019. showing breakdown of items under the captions of Revenues, Expenses, Profit before Tax, Profit after Tax. (11 marks) Prepare the statement of financial position as of December 31, 2019, showing break down of items under the captions of Total Assets, Total Liabilities, Total Shareholder's Equity and Total Liabilities & Shareholders' Equity. (21 marks) (c)

Total Marks: 100 marks Question 1 (50 marks) Beauty Forever Company is engaged in providing medical beauty service including various treatment service and medical consultation service. Adjusting entries are performed on a monthly basis. Closing entries are performed annually on December 31. Below is the Company's unadjusted trial balance at the year ended December 31, 2019. Credit $ Debit $ 228,800 440,200 72,000 13,000 240,000 Beauty Forever Company Unadjusted Trial Balance December 31, 2019 Account Title Cash . Accounts receivable Prepaid rent Supplies Equipment Accumulated depreciation: Equipment Accounts payable Income taxes payable Unearned service revenue 6% Notes payable (Due on March 31, 2020) Share capital (S4 per share) Retained eamings Service revenue Salaries expense Rent expense Insurance expense Depreciation expense Supplies expense Interest expense Income taxes expense 52,500 48,000 18,200 42,000 84,000 400,000 154,000 589,020 100,000 182,000 24,000 22,500 6,000 4,620 54,600 $1,387.720 S1,387,720 Information on adjusting entries: (1) Supplies on hand on 31 December 2019 were $7,500. (2) The $42,000 uneamed service revenue was related to the prepaid packages for the beauty injection services. In December 2019, the doctors have performed beauty injection service amounted to $15,000 on customers who had paid in advance. (3) Equipment was depreciated by straight-line method over an estimated useful life of 8 years. Depreciation expense had been updated to end of September 2019. (4) Monthly interest on Notes Payable is due on the first day of next month. Yo entries had been made since last payment. (5) The Company had prepaid in advance a one-year office rental on 1 May 2019. (6) On 31 December 2019, the Company signed an agreement of $120,000 with New Star Company to provide body slimming treatment for their artists starting from May 2020. (7) The accountant estimated that the total income tax expense for the entire year should be $65,700. The amount will be due in mid of April 2020. (8) On 31 December, 2019, the Company declared a dividend of $0.2 per share, which is payable on 31 March 2020. (9) Unrecorded and unpaid salary owed to staff in December amounted to $18,000. Required: (b) Prepare the necessary adjusting journal entries on December 31, 2019 so as to bring the financial records of Beauty Forever Company up-to-date. Use the account titles given in the Trial Balance where appropriate. Show your workings. Explanations are NOT required. If no adjusting entries are required, state "No entry" and name the accounting principle applied. (18 marks) Prepare the income statement of the Company for the year ended December 31, 2019. showing breakdown of items under the captions of Revenues, Expenses, Profit before Tax, Profit after Tax. (11 marks) Prepare the statement of financial position as of December 31, 2019, showing break down of items under the captions of Total Assets, Total Liabilities, Total Shareholder's Equity and Total Liabilities & Shareholders' Equity. (21 marks) (c)

1a,b,c please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started