Question

1.Adjust the colum width of column D and column F to 40. 2.Fill out the cells D2-D13 in net income worksheet with the appropriate the

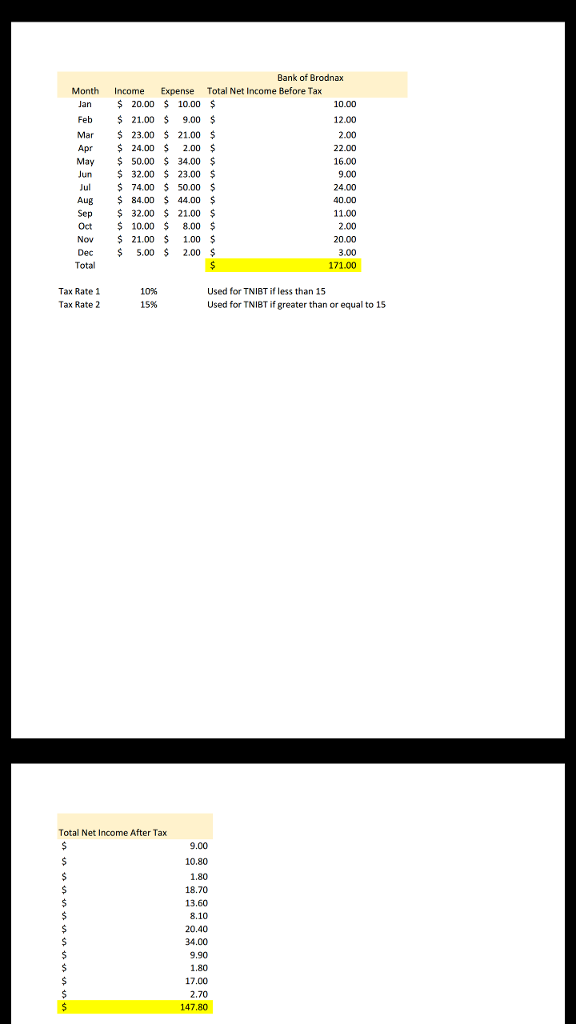

1.Adjust the colum width of column D and column F to 40.

2.Fill out the cells D2-D13 in "net income" worksheet with the appropriate the total for both TNIBT and TNIAT using the SUM function. Make sure any cells associated with dollars are formated as such.

3. You must use the tax rate table for the tax calculation associated with the results for Total Net Income After Tax based on the tax Table

4.Fill out the cells F2-F13 in "Net Income" worksheet with appropriate calculations by reducing the Tax Rate. Note:Use absolute refrence and tax rate in cell B16 to get credit

5. Be sure Net Income Tab is appropriately Labled

Bank of Brodnax Month Income Expense Total Net Income Before Tax Jan 20.00 s 10.00 10.00 Feb 21.00 9.00 12.00 Mar 23.00 21.00 2.00 Apr 24.00 2.00 22.00 May 50,00 34,00 16.00 Jun 32.00 23.00 9.00 Jul 74,00 50,00 24.00 Aug 84.00 44.00 40.00 Sep 32.00 21.00 11.00 Oct 10.00 8.00 2.00 Nov 21.00 1.00 20.00 Dec 5.00 2.00 3.00 Total 171.00 Tax Rate 1 Used for TNIBT if ess than 15 Tax Rate 2 15% Used for TNIBT if greater than or equal to 15 Total Net Income After Tax 9.00 10,80 1.800 18.70 13,60 8.10 20.40 34.00 9,90 1.80 17.00 2,70 147.80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started