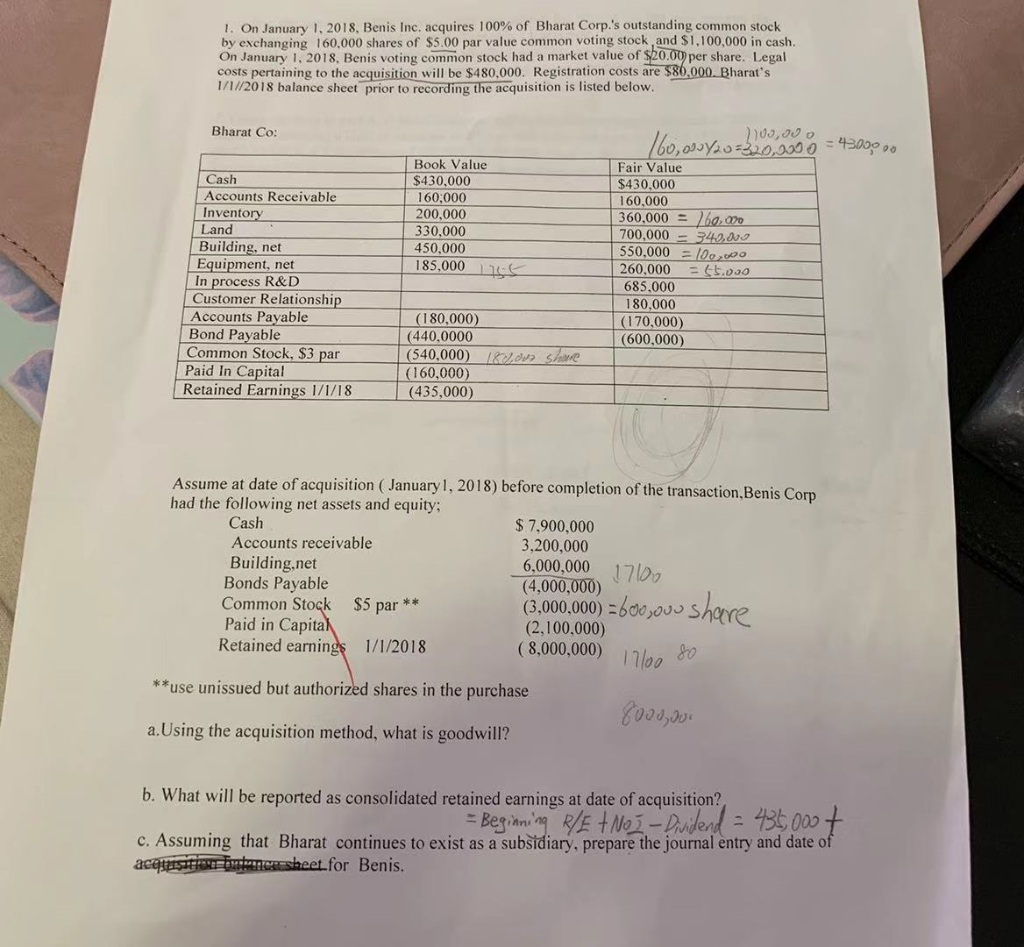

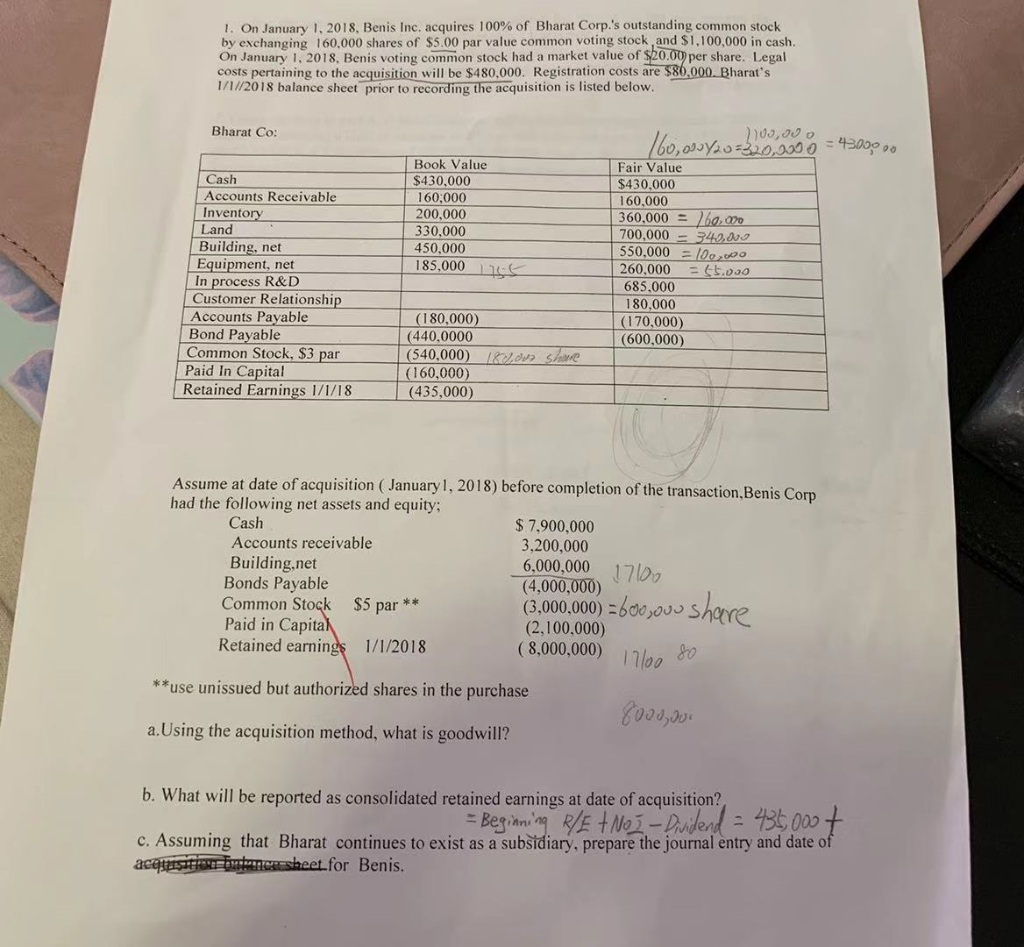

I. On January 1, 2018, Benis Inc. acquires 100% of Bhart Corp.'s outstanding common stock by exchanging 160.000 shares of $5.00 par value common voting stock, and S1,100,000 in cash. On January 1, 2018, Benis voting common stock had a market value of $20.0 per share. Legal costs pertaining to the acquisition will be $480,000. Registration costs are $80,000 Bharat's 1/1//2018 balance sheet prior to recording the acquisition is listed below. Bharat Co: Book Value $430.000 160:000 200,000 330,000 450,000 185,000 Fair Value $430,000 160.000 360,000 700,000 340000 550.000 l0gso 260.000- Go0 685,000 180,000 (170,000) (600,000) Cash Accounts Receivable Inventory Land Building, net Equipment, net In process R&D Customer Relationshijp Accounts Payable Bond Payable Common Stock, $3 par Paid In Capital Retained Earnings 1/1/18 (180,000) (440,0000 (540,000) dep Sten (160,000) (435,000) Assume at date of acquisition (January l, 2018) before completion of the transaction, Benis Corp had the following net assets and equity Cash Accounts receivable Building,net Bonds Payable Common Stock $5 par** Paid in Capita Retained earnings 1/1/2018 $7,900,000 3,200,000 6.000,000 1D (4,000,000) (3,000.000) 600S (2,100.000) ( 8,000,000) 11loo :boow shore **use unissued but authorized shares in the purchase a.Using the acquisition method, what is goodwill? b. What will be reported as consolidated retained earnings at date of acquisition? c. Assuming that Bharat continues to exist as a subsidiary, prepare the journal entry and date o for Benis. I. On January 1, 2018, Benis Inc. acquires 100% of Bhart Corp.'s outstanding common stock by exchanging 160.000 shares of $5.00 par value common voting stock, and S1,100,000 in cash. On January 1, 2018, Benis voting common stock had a market value of $20.0 per share. Legal costs pertaining to the acquisition will be $480,000. Registration costs are $80,000 Bharat's 1/1//2018 balance sheet prior to recording the acquisition is listed below. Bharat Co: Book Value $430.000 160:000 200,000 330,000 450,000 185,000 Fair Value $430,000 160.000 360,000 700,000 340000 550.000 l0gso 260.000- Go0 685,000 180,000 (170,000) (600,000) Cash Accounts Receivable Inventory Land Building, net Equipment, net In process R&D Customer Relationshijp Accounts Payable Bond Payable Common Stock, $3 par Paid In Capital Retained Earnings 1/1/18 (180,000) (440,0000 (540,000) dep Sten (160,000) (435,000) Assume at date of acquisition (January l, 2018) before completion of the transaction, Benis Corp had the following net assets and equity Cash Accounts receivable Building,net Bonds Payable Common Stock $5 par** Paid in Capita Retained earnings 1/1/2018 $7,900,000 3,200,000 6.000,000 1D (4,000,000) (3,000.000) 600S (2,100.000) ( 8,000,000) 11loo :boow shore **use unissued but authorized shares in the purchase a.Using the acquisition method, what is goodwill? b. What will be reported as consolidated retained earnings at date of acquisition? c. Assuming that Bharat continues to exist as a subsidiary, prepare the journal entry and date o for Benis