1.All Journals related to July

2.All July Adjusting Entries

3.Adjusted Trial Balance at July 31

4.The three Statements

5.All Closing Entries

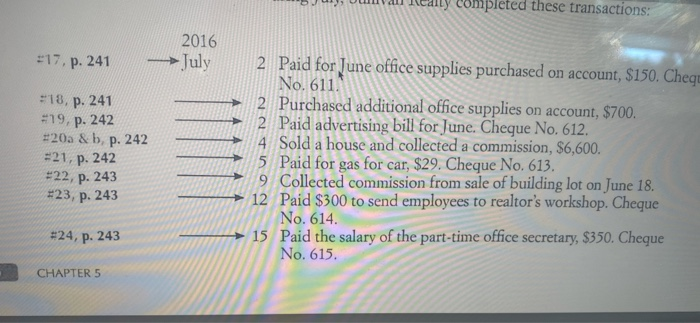

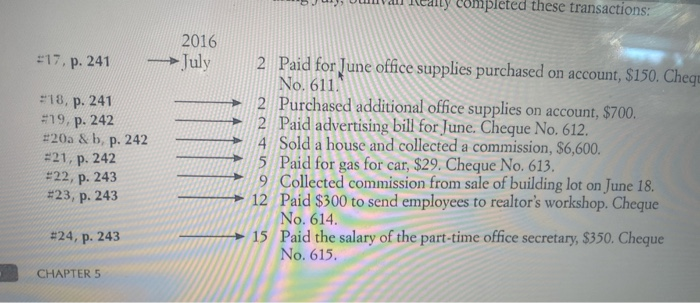

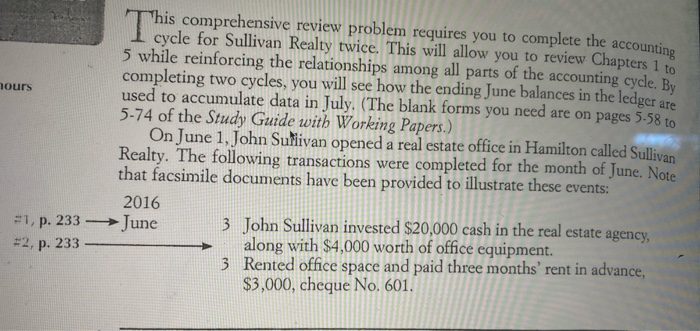

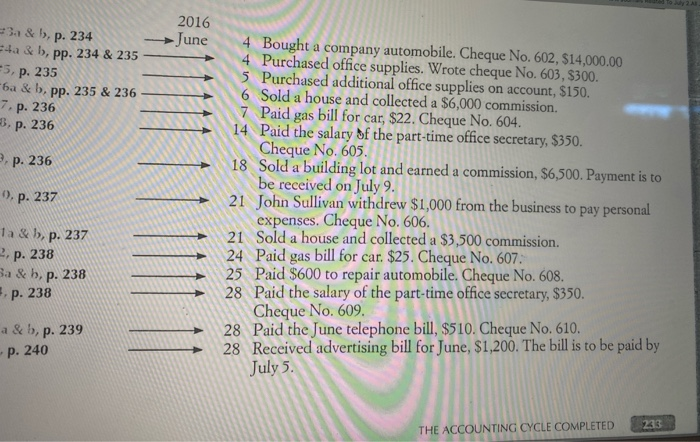

completed these transactions: +17, p. 241 2016 July +18, p. 241 +19, p. 242 #20a & b. p. 242 #21, p. 242 #22, p. 243 #23, p. 243 2 Paid for June office supplies purchased on account, $150. Chequ No. 611. 2 Purchased additional office supplies on account, $700. 2 Paid advertising bill for June. Cheque No. 612. 4 Sold a house and collected a commission, $6,600. 5 Paid for gas for car, $29. Cheque No. 613. 9 Collected commission from sale of building lot on June 18. 12 Paid $300 to send employees to realtor's workshop. Cheque No. 614. 15 Paid the salary of the part-time office secretary, $350. Cheque No. 615. #24, p. 243 CHAPTER 5 completed these transactions: #17, p. 241 2016 July - #18, p. 241 #19, p. 242 #20a & b, p. 242 +21, p. 242 #22, p. 243 #23, p. 243 2 Paid for June office supplies purchased on account, $150. Cheqe No. 611. 2 Purchased additional office supplies on account, $700. 2 Paid advertising bill for June. Cheque No. 612. 4 Sold a house and collected a commission, $6,600. 5 Paid for gas for car, $29. Cheque No. 613. 9 Collected commission from sale of building lot on June 18. 12 Paid $300 to send employees to realtor's workshop. Cheque No. 614. 15 Paid the salary of the part-time office secretary, $350. Cheque No. 615. #24, p. 243 CHAPTER 5 nours This This comprehensive review problem requires you to complete the accounting cycle for Sullivan Realty twice. This will allow you to review Chapters 1 to 5 while reinforcing the relationships among all parts of the accounting cycle. By completing two cycles, you will see how the ending June balances in the ledger are used to accumulate data in July. (The blank forms you need are on pages 5.58 to 5-74 of the Study Guide with Working Papers.) On June 1, John Sullivan opened a real estate office in Hamilton called Sullivan Realty. The following transactions were completed for the month of June. Note that facsimile documents have been provided to illustrate these events: 2016 June 3 John Sullivan invested $20,000 cash in the real estate agency, along with $4,000 worth of office equipment. 3 Rented office space and paid three months' rent in advance, $3,000, cheque No. 601. #1, p. 233 #2, p. 233 2A 2016 June 3. & , p. 234 4a & b), pp. 234 & 235 -5, p. 235 6a & b, pp. 235 & 236 7. p. 236 3. p. 236 2. p. 236 9. p. 237 4 Bought a company automobile. Cheque No. 602, $14,000.00 4 Purchased office supplies. Wrote cheque No. 603, $300. 5 Purchased additional office supplies on account, $150. 6 Sold a house and collected a $6,000 commission. 7 Paid gas bill for car, $22. Cheque No. 604. 14 Paid the salary of the part-time office secretary, $350. Cheque No. 605. 18 Sold a building lot and earned a commission, $6,500. Payment is to be received on July 9. 21 John Sullivan withdrew $1,000 from the business to pay personal expenses. Cheque No. 606. 21 Sold a house and collected a $3,500 commission. 24 Paid gas bill for car. $25. Cheque No. 607 25 Paid $600 to repair automobile. Cheque No. 608. 28 Paid the salary of the part-time office secretary, $350. Cheque No. 609. 28 Paid the June telephone bill, $510. Cheque No. 610. 28 Received advertising bill for June, $1,200. The bill is to be paid by July 5. 1a & b, p. 237 p. 238 a & b, p. 239 p. 240 233 THE ACCOUNTING CYCLE COMPLETED