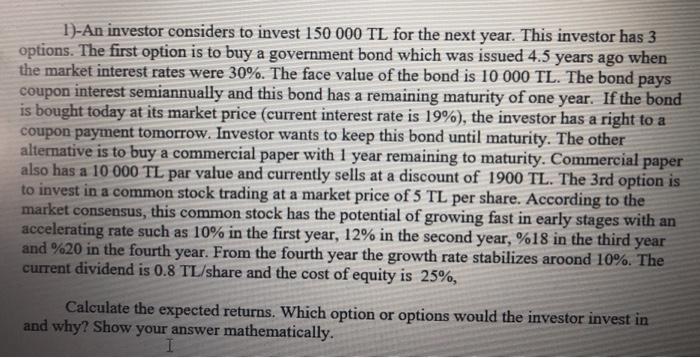

1)-An investor considers to invest 150 000 TL for the next year. This investor has 3 options. The first option is to buy a government bond which was issued 4.5 years ago when the market interest rates were 30%. The face value of the bond is 10 000 TL. The bond pays coupon interest semiannually and this bond has a remaining maturity of one year. If the bond is bought today at its market price (current interest rate is 19%), the investor has a right to a coupon payment tomorrow. Investor wants to keep this bond until maturity. The other alternative is to buy a commercial paper with 1 year remaining to maturity. Commercial paper also has a 10 000 TL par value and currently sells at a discount of 1900 TL. The 3rd option is to invest in a common stock trading at a market price of 5 TL per share. According to the market consensus, this common stock has the potential of growing fast in early stages with an accelerating rate such as 10% in the first year, 12% in the second year, %18 in the third year and %20 in the fourth year. From the fourth year the growth rate stabilizes aroond 10%. The current dividend is 0.8 TL/share and the cost of equity is 25%, Calculate the expected returns. Which option or options would the investor invest in and why? Show your answer mathematically. 1)-An investor considers to invest 150 000 TL for the next year. This investor has 3 options. The first option is to buy a government bond which was issued 4.5 years ago when the market interest rates were 30%. The face value of the bond is 10 000 TL. The bond pays coupon interest semiannually and this bond has a remaining maturity of one year. If the bond is bought today at its market price (current interest rate is 19%), the investor has a right to a coupon payment tomorrow. Investor wants to keep this bond until maturity. The other alternative is to buy a commercial paper with 1 year remaining to maturity. Commercial paper also has a 10 000 TL par value and currently sells at a discount of 1900 TL. The 3rd option is to invest in a common stock trading at a market price of 5 TL per share. According to the market consensus, this common stock has the potential of growing fast in early stages with an accelerating rate such as 10% in the first year, 12% in the second year, %18 in the third year and %20 in the fourth year. From the fourth year the growth rate stabilizes aroond 10%. The current dividend is 0.8 TL/share and the cost of equity is 25%, Calculate the expected returns. Which option or options would the investor invest in and why? Show your answer mathematically