Answered step by step

Verified Expert Solution

Question

1 Approved Answer

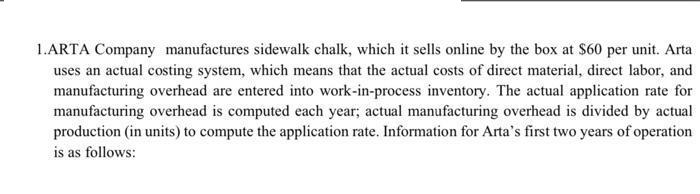

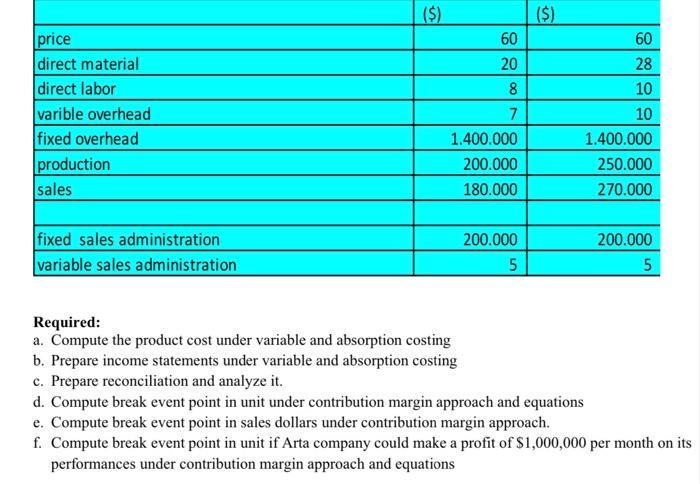

1.ARTA Company manufactures sidewalk chalk, which it sells online by the box at $60 per unit. Arta uses an actual costing system, which means

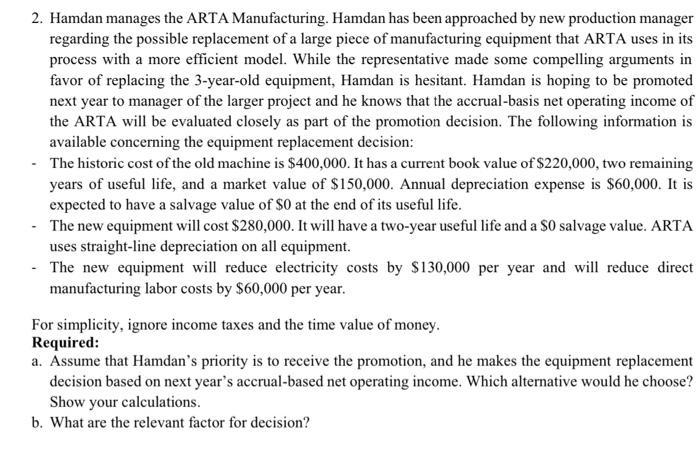

1.ARTA Company manufactures sidewalk chalk, which it sells online by the box at $60 per unit. Arta uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in-process inventory. The actual application rate for manufacturing overhead is computed each year; actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Arta's first two years of operation is as follows: price direct material direct labor varible overhead fixed overhead production sales fixed sales administration variable sales administration ($) 60 20 0 8 7 1.400.000 200.000 180.000 200.000 5 ($) 60 28 10 10 1.400.000 250.000 270.000 200.000 5 Required: a. Compute the product cost under variable and absorption costing b. Prepare income statements under variable and absorption costing c. Prepare reconciliation and analyze it. d. Compute break event point in unit under contribution margin approach and equations e. Compute break event point in sales dollars under contribution margin approach. f. Compute break event point in unit if Arta company could make a profit of $1,000,000 per month on its performances under contribution margin approach and equations 2. Hamdan manages the ARTA Manufacturing. Hamdan has been approached by new production manager regarding the possible replacement of a large piece of manufacturing equipment that ARTA uses in its process with a more efficient model. While the representative made some compelling arguments in favor of replacing the 3-year-old equipment, Hamdan is hesitant. Hamdan is hoping to be promoted next year to manager of the larger project and he knows that the accrual-basis net operating income of the ARTA will be evaluated closely as part of the promotion decision. The following information is available concerning the equipment replacement decision: - The historic cost of the old machine is $400,000. It has a current book value of $220,000, two remaining years of useful life, and a market value of $150,000. Annual depreciation expense is $60,000. It is expected to have a salvage value of $0 at the end of its useful life. - The new equipment will cost $280,000. It will have a two-year useful life and a $0 salvage value. ARTA uses straight-line depreciation on all equipment. - The new equipment will reduce electricity costs by $130,000 per year and will reduce direct manufacturing labor costs by $60,000 per year. For simplicity, ignore income taxes and the time value of money. Required: a. Assume that Hamdan's priority is to receive the promotion, and he makes the equipment replacement decision based on next year's accrual-based net operating income. Which alternative would he choose? Show your calculations. b. What are the relevant factor for decision?

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 a Product Cost under Variable Costing Direct Material 20 x 200000 4000000 Direct Labor 8 x 200000 1600000 Variable Overhead 7 x 200000 1400000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started