Answered step by step

Verified Expert Solution

Question

1 Approved Answer

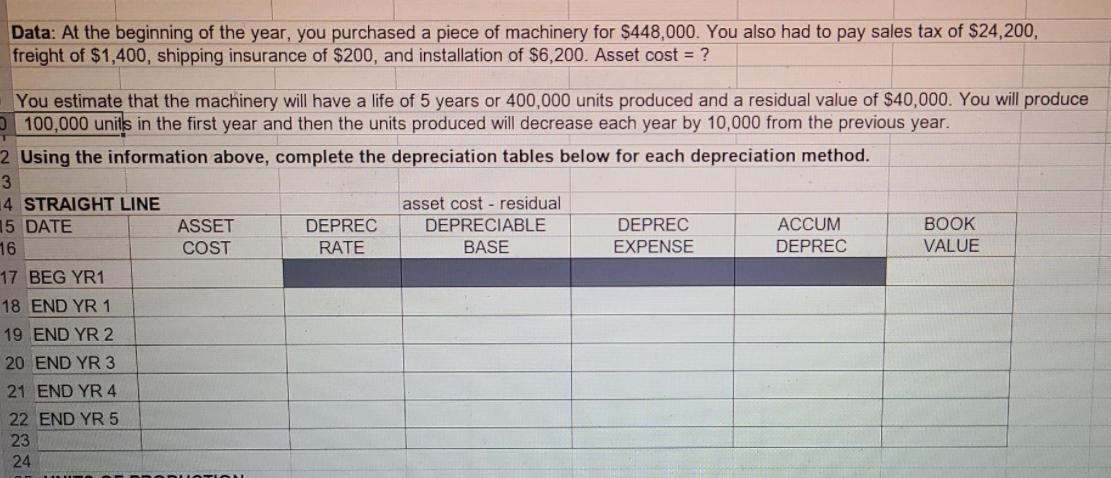

how to find the depreciation of an object and the amount it goes down each year Data: At the beginning of the year, you

![]()

how to find the depreciation of an object and the amount it goes down each year Data: At the beginning of the year, you purchased a piece of machinery for $448,000. You also had to pay sales tax of $24,200, freight of $1,400, shipping insurance of $200, and installation of $6,200. Asset cost = ? You estimate that the machinery will have a life of 5 years or 400,000 units produced and a residual value of $40,000. You will produce 0 100,000 unitls in the first year and then the units produced will decrease each year by 10,000 from the previous year. 2 Using the information above, complete the depreciation tables below for each depreciation method. 3 4 STRAIGHT LINE asset cost - residual 15 DATE ASSET DEPREC DEPRECIABLE DEPREC ACCUM BOOK 16 COST RATE BASE EXPENSE DEPREC VALUE 17 BEG YR1 18 END YR 1 19 END YR 2 20 END YR3 21 END YR 4 22 END YR 5 23 24

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Asset cost price of machine 448000 sales tax 24200 freight 1400 shipping insurance 200 installation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

625e45eeae875_april19.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started