Answered step by step

Verified Expert Solution

Question

1 Approved Answer

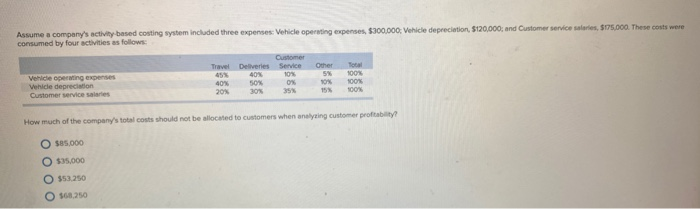

1)Assume a companys activity-based costing system included three expenses: Vehicle operating expenses, $300,000; Vehicle depreciation, $120,000; and Customer service salaries, $175,000. These costs were consumed

1)Assume a companys activity-based costing system included three expenses: Vehicle operating expenses, $300,000; Vehicle depreciation, $120,000; and Customer service salaries, $175,000. These costs were consumed by four activities as follows:

Travel Deliveries Customer Service Other Total

Vehicle operating expenses 45 % 40 % 10 % 5 % 100 %

Vehicle depreciation 40 % 50 % 0 % 10 % 100 %

Customer service salaries 20 % 30 % 35 % 15 % 100 %

How much of the companys total costs should not be allocated to customers when analyzing customer profitability?

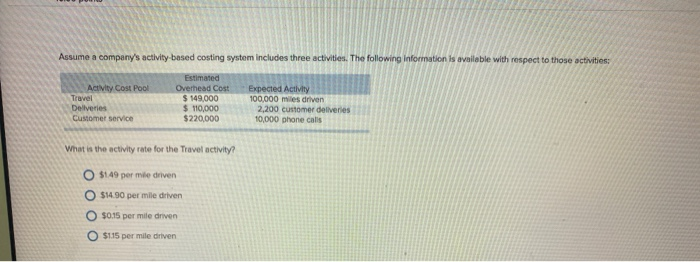

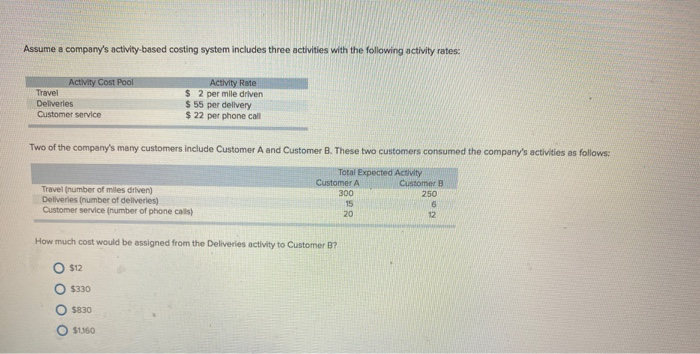

2) Assume a companys activity-based costing system includes three activities. The following information is available with respect to those activities:

Activity Cost Pool Estimated Overhead Cost Expected Activity

Travel $ 149,000 100,000 miles driven

Deliveries $ 110,000 2,200 customer deliveries

Customer service $ 220,000 10,000 phone calls

What is the activity rate for the Travel activity?

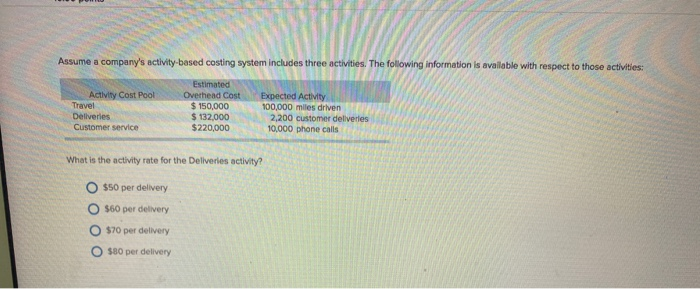

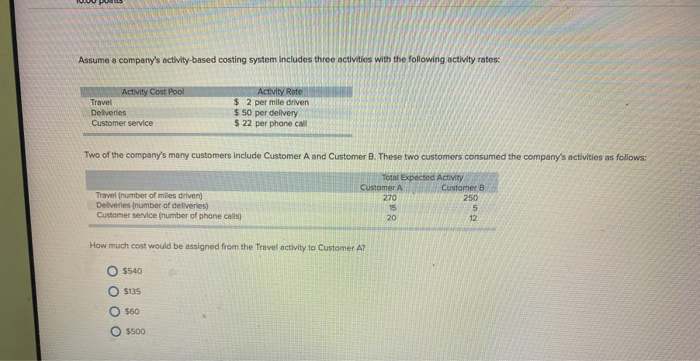

Number 3,4 and 5 picture is clear.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started