Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Assume that the firm is 50% financed by debt and 50% financed by equity. Its cost of debt is 12% and the cost of equity

1.Assume that the firm is 50% financed by debt and 50% financed by equity. Its cost of debt is 12% and the cost of equity is 18%. The tax rate is 40%.

a. Find the WACC and the return on unlevered equity.

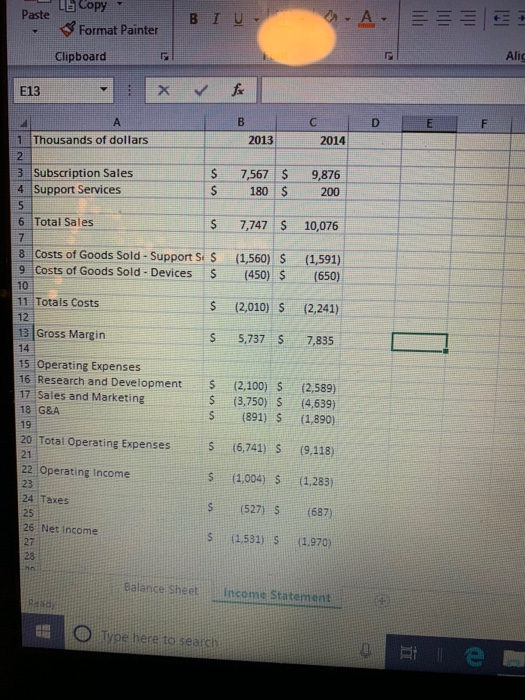

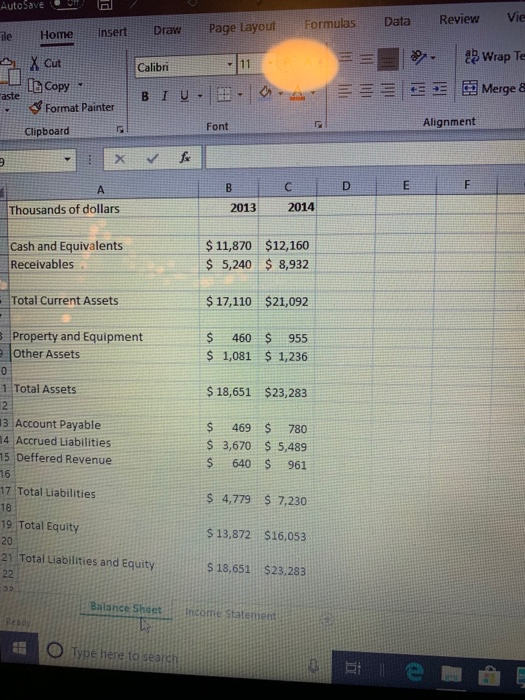

3. Cybercode is a cyber-software company in early development. The firm has already built its first prototype and secured a number of government contacts that are slowly paying off. However, a significant new investment is required to expand the product to penetrate private markets. In particular, the firm is developing a novel approach to encrypting financial data flows and plan to start selling the new software to banks and insurance companies starting in 2015.

Cybercodes 2013 and 2014 balance sheet and income statement are included in the excel file. Please, use this information to answer the following questions.

a. Calculate sales growth, a change in net operating assets and asset intensity of Cybercode in 2014.

b. Assume that the asset intensity will remain constant at the level of 2014, build a projection of free cash flow for Cybercode under the following assumptions:

i. Assume that sales growth in 2015-2019 will remain the same as in 2014 and becomes constant in 2020 at the rate of 5% forever.

ii. Assume that the asset intensity will remain constant at the level of 2014.

iii. Assume that in 2015 and later net income turns to positive due to reduced development costs and is equal to 20% of sales.

c. Apply DCF to calculate the valuation for the venture at the end of 2013 if the discount rate is 15%.

d. If investors and founders agree on the valuation from part c, what ownership would they seek to give a company $20M?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started