Answered step by step

Verified Expert Solution

Question

1 Approved Answer

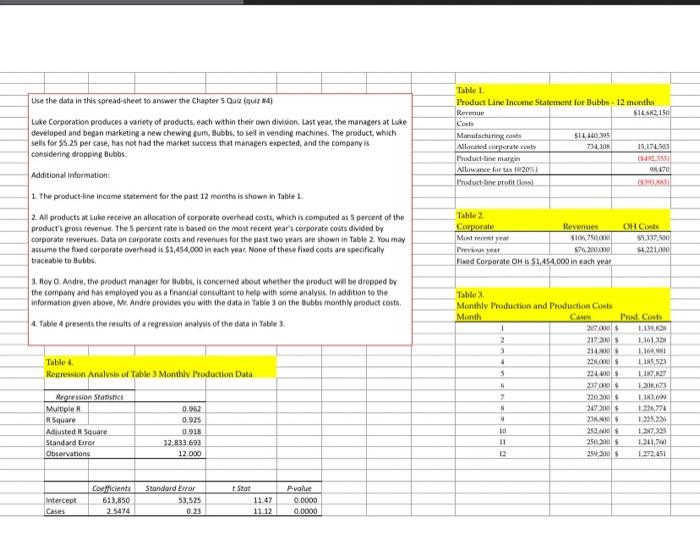

1.Assume the variable allocated cooperate costs are $ 0.192 per case of bubb's. Based on the available information what is the total available cost per

1.Assume the variable allocated cooperate costs are $ 0.192 per case of bubb's. Based on the available information what is the total available cost per case of bubbs

2. what is the contribution margin per case of bubbs

3. What is the monthly average number of cases of Bubbs that lukes sold last year .round to the nearest whole number

please thanks

| Table 1. | ||||||||||||

| Product Line Income Statement for Bubbs - 12 months | ||||||||||||

| Revenue | ||||||||||||

| Costs | ||||||||||||

| Manufacturing costs | ||||||||||||

| Allocated corporate costs | ||||||||||||

| Product-line margin | ||||||||||||

| Allowance for tax (@20%) | ||||||||||||

| Product-line profit (loss) | ||||||||||||

| Table 2. | ||||||||||||

| Corporate | Revenues | OH Costs | ||||||||||

| Most recent year | ||||||||||||

| Previous year | ||||||||||||

| Fixed Corporate OH is $1,454,000 in each year | ||||||||||||

| Table 3. | ||||||||||||

| Monthly Production and Production Costs | ||||||||||||

| Month | Cases | Prod. Costs | ||||||||||

| Table 4. | ||||||||||||

| Regression Analysis of Table 3 Monthly Production Data | ||||||||||||

| Regression Statistics | ||||||||||||

| Multiple R | ||||||||||||

| R Square | ||||||||||||

| Adjusted R Square | ||||||||||||

| Standard Error | ||||||||||||

| Observations | ||||||||||||

Coefficients | Standard Error | t Stat | P-value | |||||||||

| Intercept | ||||||||||||

| Cases |

i did link it twice, clearer version at the bottom

Table 1 Product Line Income Statement for Bubbs - 12 months Revue $14.662,150 Use the data in this spread sheet to answer the Chapter 5 Quiz (quiz 4) Luke Corporation produces a variety of products, each within their own division. Last year, the managers at Luke developed and began marketing a new chewing gum Bubbis, to sel in vending machines. The product, which sells for $s 25 per case, has not had the market success that managers expected, and the company is considering dropping Bubbs. $14 15 734,105 Manufacturing Allocated corporate con Product line mark Allowance for tax 205 Pet-line proti 15,174,500 192.183 99,170 Additional Information: 1. The product-line income statement for the past 12 months is shown in Table 1.. 2. All products of Luke receive an allocation of corporate overhead costs, which is computed as 5 percent of the product's gross revenue. The 5 percent rate is based on the most recent year's corporate costs divided by corporate revenues. Data on corporate costs and revenues for the past two years are shown in Table 2. You may assume the fond corporate overhead is $1,454,000 in each year. None of these fined costs are specifically traceable to Bubbs Table 2 Corporate Mestre year SI sar $76.200.000 Fed Corporate OH is $1,454.000 in each year OHC $5.1970 S4221.00 3. Hoy O. Andre, the product manager for Bubbt, is concerned about whether the product will be dropped by the company and has employed you as a financial consultant to help with some analysis. In addition to the information given above, Mr. Andre provides you with the data in table on the Bubbs monthly product costs, 4. Table a presents the results of a repression analysis of the data in Tables Tablet Regression Analysis of Table 3 Monthly Production Data Table Monthly Production and Production Costs Month Caus Prud Costs 1 207.000 LO 217 2018 11013 214 4 22.000 11523 S 221.00 1.1.2 237000 1675 7 220 2005 LI 24720 1226776 0 28 12252 10 2521 1.37.225 11 250 205 1241,70 25 2015 1 272,451 Regression Statistics Multiple R Square Adjusted R Square Standard Error Observations 0.062 0.925 0.018 12.833.693 12.000 Intercept Cases Coeficients 613,850 2.5474 Standard Error 53,525 0.23 Stot 11.47 11.12 Puvolve 0.0000 0.0000 Table 1 Product Line Income Statement for Bubbs - 12 months Revue $14.662,150 Use the data in this spread sheet to answer the Chapter 5 Quiz (quiz 4) Luke Corporation produces a variety of products, each within their own division. Last year, the managers at Luke developed and began marketing a new chewing gum Bubbis, to sel in vending machines. The product, which sells for $s 25 per case, has not had the market success that managers expected, and the company is considering dropping Bubbs. $14 15 734 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started