Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 28.2 Current and prior periods intragroup transfers of inventories Monica Ltd owns all the share capital of Phoebe Ltd. The income tax rate

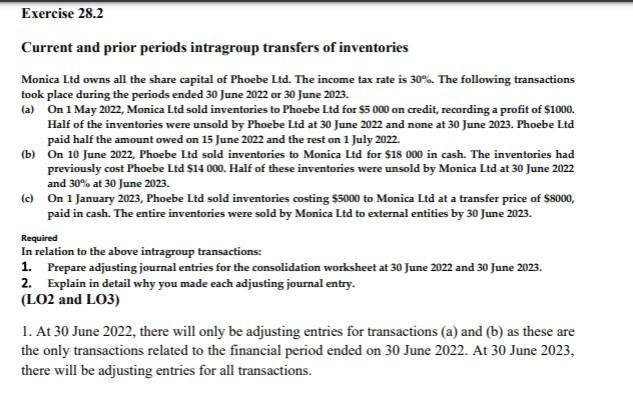

Exercise 28.2 Current and prior periods intragroup transfers of inventories Monica Ltd owns all the share capital of Phoebe Ltd. The income tax rate is 30%. The following transactions took place during the periods ended 30 June 2022 or 30 June 2023. (a) On 1 May 2022, Monica Ltd sold inventories to Phoebe Ltd for $5 000 on credit, recording a profit of $1000. Half of the inventories were unsold by Phoebe Ltd at 30 June 2022 and none at 30 June 2023. Phoebe Ltd paid half the amount owed on 15 June 2022 and the rest on 1 July 2022. (b) On 10 June 2022, Phoebe Ltd sold inventories to Monica Ltd for $18 000 in cash. The inventories had previously cost Phoebe Ltd $14 000. Half of these inventories were unsold by Monica Ltd at 30 June 2022 and 30% at 30 June 2023. (c) On 1 January 2023, Phoebe Ltd sold inventories costing $5000 to Monica Ltd at a transfer price of $8000, paid in cash. The entire inventories were sold by Monica Ltd to external entities by 30 June 2023. Required In relation to the above intragroup transactions: 1. Prepare adjusting journal entries for the consolidation worksheet at 30 June 2022 and 30 June 2023. 2. Explain in detail why you made each adjusting journal entry. (LO2 and LO3) 1. At 30 June 2022, there will only be adjusting entries for transactions (a) and (b) as these are the only transactions related to the financial period ended on 30 June 2022. At 30 June 2023, there will be adjusting entries for all transactions.

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Ans 1 Solution Nitrogen cannot be used directly by plants Nitrogen has to be chang...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started