Answered step by step

Verified Expert Solution

Question

1 Approved Answer

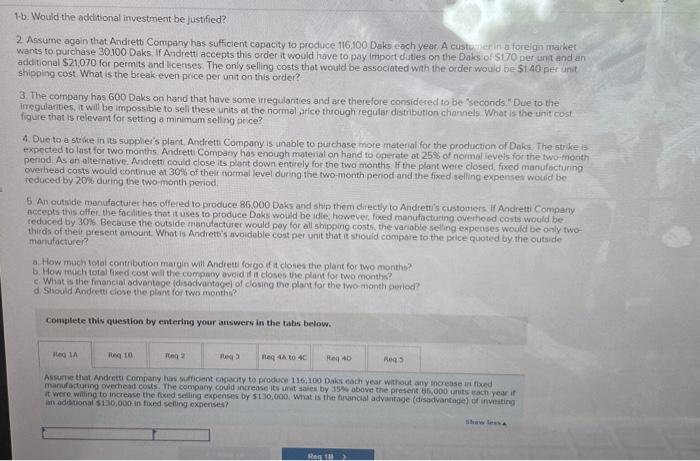

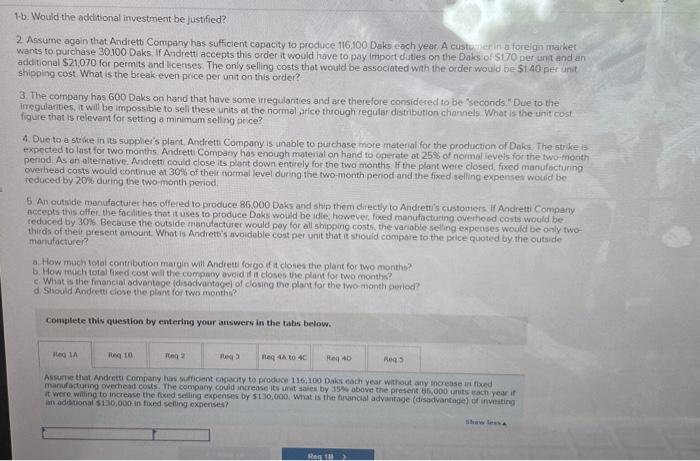

1.b. Would the additional investment be justified? 2. Assume again that Andrett Company has sufficient capacity to groduce 116.100 Daks each year A custy wants

1.b. Would the additional investment be justified? 2. Assume again that Andrett Company has sufficient capacity to groduce 116.100 Daks each year A custy wants to purchase 30.100 Daks. If Andrett accepts th/5 order it would have to pay import duties on the Daks o: $170 per unt and an addional $21,070 for permits and licenses. The only selling costs that would be associated with the order would be $1.40 per urif stipping cost What is the break-even pice per unit on this order? 3. The cornpary has 600 Daks on hand that have some irregularities and are therefore considered to be kseconds "Due to the Irregularities, it wall be ifrposstble to sell these units at the normal pice through regular distribution channels What is the unit cost figure that is relevant for setting a minimam selling price? 4. Due to a stifie in its suppliet's plant, Antrett Company is unable to purchase more material foc the prodictuon of Doks. The strike is expected to last for two months. Andrett Compaty has enough material on hand to operate ot 2585 of normal ieveis for the two fnonth period. As an alternative. Ardretti could close its purt down entirely for the two months. If the plant were closed, fixed maruf cturing oyerhesd costs would continae at 30% of thel tormal level during the two-month period ard ihe fised selling expenset wouid be reduced by 2096 during the two-month period. 5 An outside manufacturer hos offered to produce. 86.000 Doks and ship thern directly to Andrettis customers if Andretti Cormpariy nccepts this difer, the fechlities that it uses to produce Doks would be idie, however, fored manufacturing ovettiedd costs would be. reduced by 30 s. Because the outside mantucturer would pay for all shipping contr, the variobie selling expenses would be only twothirds of theit present amount. What is Andrettis avoldoble cost per unit that it sfiouid compait to the pice quoted by the outside manutacturei? a How much tohat contribution margin will Andrett forgo if it closes the plant for two months? b. How thich total fiked cost wil the company avoid if it closes the plint for two months? c. What is the funanciol advantege (disadvantage) of closing the plant for the wwo-month ouriod? d Shound Andretti clove the plant for two months? comptete this question by enterimg your answers in the tabs below. Asserie that Andreti Company has siaticient cagecity to produce 116,100 0aks each year without any increase ir fixed it were willing to increpse the foced selling expenses by $130,000. What is the fruanclal advuitage (distadyantage) of in yeating in adedtional $130,000 in foxed selung oxgenses

1.b. Would the additional investment be justified? 2. Assume again that Andrett Company has sufficient capacity to groduce 116.100 Daks each year A custy wants to purchase 30.100 Daks. If Andrett accepts th/5 order it would have to pay import duties on the Daks o: $170 per unt and an addional $21,070 for permits and licenses. The only selling costs that would be associated with the order would be $1.40 per urif stipping cost What is the break-even pice per unit on this order? 3. The cornpary has 600 Daks on hand that have some irregularities and are therefore considered to be kseconds "Due to the Irregularities, it wall be ifrposstble to sell these units at the normal pice through regular distribution channels What is the unit cost figure that is relevant for setting a minimam selling price? 4. Due to a stifie in its suppliet's plant, Antrett Company is unable to purchase more material foc the prodictuon of Doks. The strike is expected to last for two months. Andrett Compaty has enough material on hand to operate ot 2585 of normal ieveis for the two fnonth period. As an alternative. Ardretti could close its purt down entirely for the two months. If the plant were closed, fixed maruf cturing oyerhesd costs would continae at 30% of thel tormal level during the two-month period ard ihe fised selling expenset wouid be reduced by 2096 during the two-month period. 5 An outside manufacturer hos offered to produce. 86.000 Doks and ship thern directly to Andrettis customers if Andretti Cormpariy nccepts this difer, the fechlities that it uses to produce Doks would be idie, however, fored manufacturing ovettiedd costs would be. reduced by 30 s. Because the outside mantucturer would pay for all shipping contr, the variobie selling expenses would be only twothirds of theit present amount. What is Andrettis avoldoble cost per unit that it sfiouid compait to the pice quoted by the outside manutacturei? a How much tohat contribution margin will Andrett forgo if it closes the plant for two months? b. How thich total fiked cost wil the company avoid if it closes the plint for two months? c. What is the funanciol advantege (disadvantage) of closing the plant for the wwo-month ouriod? d Shound Andretti clove the plant for two months? comptete this question by enterimg your answers in the tabs below. Asserie that Andreti Company has siaticient cagecity to produce 116,100 0aks each year without any increase ir fixed it were willing to increpse the foced selling expenses by $130,000. What is the fruanclal advuitage (distadyantage) of in yeating in adedtional $130,000 in foxed selung oxgenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started