Question

1.Borrowing by issuing a note payable is a/an asset source transaction. asset use transaction. asset exchange transaction. claims exchange transaction. 2. 3 .In accounting for

1.Borrowing by issuing a note payable is a/an

asset source transaction.

asset use transaction.

asset exchange transaction.

claims exchange transaction.

2.

3 .In accounting for a contingent liability, if the likelihood of the obligation is probable and the amount can be estimated, a company must

report the liability on the balance sheet.

provide disclosure in the footnotes to the financial statements.

not recognize the liability until it is certain and the exact amount is known.

do nothing.

4. Regardless of the specific type of long-term debt, which of the following are normally required with debt transactions?

to repay the debt

to pay dividends

to pay interest

to repay the debt and to pay interest are both correct

5.

6. 7.

7. 8.Which form of business organization is established as a separate legal entity from its owners?

8.Which form of business organization is established as a separate legal entity from its owners?

Sole proprietorship

Corporation

Partnership

None of these

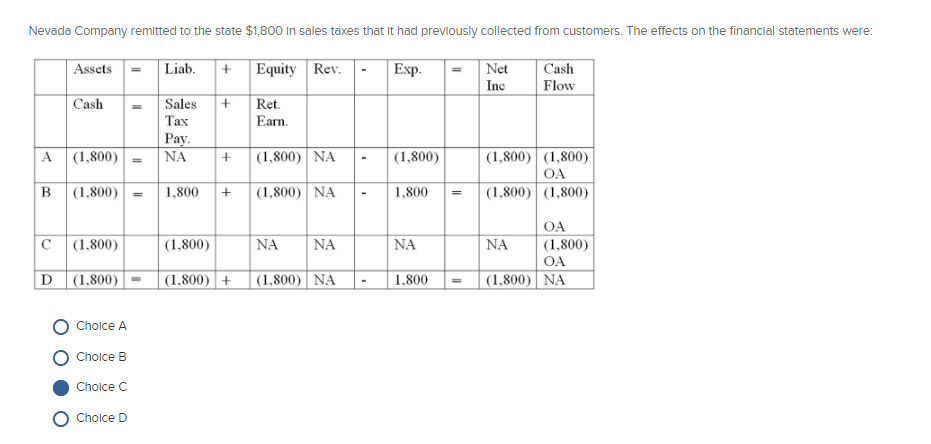

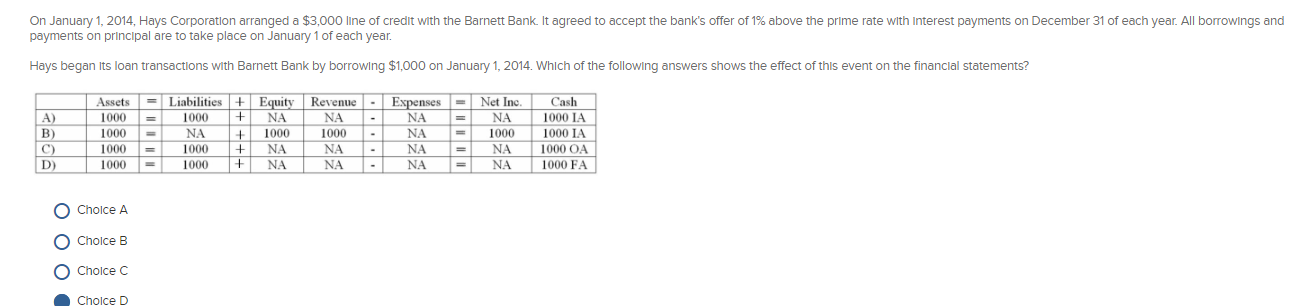

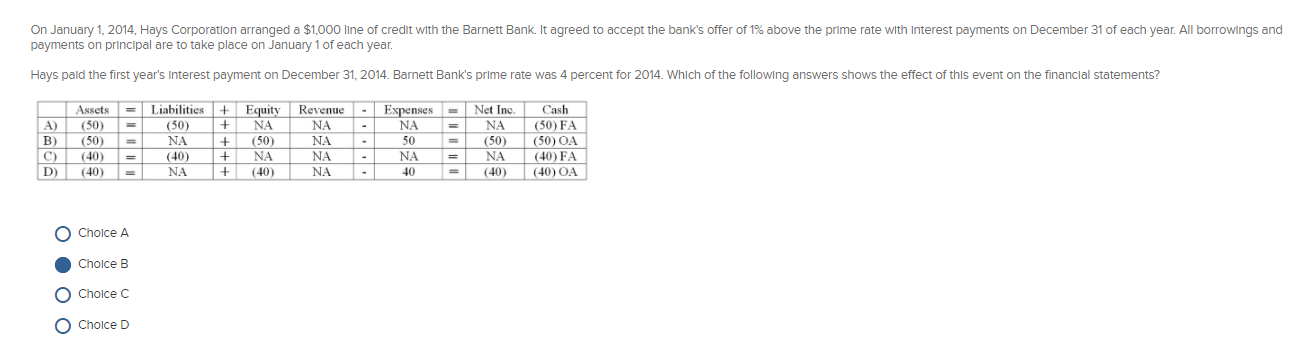

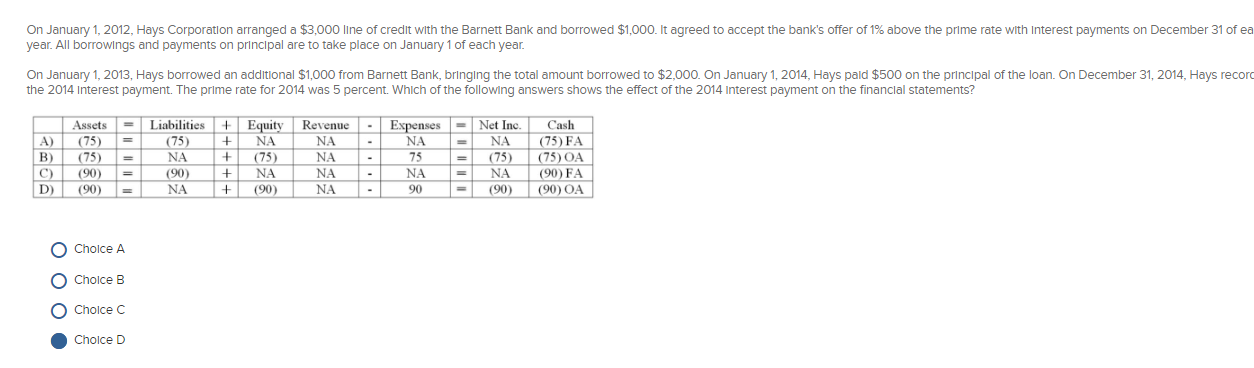

Nevada Company remitted to the state $1,800 in sales taxes that it had previously collected from customers. The effects on the financial statements were: Assets Liab. + Equity Rev. Exp. Net Inc Cash Flow + Ret. Earn. Cash Sales Tax Pay A (1,800) = NA + (1,800) NA (1,800) (1,800) (1,800) OA (1.800) (1.800) B (1.800) = 1,800 + (1,800) NA 1,800 (1.800) (1.800) NA NA NA OA NA (1.800) OA (1.800) NA D (1,800) - (1.800) + (1.800) NA 1.800 Cholce A Choice B Cholce C Cholce D On January 1, 2014, Hays Corporation arranged a $3,000 line of credit with the Barnett Bank. It agreed to accept the bank's offer of 1% above the prime rate with Interest payments on December 31 of each year. All borrowings and payments on principal are to take place on January 1 of each year. Hays began its loan transactions with Barnett Bank by borrowing $1,000 on January 1, 2014. Which of the following answers shows the effect of this event on the financial statements? = A) B) C) D) Assets 1000 1000 1000 1000 Liabilities + Equity Revenue 1000 + NA NA NA + 1000 1000 1000 + NA NA 1000 + NA NA Expenses Net Inc. NA NA NA 1000 NA NA NA NA Cash 1000 IA 1000 IA 1000 OA 1000 FA - O Choice A OOO O Choice B O Choice C Cholce D On January 1, 2014, Hays Corporation arranged a $1,000 line of credit with the Barnett Bank. It agreed to accept the bank's offer of 1% above the prime rate with Interest payments on December 31 of each year. All borrowings and payments on principal are to take place on January 1 of each year. Hays paid the first year's Interest payment on December 31, 2014. Barnett Bank's prime rate was 4 percent for 2014. Which of the following answers shows the effect of this event on the financial statements? Assets (50) (50) (40) (40) A) B) C) D) Liabilities + Equity (50) + NA NA + (50) (40) + NA NA + (40) Revenue NA NA NA NA - Expenses NA 50 NA 40 Net Inc NA (50) NA (40) Cash (50) FA (50) OA (40) FA (40) OA - = O Choice A Choice B O Cholce C O Choice D On January 1, 2012, Hays Corporation arranged a $3,000 line of credit with the Barnett Bank and borrowed $1,000. It agreed to accept the bank's offer of 1% above the prime rate with Interest payments on December 31 of ea year. All borrowings and payments on principal are to take place on January 1 of each year. On January 1, 2013, Hays borrowed an additional $1,000 from Barnett Bank, bringing the total amount borrowed to $2,000. On January 1, 2014, Hays pald $500 on the principal of the loan. On December 31, 2014, Hays record the 2014 Interest payment. The prime rate for 2014 was 5 percent. Which of the following answers shows the effect of the 2014 Interest payment on the financial statements? Net Inc. NA A) B) C D) Assets (75) (75) (90) (90) Liabilities + Equity (75) + NA NA + (75) (90) + NA NA + (90) Revenue NA NA NA NA Expenses NA 75 NA 90 (75) NA (90) Cash (75) FA (75) OA (90) FA (90) OA Choice A O Choice B O Cholce c Cholce D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started