1. Calculate current ratio and acid test ratio for the firm. 2. Calculate DSO, fixed assets turnover, and total asset turnover for the firm. 3.

1. Calculate current ratio and acid test ratio for the firm.

2. Calculate DSO, fixed assets turnover, and total asset turnover for the firm.

3. Calculate liabilities-to-assets ratio and times-interest-earned ratio for the firm.

4. Calculate net profit margin and return on equity for the firm.

5. Evaluate the performance of the firm in the following areas: Liquidity management Asset management Debt management Profitability management When you explain the firm’s strength or weakness in each area, you must support your arguments through the evaluative reasoning process by providing reasons, methods, criteria, or assumptions behind the claims made.

6. Deductive reasoning starts with a general principle and deduces that it applies to a specific case. Deductive reasoning moves with exacting precision from the assumed truth of a set of premises to a conclusion which cannot be false if those premises are true. Explain the deductive reasoning process applied to analyze the firm’s performance.

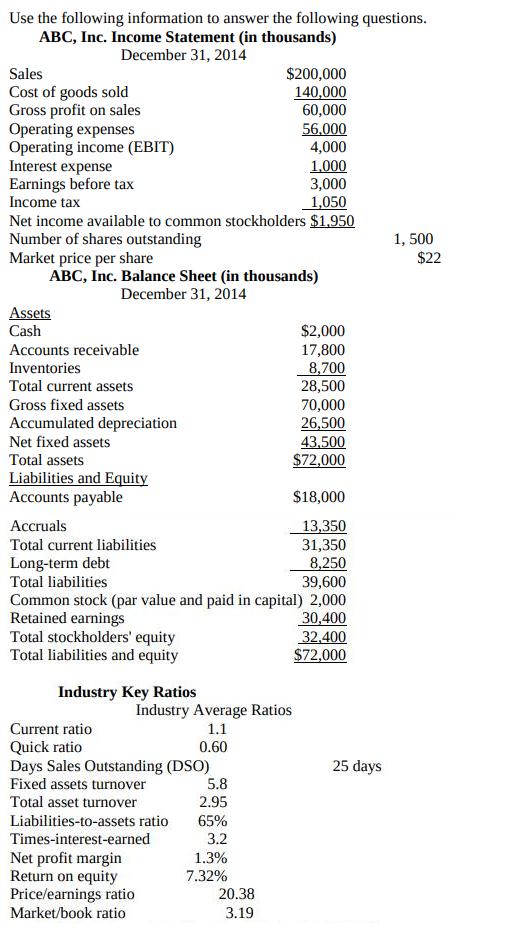

Use the following information to answer the following questions. ABC, Inc. Income Statement (in thousands) December 31, 2014 $200,000 140,000 60,000 56.000 4,000 1.000 3,000 1,050 Net income available to common stockholders $1.950 Sales Cost of goods sold Gross profit on sales Operating expenses Operating income (EBIT) Interest expense Earnings before tax Income tax Number of shares outstanding Market price per share 1, 500 $22 ABC, Inc. Balance Sheet (in thousands) December 31, 2014 Assets Cash $2,000 17,800 8,700 28,500 70,000 26,500 43,500 $72,000 Accounts receivable Inventories Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and Equity Accounts payable $18,000 13,350 31,350 8,250 39,600 Common stock (par value and paid in capital) 2,000 30,400 32,400 $72,000 Accruals Total current liabilities Long-term debt Total liabilities Retained earnings Total stockholders' equity Total liabilities and equity Industry Key Ratios Industry Average Ratios Current ratio 1.1 Quick ratio 0.60 Days Sales Outstanding (DSO) 5.8 2.95 65% 3.2 25 days Fixed assets turnover Total asset turnover Liabilities-to-assets ratio Times-interest-earned Net profit margin Return on equity Price/earnings ratio 1.3% 7.32% 20.38 Market/book ratio 3.19

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Calculate current ratio and acid test ratio for the firm Current ratio Current assets Current Liabilities 28500 31350 091 times Acid test rat...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started