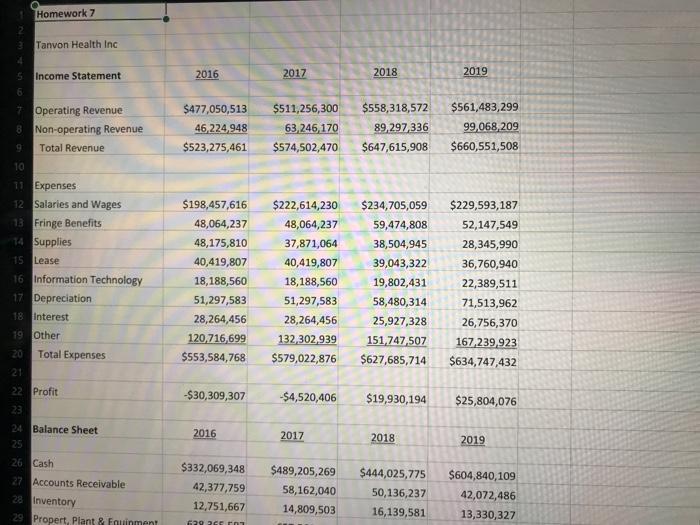

Question: Homework 7 Tanvon Health Inc Income Statement 2016 2017 2018 2019 7 Operating Revenue $477,050,513 $511,256,300 $558,318,572 $561,483,299 8 Non-operating Revenue 46,224,948 63,246,170 89,297,336

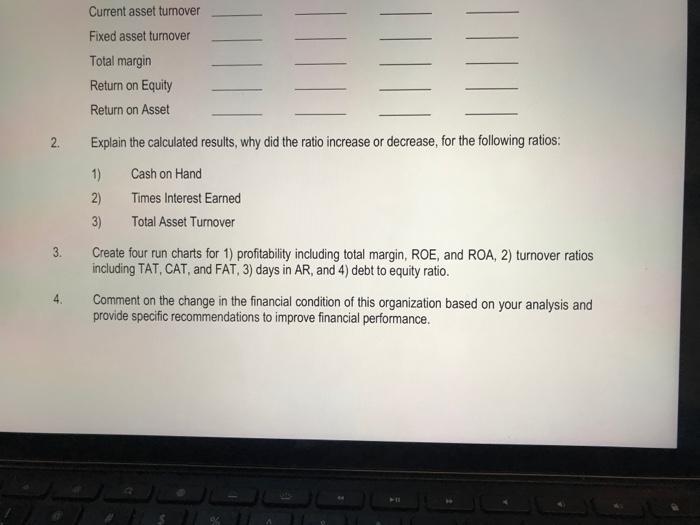

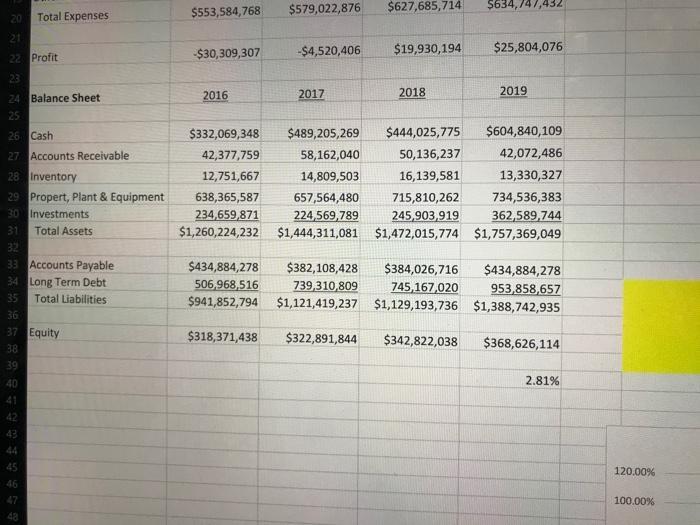

Homework 7 Tanvon Health Inc Income Statement 2016 2017 2018 2019 7 Operating Revenue $477,050,513 $511,256,300 $558,318,572 $561,483,299 8 Non-operating Revenue 46,224,948 63,246,170 89,297,336 99,068,209 Total Revenue $523,275,461 $574,502,470 $647,615,908 $660,551,508 10 11 Expenses 12 Salaries and Wages $198,457,616 $222,614,230 $234,705,059 $229,593,187 13 Fringe Benefits 14 Supplies 48,064,237 48,064,237 59,474,808 52,147,549 48,175,810 37,871,064 38,504,945 28,345,990 15 Lease 40,419,807 40,419,807 39,043,322 36,760,940 16 Information Technology 18,188,560 18,188,560 19,802,431 22,389,511 17 Depreciation 51,297,583 51,297,583 58,480,314 71,513,962 18 Interest 28,264,456 28,264,456 25,927,328 26,756,370 19 Other 120,716,699 132,302,939 151,747,507 167,239,923 20 Total Expenses $553,584,768 $579,022,876 $627,685,714 $634,747,432 21 22 Profit -$30,309,307 $19,930,194 -$4,520,406 $25,804,076 23 24 Balance Sheet 2016 2017 2018 25 2019 26 Cash $332,069,348 $489,205,269 $444,025,775 $604,840,109 27 Accounts Receivable 42,377,759 58,162,040 50,136,237 28 Inventory 42,072,486 12,751,667 14,809,503 16,139,581 29 Propert, Plant & Eguinment 13,330,327 629 265 CO1 Current asset turnover Fixed asset turnover Total margin Return on Equity Return on Asset 2. Explain the calculated results, why did the ratio increase or decrease, for the following ratios: 1) Cash on Hand 2) Times Interest Earned 3) Total Asset Turnover Create four run charts for 1) profitability including total margin, ROE, and ROA, 2) turnover ratios including TAT, CAT, and FAT, 3) days in AR, and 4) debt to equity ratio. 3. 4. Comment on the change in the financial condition of this organization based on your analysis and provide specific recommendations to improve financial performance. $553,584,768 $579,022,876 $627,685,714 $634,747,43 20 Total Expenses 21 $30,309,307 -$4,520,406 $19,930,194 $25,804,076 22 Profit 23 24 Balance Sheet 2016 2017 2018 2019 25 26 Cash $332,069,348 $489,205,269 $444,025,775 $604,840,109 27 Accounts Receivable 42,377,759 58,162,040 50,136,237 42,072,486 28 Inventory 12,751,667 14,809,503 16,139,581 13,330,327 29 Propert, Plant & Equipment 638,365,587 657,564,480 715,810,262 734,536,383 30 Investments 234,659,871 $1,260,224,232 $1,444,311,081 $1,472,015,774 $1,757,369,049 224,569,789 245,903,919 362,589,744 31 Total Assets 32 33 Accounts Payable 34 Long Term Debt $434,884,278 $382,108,428 $384,026,716 $434,884,278 506,968,516 739,310,809 745,167,020 953,858,657 $941,852,794 $1,121,419,237 $1,129,193,736 $1,388,742,935 35 Total Liabilities 36 37 Equity $318,371,438 $322,891,844 $342,822,038 $368,626,114 38 39 40 2.81% 41 42 43 44 45 120.00% 46 47 100.00% 48

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

1 2 3 31 FORMULAS 4 5 6 Fo... View full answer

Get step-by-step solutions from verified subject matter experts