Answered step by step

Verified Expert Solution

Question

1 Approved Answer

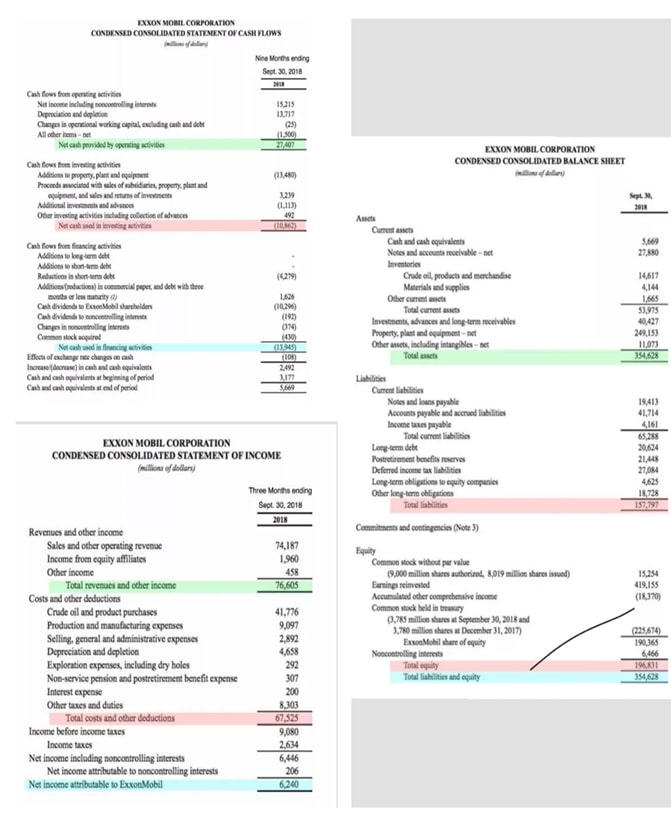

1-Calculate financial ratios of the firm. 2- Analyse the raitos and write your comments EXXON MOBIL CORPORATION CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS Nine Mortending

1-Calculate financial ratios of the firm.

2- Analyse the raitos and write your comments

EXXON MOBIL CORPORATION CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS Nine Mortending Seot 30, 2018 1117 1.500 EXXON MOBIL CORPORATION CONDENSED CONSOLIDATED BALANCE SHEET (11.40) (1.113) 2018 101 Cash flows from operating activities Net income including controlling interest Depreciation and depleti Cape is opencional working capital, escluding and und debt All other items! Net cul provided by penting activities Cash flows from investing activities Addition to property, plus de Poceeds sected with sales of property, plund itud led to investe Additionale Other investing activities including collection of brace Nel cual vaig activities Cal flows from financing stivities Miesto kong term Motions to be cum debe Raductions in stenom det Mites rodatkowe) in commercial paper, und debt with three mooth or low may Canh divided to take Mobil shareholders Cah dividendeling in Changes in controlling inte Comment acquired Nutcash we fining activities Effects of change chanh Inreder) in cash and cash equal Cahend ohuvlaring period Cash nl chaquivalente at end of period 5.669 27.80 (429) Ant Current Cash and cash equivalent Notes and accounts receivable-net Inventories Crude all products and merchandise Materials and supplies Other current Total currentes Investments, races and long-term monivables Property, plante ment- Other iets, including intanes- Totalt 14617 4144 1.665 1.426 (1024) 51975 010 (430) (13.943 108 40,427 249,153 11,073 354628 Current liabilities Notes and loans payable Accounts payable and credibilities Income taxes payable Total current liabil Long term dhe Postretirement benefits Deferred income taxi Long term obligations to equity companies Other long-term obligations Total liabilities Commitments and contingencies (Note 3) 18,413 41,714 4,161 65,288 20,44 2148 EXXON MOBIL CORPORATION CONDENSED CONSOLIDATED STATEMENT OF INCOME Three Months ending Sept 30, 2018 2018 4625 18,728 157.797 74,187 1.960 76,605 15,254 419.155 (11.370) Revenues and other income Sales and other operating revenue Income from equity affiliates Other income Totul revenues and other income Costs and other deductions Crude oil and product purchases Production and manufacturing expenses Selling, general and administrative expenses Depreciation and depletion Exploration expenses, including dry holes Non-service pension and postretirement benefit expense Interest expense Other taxes and duties Total costs and other deductions Income before income taxes Income taxes Net income including noncontrolling interests Net income attributable to noncontrolling interests Net income attributable to ExxonMobil Commen stock without per value (3,000 million states authorised, 8.019 million shares inued) Earnings invested Accumulated other comprehensive income Com ock held in tery (3,785 million shares at September 30, 2018 and 3,780 million shares December 31, 2017) ExxonMobil share of equity No controlling interest Total quity Total liabilities and equity (225,674 190,365 6466 TES 354 41.776 9,097 2,892 4,658 292 307 200 8,303 67.525 9,080 2,634 6,446 206 6,240 EXXON MOBIL CORPORATION CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS Nine Mortending Seot 30, 2018 1117 1.500 EXXON MOBIL CORPORATION CONDENSED CONSOLIDATED BALANCE SHEET (11.40) (1.113) 2018 101 Cash flows from operating activities Net income including controlling interest Depreciation and depleti Cape is opencional working capital, escluding and und debt All other items! Net cul provided by penting activities Cash flows from investing activities Addition to property, plus de Poceeds sected with sales of property, plund itud led to investe Additionale Other investing activities including collection of brace Nel cual vaig activities Cal flows from financing stivities Miesto kong term Motions to be cum debe Raductions in stenom det Mites rodatkowe) in commercial paper, und debt with three mooth or low may Canh divided to take Mobil shareholders Cah dividendeling in Changes in controlling inte Comment acquired Nutcash we fining activities Effects of change chanh Inreder) in cash and cash equal Cahend ohuvlaring period Cash nl chaquivalente at end of period 5.669 27.80 (429) Ant Current Cash and cash equivalent Notes and accounts receivable-net Inventories Crude all products and merchandise Materials and supplies Other current Total currentes Investments, races and long-term monivables Property, plante ment- Other iets, including intanes- Totalt 14617 4144 1.665 1.426 (1024) 51975 010 (430) (13.943 108 40,427 249,153 11,073 354628 Current liabilities Notes and loans payable Accounts payable and credibilities Income taxes payable Total current liabil Long term dhe Postretirement benefits Deferred income taxi Long term obligations to equity companies Other long-term obligations Total liabilities Commitments and contingencies (Note 3) 18,413 41,714 4,161 65,288 20,44 2148 EXXON MOBIL CORPORATION CONDENSED CONSOLIDATED STATEMENT OF INCOME Three Months ending Sept 30, 2018 2018 4625 18,728 157.797 74,187 1.960 76,605 15,254 419.155 (11.370) Revenues and other income Sales and other operating revenue Income from equity affiliates Other income Totul revenues and other income Costs and other deductions Crude oil and product purchases Production and manufacturing expenses Selling, general and administrative expenses Depreciation and depletion Exploration expenses, including dry holes Non-service pension and postretirement benefit expense Interest expense Other taxes and duties Total costs and other deductions Income before income taxes Income taxes Net income including noncontrolling interests Net income attributable to noncontrolling interests Net income attributable to ExxonMobil Commen stock without per value (3,000 million states authorised, 8.019 million shares inued) Earnings invested Accumulated other comprehensive income Com ock held in tery (3,785 million shares at September 30, 2018 and 3,780 million shares December 31, 2017) ExxonMobil share of equity No controlling interest Total quity Total liabilities and equity (225,674 190,365 6466 TES 354 41.776 9,097 2,892 4,658 292 307 200 8,303 67.525 9,080 2,634 6,446 206 6,240Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started