Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1)Calculate the market value of Nandipha Beds bonds after tax? - Assume tax rate is 28% 2)Calculate the cost of non-redeemable preference shares for Nandipha?

1)Calculate the market value of Nandipha Beds bonds after tax? - Assume tax rate is 28% 2)Calculate the cost of non-redeemable preference shares for Nandipha? ..% 3)Calculate the market value of Nandipha Beds ordinary shares? R.

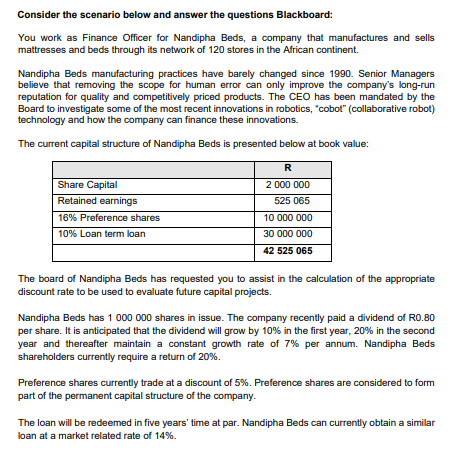

Consider the scenario below and answer the questions Blackboard: You work as Finance Officer for Nandipha Beds, a company that manufactures and sells mattresses and beds through its network of 120 stores in the African continent. Nandipha Beds manufacturing practices have barely changed since 1990. Senior Managers believe that removing the scope for human error can only improve the company's long-run reputation for quality and competitively priced products. The CEO has been mandated by the Board to investigate some of the most recent innovations in robotics, "cobot" (collaborative robot) technology and how the company can finance these innovations. The current capital structure of Nandipha Beds is presented below at book value: The board of Nandipha Beds has requested you to assist in the calculation of the appropriate discount rate to be used to evaluate future capital projects. Nandipha Beds has 1000000 shares in issue. The company recently paid a dividend of R0.80 per share. It is anticipated that the dividend will grow by 10% in the first year, 20% in the second year and thereafter maintain a constant growth rate of 7% per annum. Nandipha Beds shareholders currently require a return of 20%. Preference shares currently trade at a discount of 5%. Preference shares are considered to form part of the permanent capital structure of the company. The loan will be redeemed in five years' time at par. Nandipha Beds can currently obtain a similar loan at a market related rate of 14%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started