Question

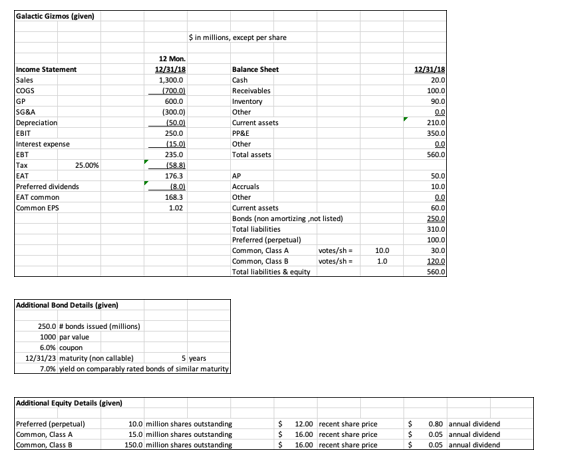

1.Calculate todays value of one bond, using the information above, including interest (round to the nearest whole number). 2. What is the debt-to-total capital ratio,

1.Calculate todays value of one bond, using the information above, including interest (round to the nearest whole number).

2. What is the debt-to-total capital ratio, based on the book values above?

3.What is the firms enterprise value (EV) and the EV / EBITDA ratio based on the data above?

4.What is the cost of preferred stock?

5.What is the firms P/E ratio?

6.What percent of the total voting interest do the Class B common shareholders possess?

another one"

. ACME Oil Company is considering drilling an oil rig which will cost $300 today, and in one year will be defined as a success or failure. Management estimates a 50% probability of either outcome. The present value of a successful outcome is $575, with the present value of failure is $0. ACMEs hurdle rate is 10%. The equipment may be sold for $250 (salvage value) a year from now. What is the value of the option to abandon the project?

A. $287.50

B. $412.50

C. $0.00

D. $113.64

E. Unable to determine from the information provided.

Galactic Gizmos (given) $ in millions, except per share 12/31/18 200 1000 90.0 12 Mon. 12/31/18 1,300.0 17000) 6000 (3000) 1500) 2500 (150) 235.0 1889 Income Statement Sales COGS GP SGRA Depreciation EBIT interest expense EBT Tax 25.00% LEAT Preferred dividends EAT common Common EPS Balance Sheet Cash Receivables Inventory Other Current assets PPRE Other Total assets 2100 3500 560.01 180) 1683 AP Accruals Other Current assets Bonds (non amortizing not listed) Total liabilities Preferred (perpetual) Common, Class A votes/sh Common, Class votes/sh Total liabilities & equity 50.00 100 0. 60.0 2500 3100 100.0 30.0 1200 560.0 10.0 10 Additional Bond Details given) 250.0 # bonds issued millions) 1000 par value 60% coupon 12/31/23 maturity (non callable) 7.0% yield on comparably rated bonds of similar maturity 5 years Additional Equity Details given) $ Preferred (perpetual) Common, Class A Common Class B 10,0 million shares outstanding 15.0 million shares outstanding 150.0 million shares outstanding $ 12.00 recent share price 16.00 recent share price 16.00 recent share price $ $ $ 0.80 annual dividend 0.05 annual dividend 0.05 annual dividend SStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started