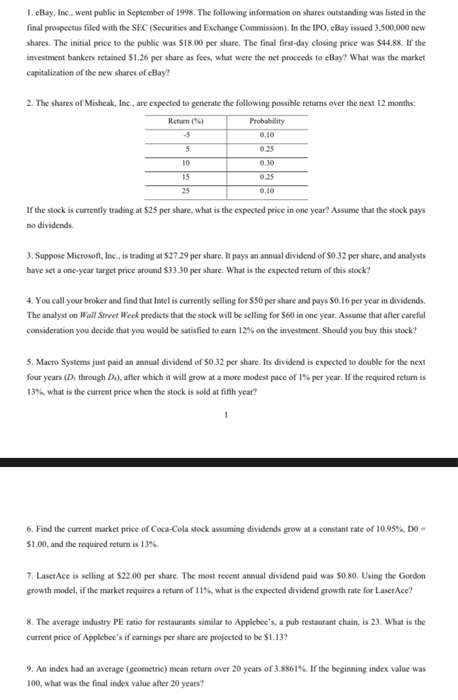

1.cBay, Inc., went public in September of 1998. The following information on shares outstanding was listed in the final prospectus filed with the SEC (Securities and Exchange Commission). In the IPO. eBay issued 3.500.000 new shares. The initial price to the public was $18.00 per share. The final first-day closing price was $64.88. If the investment bankers retained $1.26 per share as fees, what were the net proceeds to eBay? What was the market capitalization of the new shares of eBay! 2. The shares of Misheak, Inc., are expected to generate the following possible returns over the next 12 months Retur 5 Probability .10 0 10 :30 15 If the stock is currently trading at $25 per share, what is the expected price in one year? Assume that the stock pays me dividends. 3. Suppose Microsoft, Inc., is trading at $27.29 per share. It pays an annual dividend of 0.32 per share, and analysts have set a one-year target price around $33.30 per share. What is the expected return of this stock? 4. You call your broker and find that Intel is currently selling for S50 per share and pays $0.16 per year in dividends. The analyston Wall Street Week predicts that the stock will be selling for $60 in one year. Assume that after careful consideration you decide that you would be satisfied to carn 12% on the investment, Should you buy this stock? 5. Macro Systems just paid an annual dividend of $0.32 per share. Its dividend is expected to double for the next four years through D), after which it will grow at a more modest pace of 1% per year. If the required return is 13%, what is the current price when the stock is sold at fifth year? 6. Find the current market price of Coca-Cola stock assuming dividends grow at a constant rate of 10.99%, DO $1.00, and the required return is 13% 7. Laserce is selling at $22.00 per share. The most recent annual dividend paid was $0.80. Using the Gordon growth model, if the market requires a return of 11%, what is the expected dividend growth rate for Laser Ace! & The average industry P ratio for restaurants similar to Applebee's a pub restaurant chain, is 23. What is the Current price of Applebee's if earning per share are projected to be 51.13? 9. An index had an average (geometric) mean return over 20 years of 3.8861%. If the beginning index value was 100, what was the final index value after 20 years