Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Computation of free cash flows 2.Showing the assumptions for forecasting future free cash flows 3.Forecasted cash flows 4.Application of the constant growth model 5.Application of

1.Computation of free cash flows

1.Computation of free cash flows

2.Showing the assumptions for forecasting future free cash flows

3.Forecasted cash flows 4.Application of the constant growth model

5.Application of multistage growth model

6.Finding the intrinsic value per common share using each model

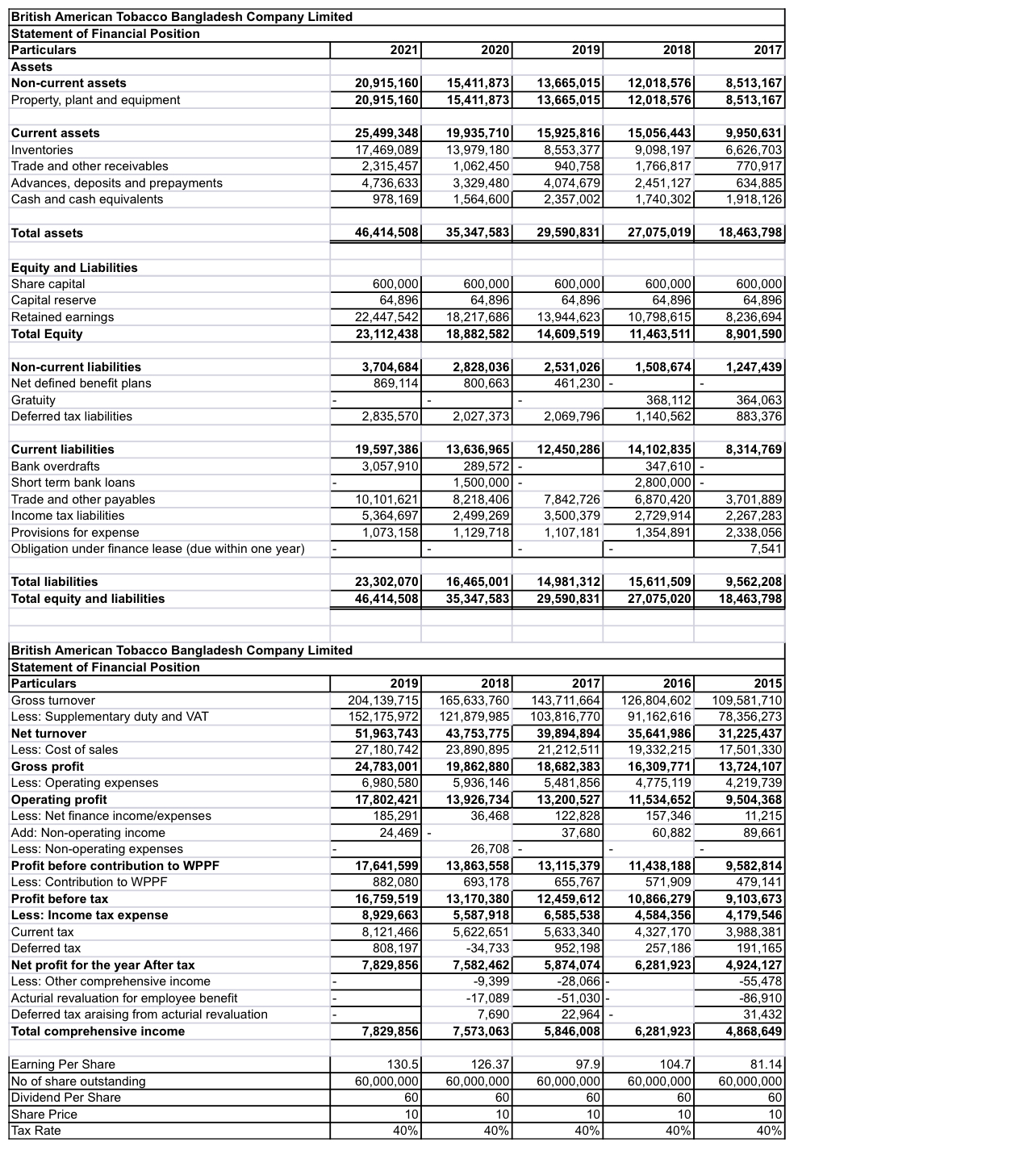

\begin{tabular}{|l|r|r|r|r|r|} \hline \multicolumn{5}{|l|}{ British American Tobacco Bangladesh Company Limited } \\ \hline Statement of Financial Position & \multicolumn{5}{l|}{} \\ \hline Particulars & 2021 & 2020 & 2019 & 2018 & 2017 \\ \hline Assets & & & & & \\ \hline Non-current assets & 20,915,160 & 15,411,873 & 13,665,015 & 12,018,576 & 8,513,167 \\ \hline Property, plant and equipment & 20,915,160 & 15,411,873 & 13,665,015 & 12,018,576 & 8,513,167 \\ \hline Current assets & & & & & \\ \hline Inventories & 25,499,348 & 19,935,710 & 15,925,816 & 15,056,443 & 9,950,631 \\ \hline Trade and other receivables & 17,469,089 & 13,979,180 & 8,553,377 & 9,098,197 & 6,626,703 \\ \hline Advances, deposits and prepayments & 2,315,457 & 1,062,450 & 940,758 & 1,766,817 & 770,917 \\ \hline Cash and cash equivalents & 4,736,633 & 3,329,480 & 4,074,679 & 2,451,127 & 634,885 \\ \hline & 978,169 & 1,564,600 & 2,357,002 & 1,740,302 & 1,918,126 \\ \hline Total assets & & & & & \\ \hline \end{tabular} Equity and Liabilities Share capital Capital reserve Retained earnings Total Equity \begin{tabular}{r|r|r|r|r|} \hline 600,000 & 600,000 & 600,000 & 600,000 & 600,000 \\ \hline 64,896 & 64,896 & 64,896 & 64,896 & 64,896 \\ \hline 22,447,542 & 18,217,686 & 13,944,623 & 10,798,615 & 8,236,694 \\ \hline 23,112,438 & 18,882,582 & 14,609,519 & 11,463,511 & 8,901,590 \\ \hline \end{tabular} Non-current liabilities Net defined benefit plans Gratuity Deferred tax liabilities Current liabilities Bank overdrafts Short term bank loans Trade and other payables Income tax liabilities Provisions for expense Obligation under finance lease (due within one year) Total liabilities Total equity and liabilities \begin{tabular}{r|r|r|r|r|} \hline 23,302,070 & 16,465,001 & 14,981,312 & 15,611,509 & 9,562,208 \\ \hline 46,414,508 & 35,347,583 & 29,590,831 & 27,075,020 & 18,463,798 \\ \hline \hline \end{tabular} British American Tobacco Bangladesh Company Limited Statement of Financial Position Particulars Gross turnover Less: Supplementary duty and VAT Net turnover Less: Cost of sales Gross profit Less: Operating expenses Operating profit Less: Net finance income/expenses Add: Non-operating income Less: Non-operating expenses Profit before contribution to WPPF Less: Contribution to WPPF Profit before tax Less: Income tax expense Current tax Deferred tax Net profit for the year After tax Less: Other comprehensive income Acturial revaluation for employee benefit Deferred tax araising from acturial revaluation Total comprehensive income \begin{tabular}{|l|r|r|r|r|r|} \hline Earning Per Share & 130.5 & 126.37 & 97.9 & 104.7 & 81.14 \\ \hline No of share outstanding & 60,000,000 & 60,000,000 & 60,000,000 & 60,000,000 & 60,000,000 \\ \hline Dividend Per Share & 60 & 60 & 60 & 60 & 60 \\ \hline Share Price & 10 & 10 & 10 & 10 & 10 \\ \hline Tax Rate & 40% & 40% & 40% & 40% & 40% \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|r|r|} \hline \multicolumn{5}{|l|}{ British American Tobacco Bangladesh Company Limited } \\ \hline Statement of Financial Position & \multicolumn{5}{l|}{} \\ \hline Particulars & 2021 & 2020 & 2019 & 2018 & 2017 \\ \hline Assets & & & & & \\ \hline Non-current assets & 20,915,160 & 15,411,873 & 13,665,015 & 12,018,576 & 8,513,167 \\ \hline Property, plant and equipment & 20,915,160 & 15,411,873 & 13,665,015 & 12,018,576 & 8,513,167 \\ \hline Current assets & & & & & \\ \hline Inventories & 25,499,348 & 19,935,710 & 15,925,816 & 15,056,443 & 9,950,631 \\ \hline Trade and other receivables & 17,469,089 & 13,979,180 & 8,553,377 & 9,098,197 & 6,626,703 \\ \hline Advances, deposits and prepayments & 2,315,457 & 1,062,450 & 940,758 & 1,766,817 & 770,917 \\ \hline Cash and cash equivalents & 4,736,633 & 3,329,480 & 4,074,679 & 2,451,127 & 634,885 \\ \hline & 978,169 & 1,564,600 & 2,357,002 & 1,740,302 & 1,918,126 \\ \hline Total assets & & & & & \\ \hline \end{tabular} Equity and Liabilities Share capital Capital reserve Retained earnings Total Equity \begin{tabular}{r|r|r|r|r|} \hline 600,000 & 600,000 & 600,000 & 600,000 & 600,000 \\ \hline 64,896 & 64,896 & 64,896 & 64,896 & 64,896 \\ \hline 22,447,542 & 18,217,686 & 13,944,623 & 10,798,615 & 8,236,694 \\ \hline 23,112,438 & 18,882,582 & 14,609,519 & 11,463,511 & 8,901,590 \\ \hline \end{tabular} Non-current liabilities Net defined benefit plans Gratuity Deferred tax liabilities Current liabilities Bank overdrafts Short term bank loans Trade and other payables Income tax liabilities Provisions for expense Obligation under finance lease (due within one year) Total liabilities Total equity and liabilities \begin{tabular}{r|r|r|r|r|} \hline 23,302,070 & 16,465,001 & 14,981,312 & 15,611,509 & 9,562,208 \\ \hline 46,414,508 & 35,347,583 & 29,590,831 & 27,075,020 & 18,463,798 \\ \hline \hline \end{tabular} British American Tobacco Bangladesh Company Limited Statement of Financial Position Particulars Gross turnover Less: Supplementary duty and VAT Net turnover Less: Cost of sales Gross profit Less: Operating expenses Operating profit Less: Net finance income/expenses Add: Non-operating income Less: Non-operating expenses Profit before contribution to WPPF Less: Contribution to WPPF Profit before tax Less: Income tax expense Current tax Deferred tax Net profit for the year After tax Less: Other comprehensive income Acturial revaluation for employee benefit Deferred tax araising from acturial revaluation Total comprehensive income \begin{tabular}{|l|r|r|r|r|r|} \hline Earning Per Share & 130.5 & 126.37 & 97.9 & 104.7 & 81.14 \\ \hline No of share outstanding & 60,000,000 & 60,000,000 & 60,000,000 & 60,000,000 & 60,000,000 \\ \hline Dividend Per Share & 60 & 60 & 60 & 60 & 60 \\ \hline Share Price & 10 & 10 & 10 & 10 & 10 \\ \hline Tax Rate & 40% & 40% & 40% & 40% & 40% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started