Question

1.Compute the average total depreciable life of assets in use for Wal-Mart at the end of Jan 31, 2015. 2.Compute the average age to date

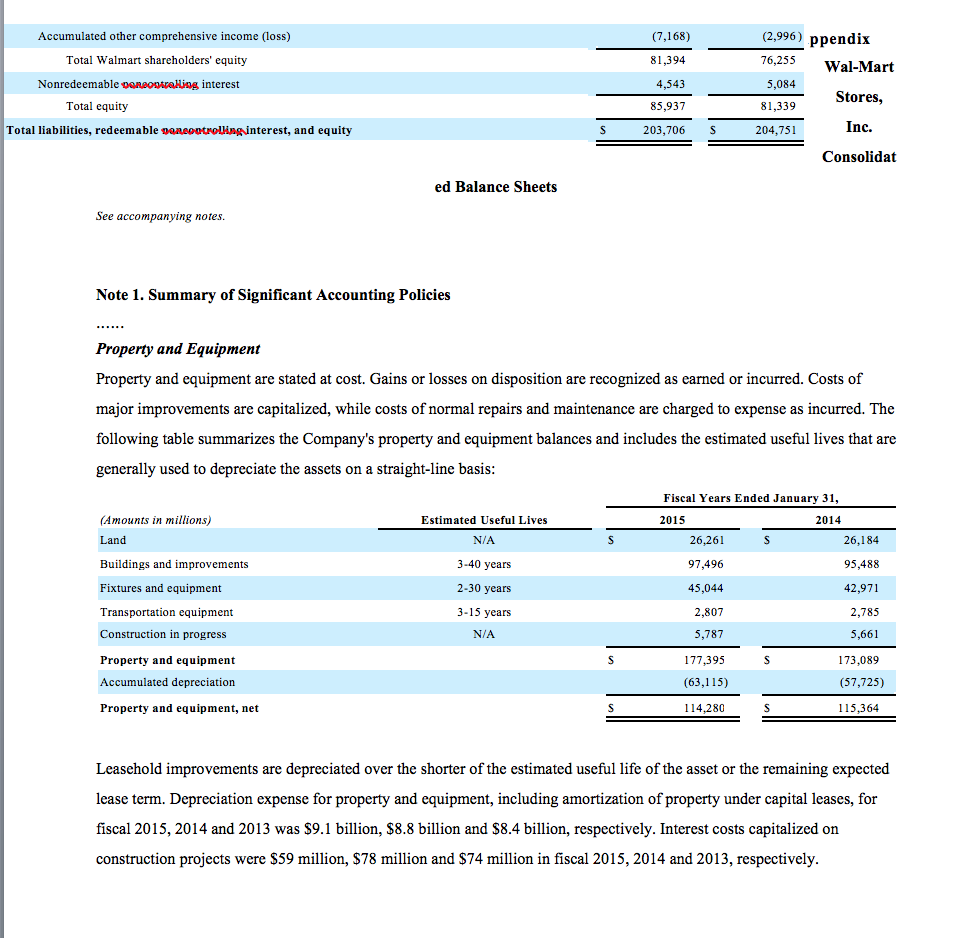

1.Compute the average total depreciable life of assets in use for Wal-Mart at the end of Jan 31, 2015.

2.Compute the average age to date of depreciable assets in use for Wal-Mart at the end of Jan 31, 2015.

3.Compute the remaining useful life of depreciable assets in use for Wal-Mart at the end of Jan 31, 2015.

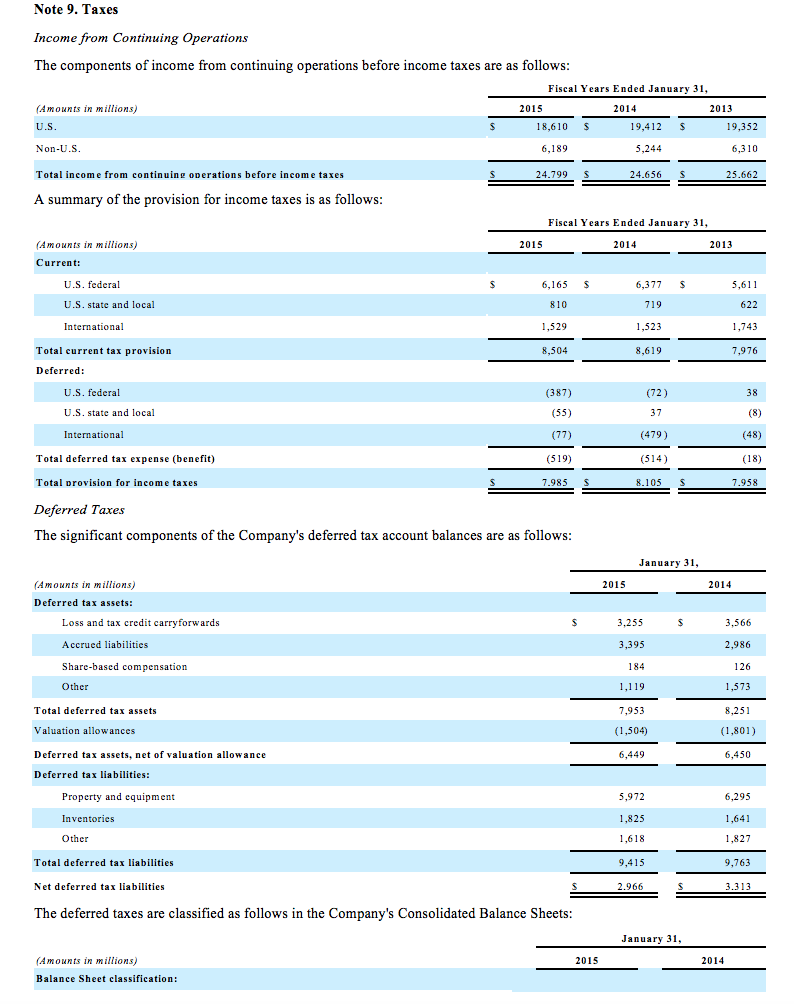

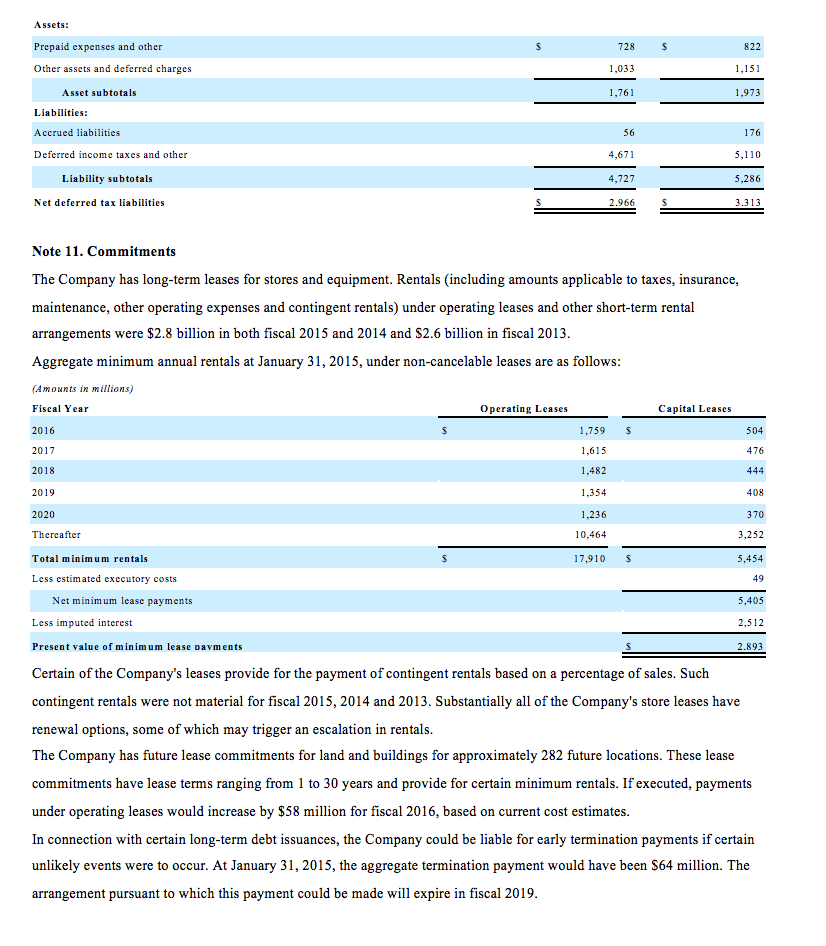

4. Compute the amount the company would report for property, plant, and equipment (net) at the end of the year if it had used tax reporting depreciation instead of financial reporting depreciation.

5.Compute the amount of depreciation expense recognized for tax purposes for fiscal 2015 using the amount of the deferred taxes liability related to deprecation timing differences.

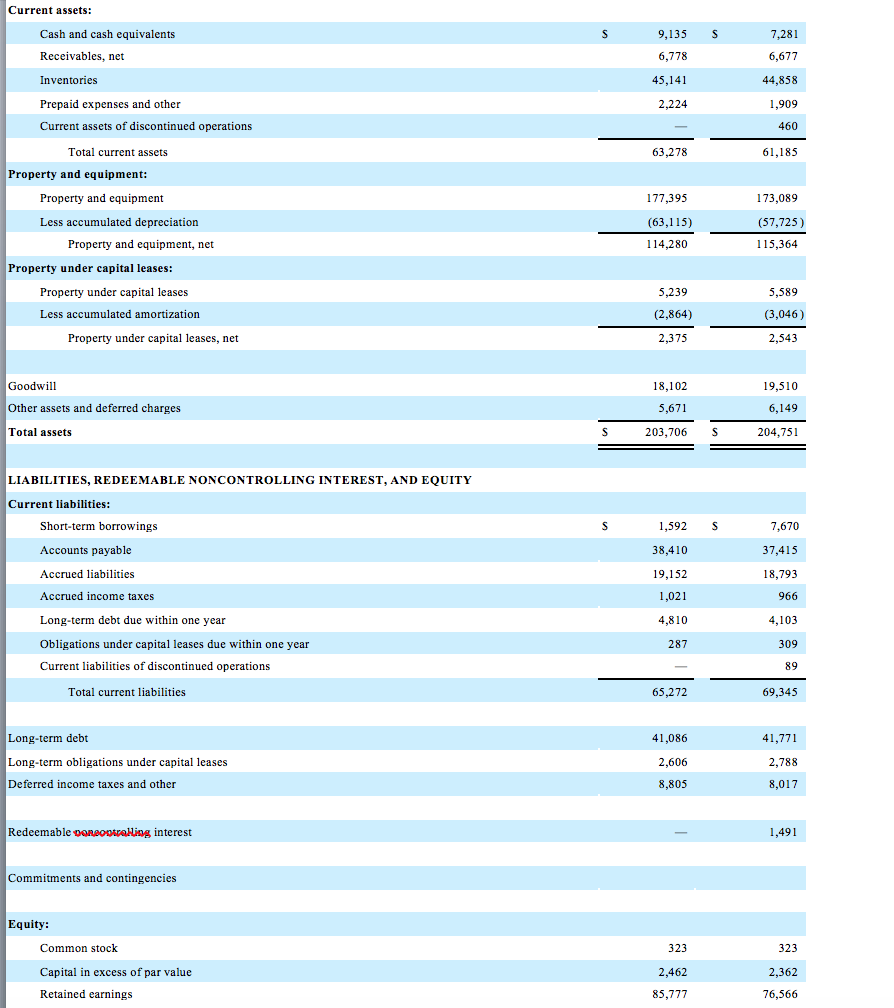

Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Current assets of discontinued operations 7,281 6,677 44,858 1,909 460 61,185 9,135 S 6,778 45,141 2,224 Total current assets 63,278 Property and equipment: 177,395 (63,115) 114,280 173,089 (57,725) 115,364 Property and equipment Less accumulated depreciation Property and equipment, net Property under capital leases: 5,239 (2,864) 2,375 5,589 (3,046) 2,543 Property under capital leases Less accumulated amortization Property under capital leases, net 18,102 Goodwill Other assets and deferred charges Total assets 19,510 6,149 204,751 5,671 203,706S LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND EQUITY Current liabilities: 1,592 S Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Obligations under capital leases due within one year Current liabilities of discontinued operations 38,410 19,152 1,021 4,810 287 7,670 37,415 18,793 966 4,103 309 89 69,345 Total current liabilities 65,272 Long-term debt Long-term obligations under capital leases Deferred income taxes and other 41,086 2,606 8,805 41,771 2,788 8,017 Redeemable voreoptroling interest 1,491 Commitments and contingencies Equity: Common stock Capital in excess of par value Retained earnings 323 2,462 85,777 323 2,362 76,566

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started