Answered step by step

Verified Expert Solution

Question

1 Approved Answer

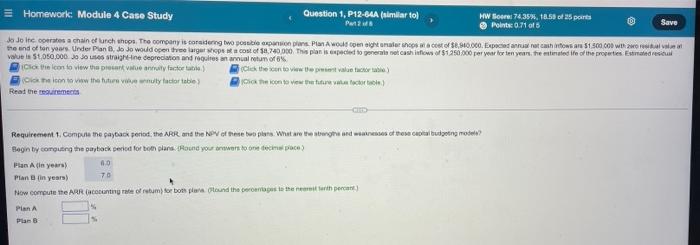

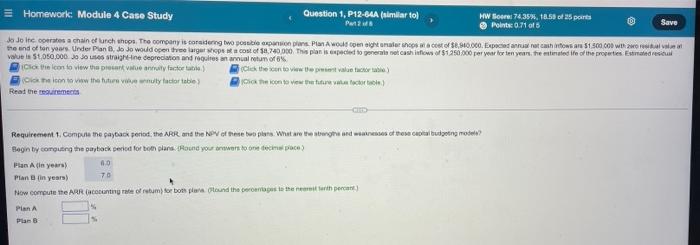

1.Compute the payback period, the ARR and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models? 2.

1.Compute the payback period, the ARR and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models?

Homework: Module 4 Case Study Question 1, P12-84A (similar to HW Seri 74,39. 18.58 of 25 parts Save Part28 Points 0.71 of 5 Jo Jo incontes a chain of unch on the company is considering two posible expansion plans Plan would open on cost of $8.50.000. Expected anrus net cash vows are $1.500 COD with well the end of ton yours Under Pan B. Jo Jo would en belanger op a cost of $0.740.000. The plan is expected to generale et cash rows $1250.000 per year for ten your heated to the properties and restul value is 51,050,000 20 30 straighine depreciation and requires an annual rum of 6% Click the icon to view the prevale annuity factor) click the tow the past value for ook the icon to www the future de nuity factor table> click the icon to view the foto) Read the moments Requirement 1. Compute the payback period, the ARR and the NPV of these two plans What are the stone and wisses et tecul budgeting model? Begin by conting the payta period for bon plans. Round you want to one dei proces Pan Afin years) 60 Plan B in years) 70 Now compute the ARR controle of retum) for bons plans tound the roages to the earth percent Plan Plans Requirements - . 1. Compute the payback period, the ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models? 2. Which expansion plan should Jo Jo choose? Why? 3. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? Print Done Jo line oferta chain of lunch shop. The company is ng pinsan Awould openilor shock 40.000 Eco 51 500.000 me and often yours. Under Pan JoJo would opengershope at a cost of $8.740.000. This plan is expected to get the town of $250.000 per year for anywhere interest value $1.050.000. Jos sigheine depreciation and for an annual rotum of Con to view the presente arvulyator) Con to the state (Click the icon to view the value analyti Click on the for Read the rest 2. Which expansion plan should JoJo Choose. Why?

3. Estimate Plans A IRR. How does the IRR compare with the companys required rate of return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started